In the ever-evolving landscape of online investment platforms, M1 Finance stands out as a unique and innovative option for investors. But the question on many investors' minds is, "Can you buy any US stock on M1 Finance?" In this article, we delve into the details of M1 Finance's stock offerings, exploring the breadth of available options and the platform's features that make it a compelling choice for investors.

Understanding M1 Finance's Stock Selection

M1 Finance offers a diverse range of stocks, providing investors with access to both well-known and emerging companies. While the platform boasts a vast selection, it's important to note that not all US stocks are available. M1 Finance focuses on stocks that are included in their automated investment strategies, which are designed to provide investors with a balanced and diversified portfolio.

The M1 Finance Platform: A Brief Overview

M1 Finance is a robo-advisor platform that allows users to invest in a variety of assets, including stocks, bonds, and ETFs. The platform uses a unique automated investment strategy, known as "M1 Portfolios," which tailors an investment approach to each user's risk tolerance and investment goals. This approach ensures that investors can benefit from a diversified portfolio that aligns with their financial objectives.

Can You Buy Any US Stock on M1 Finance?

While M1 Finance offers a wide range of stocks, it's not possible to buy any US stock on the platform. Instead, investors must rely on the stocks included in M1 Finance's pre-built portfolios. These portfolios are designed to cater to different investment strategies, such as aggressive growth, conservative income, and everything in between.

Key Features of M1 Finance's Stock Portfolios

- Automated Rebalancing: M1 Finance automatically rebalances portfolios to maintain the desired asset allocation, ensuring that investors' portfolios remain aligned with their investment goals.

- Tax-Loss Harvesting: M1 Finance offers tax-loss harvesting, a feature that helps investors minimize capital gains taxes by selling securities that have lost value.

- Fractional Shares: M1 Finance allows investors to purchase fractional shares of stocks, making it easier for them to invest in companies they're interested in, regardless of the stock's price.

- No Minimum Investment: M1 Finance does not require a minimum investment to open an account, making it accessible to investors of all levels.

Case Study: Investing in Tech Stocks on M1 Finance

Let's consider a hypothetical scenario where an investor is interested in investing in tech stocks. While M1 Finance may not offer every tech stock available, it does offer a range of tech-focused portfolios, such as the "Tech and Innovation" portfolio.

By investing in this portfolio, the investor gains exposure to a diverse range of tech companies, including giants like Apple, Microsoft, and Amazon, as well as emerging companies with high growth potential. This allows the investor to benefit from the potential upside of the tech industry while maintaining a diversified portfolio.

Conclusion

In conclusion, while M1 Finance doesn't offer every US stock, it provides investors with a wide range of options through its pre-built portfolios. By focusing on stocks that align with specific investment strategies, M1 Finance ensures that investors can achieve their financial goals with a well-diversified and automated approach. Whether you're interested in tech stocks, conservative income, or aggressive growth, M1 Finance has a portfolio that can meet your needs.

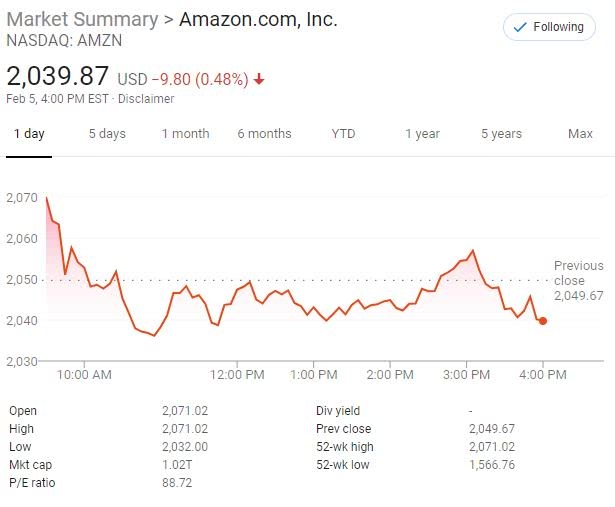

us stock market today live cha

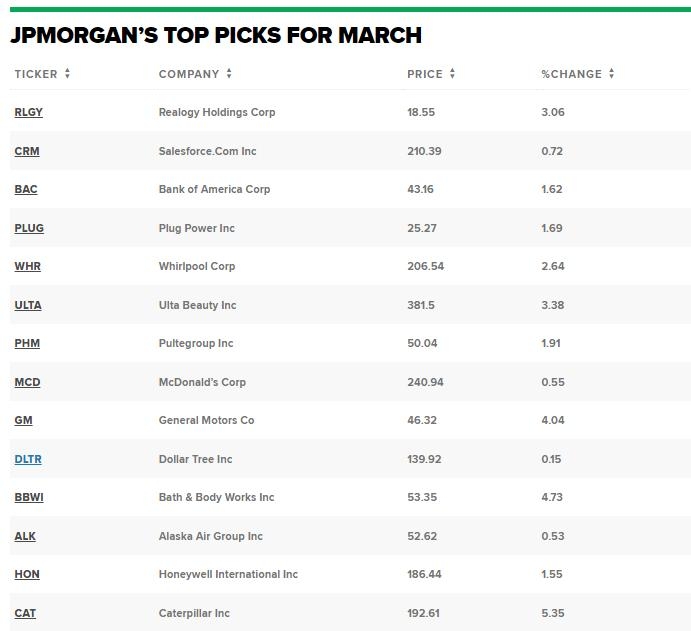

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....