The global stock market is a dynamic and ever-evolving landscape, where investors and traders closely monitor key movements to make informed decisions. In this article, we delve into the latest trends in global stocks today, providing insights and predictions that can help you navigate the market effectively.

Key Movements in Global Stocks Today

One of the most significant developments in global stocks today is the rise of technology stocks. Companies like Apple, Amazon, and Microsoft have seen a surge in their shares, driven by strong earnings reports and growing demand for their products and services. This trend is expected to continue, with tech stocks likely to remain a key driver of market growth.

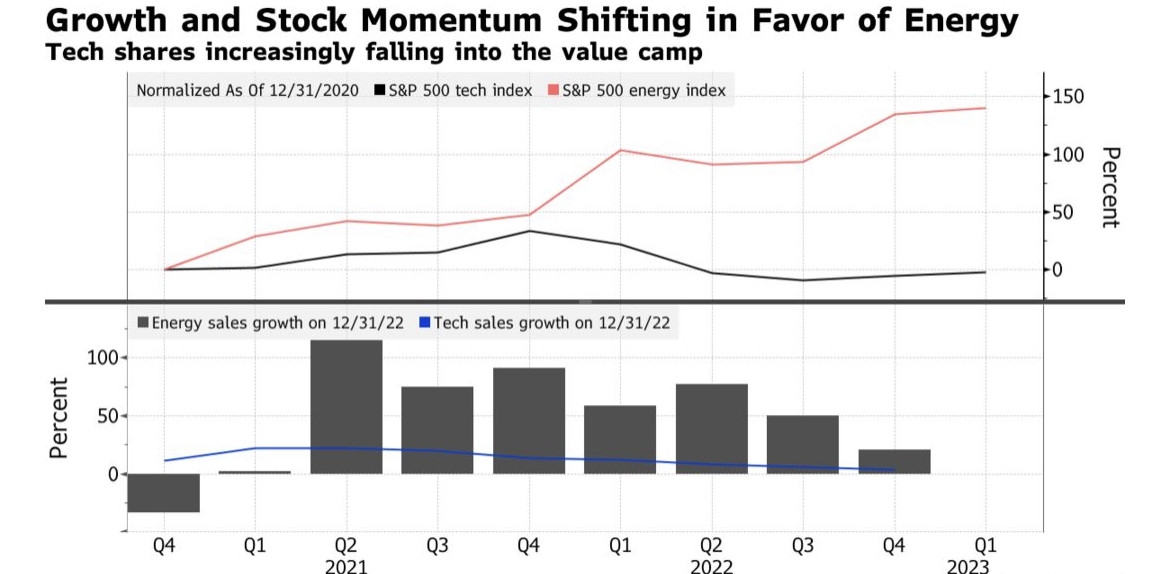

On the other hand, the energy sector has been experiencing a bit of a downturn. The drop in oil prices has negatively impacted major oil companies, leading to a decline in their stock prices. However, some analysts predict that this trend will reverse in the coming months, as demand for oil and energy-related products is expected to increase.

Emerging Markets and Developed Markets

Emerging markets have been a hot topic in global stocks today. Countries like China, India, and Brazil have seen significant growth in their stock markets, driven by increasing consumer spending and investment in infrastructure. While these markets offer potential for high returns, they also come with higher risks and volatility.

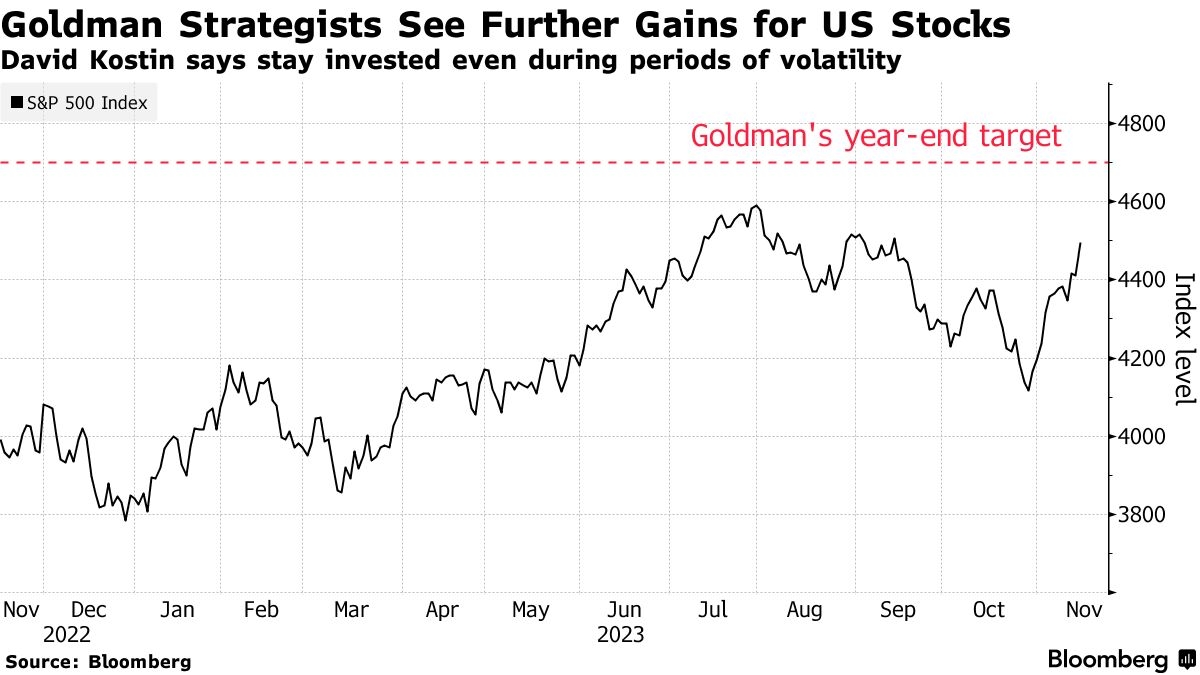

In contrast, developed markets have been experiencing a slower growth rate. However, they remain a stable investment option for many investors. The U.S. stock market, in particular, has been performing well, with the S&P 500 index hitting new record highs.

Predictions for the Future

Looking ahead, the global stock market is expected to remain volatile, with a mix of opportunities and challenges. Here are some key predictions for the future:

- Technology Stocks: Tech stocks are likely to continue their upward trend, with companies like Apple and Microsoft expected to see further growth.

- Energy Sector: The energy sector is expected to recover, with oil prices stabilizing and energy companies seeing improved financial performance.

- Emerging Markets: While emerging markets offer potential for high returns, investors should exercise caution and conduct thorough research before investing.

- Developed Markets: Developed markets will remain a stable investment option, with opportunities for growth in sectors like healthcare and consumer goods.

Case Studies

To illustrate these trends, let's look at a couple of case studies:

- Apple: Apple's stock has seen significant growth in recent years, driven by strong sales of its iPhone, iPad, and Mac products. With the introduction of new products and services, such as Apple TV+ and Apple Arcade, the company is well-positioned for continued growth.

- BP: BP, a major oil company, has seen its stock decline due to falling oil prices. However, with the company's commitment to renewable energy and its expansion into other energy sectors, there is potential for a recovery in its stock price.

In conclusion, the global stock market today is characterized by a mix of trends and opportunities. By staying informed and conducting thorough research, investors can make informed decisions and capitalize on these trends.

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....