Are you a Canadian investor looking to expand your portfolio with US stocks? With the US stock market being one of the largest and most diversified in the world, it's no wonder that many Canadian investors are interested in adding American stocks to their portfolios. In this article, we'll explore the steps and considerations for investing in US stocks from Canada.

Understanding the Basics

Before diving into the investment process, it's essential to understand the basics of investing in US stocks from Canada. Firstly, it's important to note that Canadian investors will need to consider currency exchange rates, tax implications, and the potential for currency fluctuations.

Opening a Brokerage Account

The first step in investing in US stocks from Canada is to open a brokerage account that allows you to trade on US exchanges. There are several reputable brokerage firms that cater to Canadian investors, such as TD Ameritrade, E*TRADE, and Questrade. When choosing a brokerage, consider factors such as fees, platform features, and customer service.

Understanding Tax Implications

When investing in US stocks, Canadian investors need to be aware of the tax implications. While capital gains from US stocks are not taxed in Canada, you will need to report them on your Canadian tax return. Additionally, dividends received from US stocks may be subject to withholding taxes. It's important to consult with a tax professional to understand the specific tax obligations associated with investing in US stocks.

Currency Exchange Rates

One of the main considerations for Canadian investors is the impact of currency exchange rates on their investments. When investing in US stocks, you'll be buying and selling in US dollars. Fluctuations in the exchange rate can affect the value of your investments in Canadian dollars. It's important to stay informed about currency exchange rates and consider the potential risks associated with currency fluctuations.

Diversifying Your Portfolio

Investing in US stocks can provide diversification benefits to your portfolio. The US stock market includes a wide range of industries and sectors, offering Canadian investors exposure to companies and markets that may not be available in Canada. This diversification can help reduce the overall risk of your portfolio.

Research and Analysis

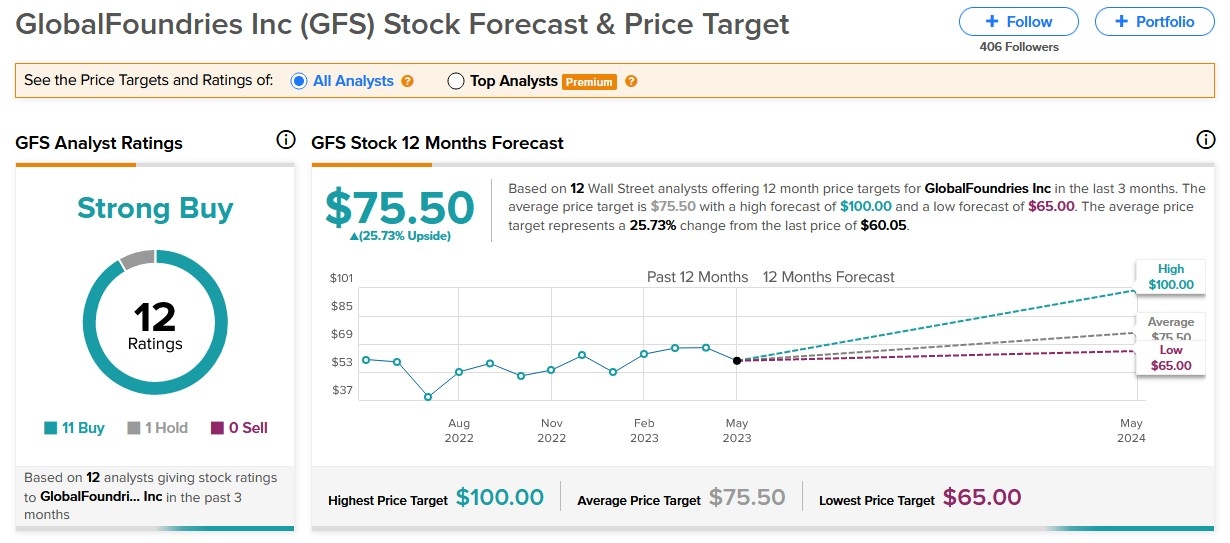

Before investing in any stock, it's crucial to conduct thorough research and analysis. This includes analyzing the financial health of the company, its industry position, and market trends. Tools such as financial statements, earnings reports, and analyst ratings can provide valuable insights into the potential of a stock.

Case Study: Investing in Apple (AAPL)

Let's consider a hypothetical scenario where a Canadian investor decides to invest in Apple Inc. (AAPL). After conducting thorough research, the investor determines that Apple is a well-established company with a strong market position and potential for growth. By opening a brokerage account that allows trading on US exchanges, the investor can purchase shares of Apple in US dollars.

Over time, the investor monitors the performance of their investment and stays informed about market trends and company news. By diversifying their portfolio with US stocks like Apple, the investor can potentially benefit from the growth of one of the world's largest and most valuable companies.

Conclusion

Investing in US stocks from Canada can offer numerous benefits, including diversification and access to a wide range of companies and markets. By understanding the basics, opening a brokerage account, and conducting thorough research, Canadian investors can make informed decisions and potentially grow their portfolios. Remember to consider tax implications and currency exchange rates when investing in US stocks.

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....