In today's globalized world, the stock markets of India and the United States have become two of the most influential and widely followed markets. While both offer unique opportunities for investors, it's crucial to understand the key differences and similarities between them. This article delves into a comprehensive analysis of the Indian and US stock markets, highlighting their unique characteristics and providing insights for investors looking to diversify their portfolios.

Market Size and Growth

One of the most striking differences between the Indian and US stock markets is their size and growth potential. The US stock market, with a market capitalization of over $35 trillion, is the largest in the world. It boasts a wide range of industries, from technology giants like Apple and Microsoft to established companies in sectors like healthcare, finance, and energy.

In contrast, the Indian stock market has a market capitalization of around $2.5 trillion, making it the 5th largest in the world. However, it has shown significant growth over the past few years, with the Sensex and Nifty indices witnessing record highs. The Indian market's growth potential is attributed to factors like a young population, increasing disposable incomes, and the government's focus on infrastructure development.

Sector Composition

Another key difference lies in the sector composition of the two markets. The US stock market is heavily concentrated in technology, with companies like Apple, Microsoft, and Amazon dominating the indices. This sector has been a major driver of growth, with innovation and digital transformation fueling its expansion.

On the other hand, the Indian stock market has a more diverse sector composition, with a significant presence of companies in sectors like finance, consumer goods, and pharmaceuticals. The Indian government's push for 'Make in India' and the growing demand for healthcare and consumer goods have contributed to the growth of these sectors.

Regulatory Environment

The regulatory environment is another crucial factor to consider when comparing the Indian and US stock markets. The US stock market operates under a stringent regulatory framework, with the Securities and Exchange Commission (SEC) overseeing the market's operations. This regulatory oversight ensures transparency, fairness, and investor protection.

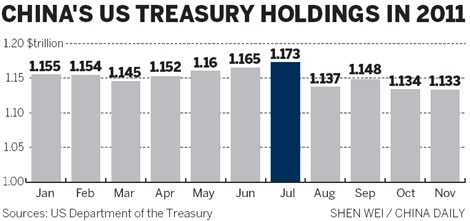

In India, the Securities and Exchange Board of India (SEBI) plays a similar role, regulating the stock market and ensuring compliance with various regulations. However, the regulatory environment in India is still evolving, with the government making efforts to streamline processes and attract more foreign investment.

Investor Sentiment

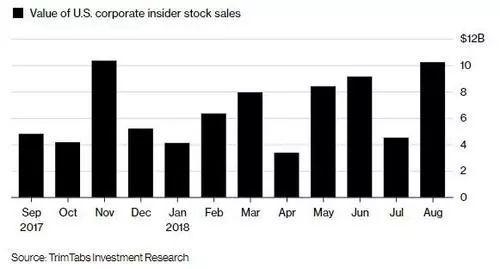

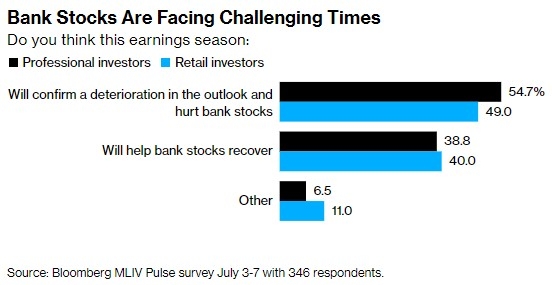

Investor sentiment also plays a crucial role in shaping the performance of the Indian and US stock markets. The US market has traditionally been considered more mature and stable, with investors showing a preference for large-cap, dividend-paying stocks. This sentiment has been further reinforced by the market's resilience during global economic downturns.

In contrast, the Indian stock market has been characterized by higher volatility, with investors showing a greater willingness to take risks. This is attributed to the market's growth potential and the government's efforts to create a more investor-friendly environment.

Case Studies

To provide a clearer picture, let's consider a few case studies:

Tata Consultancy Services (TCS): As one of India's largest IT services companies, TCS has seen significant growth in the US stock market. Its presence in the US has helped it tap into the global market and attract international clients, contributing to its revenue growth.

Apple: Apple's inclusion in the Indian stock market has been a game-changer for the market. Its presence has attracted a new wave of investors and has helped the market gain international recognition.

In conclusion, while the Indian and US stock markets have their unique characteristics, they offer significant opportunities for investors. Understanding the key differences and similarities between the two markets is crucial for making informed investment decisions. As the global economy continues to evolve, both markets have the potential to grow and offer attractive returns for investors.

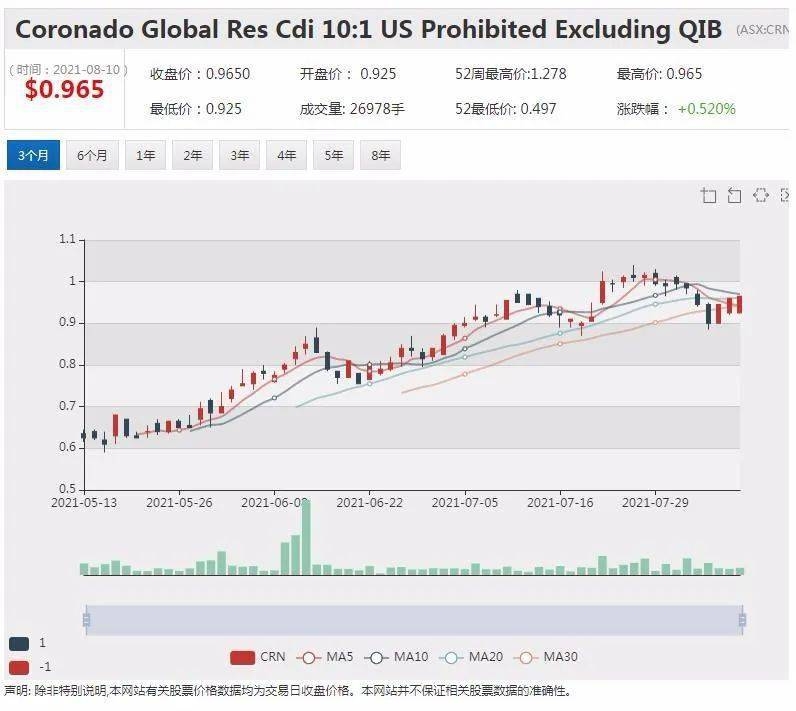

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....