In the dynamic world of finance, keeping a close eye on the stock market is crucial for investors. One bank that has been making waves is Santander, a leading financial institution with a significant presence in the United States. This article delves into the Santander Bank stock, offering insights into its performance, growth potential, and factors influencing its value.

Understanding Santander Bank Stock

Santander Bank, part of the larger Santander Group, is a major player in the banking industry. Its stock, traded under the symbol "SAN," has seen considerable movement over the years. To understand the stock's performance, it's essential to consider several key factors.

Financial Performance

Santander Bank's financial performance is a crucial indicator of its stock's value. Over the past few years, the bank has demonstrated strong profitability, with consistent growth in revenue and earnings. Its robust financial statements showcase a solid foundation for future growth.

Market Trends

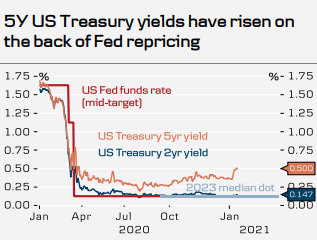

The stock market is influenced by various external factors, including economic conditions, industry trends, and regulatory changes. Understanding these trends is vital for investors looking to invest in Santander Bank stock. For instance, the rising interest rates have had a positive impact on the bank's net interest margins, contributing to its strong financial performance.

Growth Potential

Santander Bank has a promising growth potential, driven by its expansion strategies and diverse product offerings. The bank has been actively acquiring smaller banks and expanding its branch network, which has helped it capture a larger market share. Additionally, its digital transformation initiatives have enhanced customer experience and increased efficiency.

Dividend Yield

Another attractive aspect of Santander Bank stock is its dividend yield. The bank has a solid track record of paying dividends to its shareholders, offering a steady income stream. This has made it an appealing investment for income-focused investors.

Case Study: Acquisition of Sovereign Bank

A notable case study is Santander's acquisition of Sovereign Bank in 2009. This move helped the bank expand its footprint in the United States and diversify its revenue streams. The acquisition has been a significant success, contributing to the bank's growth and profitability.

Conclusion

In conclusion, Santander Bank stock presents a compelling investment opportunity for investors. Its strong financial performance, growth potential, and dividend yield make it an attractive option. However, as with any investment, it's crucial to conduct thorough research and consider your own financial goals and risk tolerance before making a decision.

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....