In the world of finance, the term "spy stock" refers to shares in companies that are known for their secretive nature. These companies often operate in high-stakes industries, such as defense, technology, and intelligence. In this article, we'll delve into the world of spy stocks in the United States, exploring their characteristics, investment potential, and the risks involved.

Understanding Spy Stocks

Spy stocks are typically associated with companies that have a significant presence in the defense, technology, or intelligence sectors. These businesses often operate under strict confidentiality agreements and are subject to stringent regulations. As a result, they tend to be less transparent than other publicly traded companies.

Characteristics of Spy Stocks

One of the defining features of spy stocks is their lack of transparency. These companies often do not disclose detailed information about their operations, financials, or future plans. This lack of information can make it challenging for investors to assess the true value of these stocks.

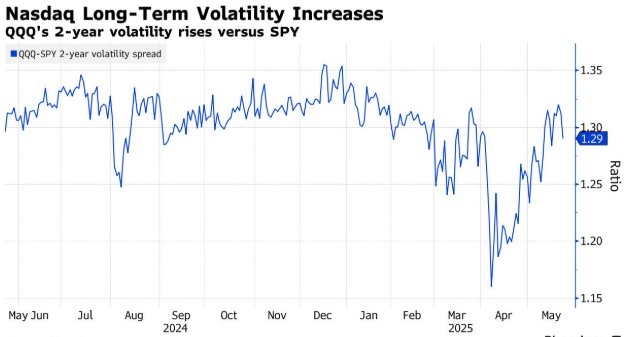

Another characteristic of spy stocks is their high volatility. Given their secretive nature, news about these companies can cause significant price fluctuations. This volatility can be both a blessing and a curse for investors.

Investment Potential

Despite the risks, spy stocks can offer significant investment potential. Companies in these sectors often have access to cutting-edge technologies and can benefit from high growth rates. Additionally, spy stocks can provide exposure to the defense and intelligence sectors, which are typically less affected by economic downturns.

Risks Involved

Investing in spy stocks comes with its own set of risks. The lack of transparency can make it difficult for investors to make informed decisions. Additionally, the high volatility of these stocks can lead to significant losses.

One of the biggest risks associated with spy stocks is the potential for regulatory changes. Given the sensitive nature of these companies, changes in government policies or regulations can have a significant impact on their operations and profitability.

Case Studies

To illustrate the potential of spy stocks, let's consider two examples: Lockheed Martin and Northrop Grumman.

Lockheed Martin: As one of the world's largest defense contractors, Lockheed Martin has a long history of success. The company is known for its advanced technologies and innovative products, making it a prime candidate for spy stock investment.

Northrop Grumman: Another leading defense contractor, Northrop Grumman, has a diverse portfolio of products and services. The company's focus on cybersecurity and intelligence solutions makes it an attractive investment for those looking to invest in spy stocks.

Conclusion

While investing in spy stocks can be risky, it also offers significant potential for high returns. Understanding the characteristics and risks associated with these stocks is crucial for investors looking to capitalize on this unique investment opportunity. By conducting thorough research and staying informed about industry trends, investors can make informed decisions and potentially benefit from the growth of spy stocks in the United States.

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....