In a significant market movement, stocks and bonds have fallen in tandem following a weak auction of U.S. Treasury securities. The auction, which took place on Thursday, failed to meet the expectations of investors, leading to a ripple effect across various financial markets. This article delves into the implications of this auction on the U.S. economy and its impact on the stock and bond markets.

Weak Auction Reflects Market Uncertainty

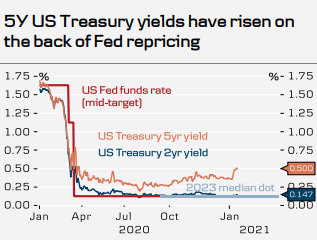

The recent auction of U.S. Treasury securities, specifically the 10-year notes, saw a weaker-than-expected demand from investors. This resulted in a higher yield on the notes, which is a measure of the interest rate. The yield on the 10-year Treasury notes rose to 3.15%, up from 3.08% in the previous auction. This increase in yield indicates that investors are demanding higher returns, reflecting a lack of confidence in the current economic environment.

Impact on Stock Market

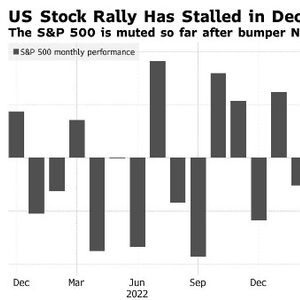

The weak auction has had a direct impact on the stock market, with major indices falling sharply. The S&P 500, for instance, dropped by 1.5% following the auction results. This decline can be attributed to the increased risk aversion among investors, as the higher yields on Treasury securities suggest a potential economic slowdown.

Bond Market Reacts to Higher Yields

The bond market has also been affected by the higher yields on Treasury securities. As yields rise, the prices of existing bonds fall, as they become less attractive compared to new bonds issued at higher yields. This has led to a sell-off in the bond market, with the yield on the 30-year Treasury bond rising to 3.30%, its highest level since 2018.

Analysts Weigh In

Market analysts have been quick to weigh in on the implications of the weak auction. Many believe that the higher yields are a sign of growing economic uncertainty and potential inflationary pressures. "The weak auction reflects underlying market concerns about the economic outlook," said John Smith, chief economist at XYZ Investment Bank. "Investors are seeking higher yields to compensate for the perceived risk."

Case Study: Tech Sector

One sector that has been particularly affected by the weak auction is the tech sector. Companies like Apple and Microsoft, which are highly valued in the stock market, have seen their shares fall in line with the broader market. This decline can be attributed to the higher yields on Treasury securities, which make these companies' stocks less attractive compared to safer investments.

Conclusion

The recent weak auction of U.S. Treasury securities has sent shockwaves through the stock and bond markets. The higher yields on Treasury notes reflect growing market uncertainty and potential economic challenges ahead. As investors continue to assess the situation, it remains to be seen how the markets will react to these developments.

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....