The US government shutdown has been a recurring event, casting a shadow over the nation's economy and the stock market. This article delves into the impact of these shutdowns on the stock market, examining how investors react and what lessons can be learned.

Understanding the Government Shutdown

A government shutdown occurs when the federal government runs out of funding, typically due to a budgetary impasse between the House of Representatives and the Senate, or between Congress and the President. During a shutdown, many federal agencies are closed, and government employees are furloughed or placed on unpaid leave.

Immediate Impact on Stocks

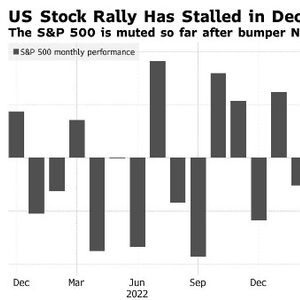

The immediate impact of a government shutdown on stocks is often negative. Investors tend to become nervous about the uncertainty and potential economic consequences of a shutdown. This nervousness is reflected in stock market volatility.

One of the most noticeable impacts is the reaction of sectors that rely heavily on government spending. For instance, defense stocks often experience a decline during shutdowns, as the government reduces its defense spending. Similarly, companies that depend on government contracts, such as aerospace and construction firms, may see their stocks drop.

Long-term Impact

While the immediate impact of a shutdown on stocks is often negative, the long-term impact can vary. In some cases, the market has recovered quickly, while in others, the impact has been more significant and prolonged.

Case Study: 2018 Government Shutdown

One notable case is the 35-day government shutdown in 2018-2019. This shutdown, which began on December 22, 2018, ended on January 25, 2019. During this period, the S&P 500 index fell by approximately 5%.

However, after the shutdown ended, the stock market quickly recovered. By the end of 2019, the S&P 500 had returned to its pre-shutdown levels, and by early 2020, it had even exceeded them.

Market Sentiment and Reactivity

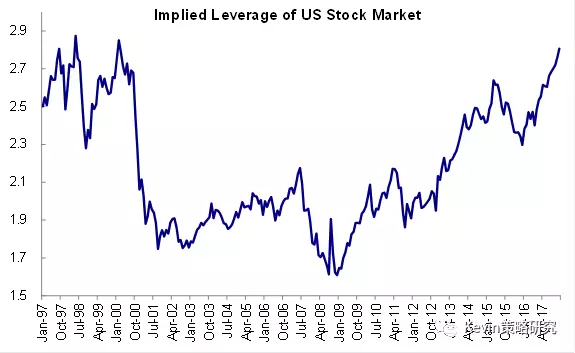

The market's reaction to government shutdowns also reflects broader market sentiment. For instance, if investors believe that a shutdown will lead to a more significant economic downturn, they may sell off stocks in anticipation of a decline in corporate earnings and economic activity.

Lessons Learned

The government shutdowns have several lessons for investors:

- Risk Management: It is crucial for investors to manage their risk, especially when the market is volatile due to political uncertainty.

- Diversification: Diversifying one's portfolio can help mitigate the impact of political uncertainty on stocks.

- Market Volatility: Investors should be prepared for market volatility during periods of political uncertainty.

In conclusion, while government shutdowns can have a significant impact on the stock market, the long-term impact can vary. Investors should be aware of the risks and opportunities associated with political uncertainty and adapt their strategies accordingly.

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....