The financial world is buzzing with anticipation as US stock futures display a mixed bag ahead of some critical economic data set to be released in the coming days. Investors are keeping a close eye on these figures, as they could potentially shape the trajectory of the markets in the near term.

Economic Data in Focus

The upcoming economic reports include jobless claims, retail sales, and the consumer price index (CPI), all of which are vital indicators of the country's economic health. These reports often provide a snapshot of consumer spending, business activity, and inflation trends, which are crucial factors in determining the future direction of the stock market.

Jobless Claims: A Window into the Labor Market

The initial jobless claims report is expected to offer insights into the current state of the labor market. A decrease in claims typically suggests a healthy job market, which can boost investor confidence and potentially drive stock futures higher. Conversely, an increase could signal weakness in the labor market, casting a shadow over future economic growth and possibly causing stock futures to decline.

Retail Sales: Consumer Spending at the Center Stage

Retail sales figures provide a gauge of consumer spending, which accounts for a significant portion of the US economy. Strong retail sales can indicate robust consumer confidence and spending, potentially spurring stock futures to rise. However, if retail sales show signs of slowing down, it could raise concerns about consumer confidence and lead to a decline in stock futures.

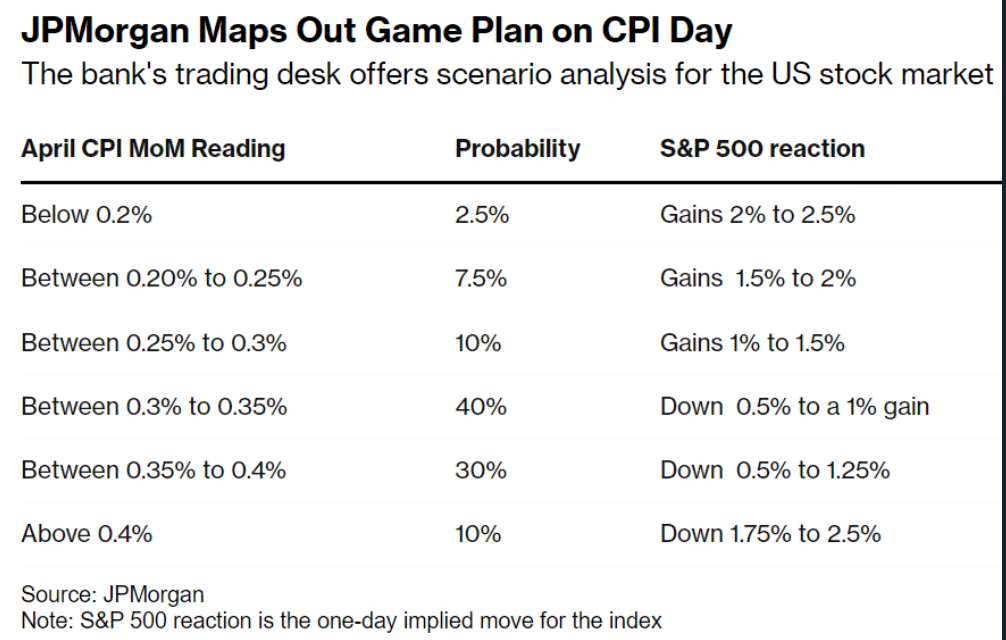

Consumer Price Index (CPI): Keeping Inflation in Check

The CPI is a key measure of inflation, and it is closely watched by investors and policymakers alike. A moderate level of inflation is typically seen as a sign of a healthy economy, but too much inflation can erode purchasing power and impact corporate profitability. Stock futures may see upward movement if the CPI indicates a stable or slightly rising inflation rate, but could face downward pressure if inflation shows signs of overheating.

Market Reaction: A Case Study

In a past scenario, when the US released stronger-than-expected retail sales figures, stock futures responded positively. This was due to the strong consumer spending indicators suggesting robust economic growth. Conversely, when the jobless claims report showed a significant increase, stock futures took a hit, reflecting concerns about the labor market and potential economic slowdown.

Conclusion: Awaiting the Data

As the market braces for these key economic reports, it's clear that the future of US stock futures hinges on the outcomes of these data points. Investors are advised to stay vigilant and prepared for potential market volatility as the results roll in. The interplay between economic data and market sentiment will undoubtedly shape the trajectory of stock futures in the coming days.

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....