Introduction: Investing in the stock market can be a thrilling journey, but it’s not just about buying low and selling high. Understanding how to maximize stock profit is essential for anyone looking to grow their wealth. In this article, we’ll delve into the secrets of stock profit and provide you with valuable insights and strategies to help you achieve your financial goals.

Understanding Stock Profit: Stock profit refers to the money you make from buying and selling stocks. It is calculated by subtracting the purchase price from the sale price of the stock, and adding any dividends received. To maximize stock profit, it’s crucial to research, analyze, and make informed decisions.

- Research and Analysis Before diving into the stock market, thorough research and analysis are paramount. Here are a few key factors to consider:

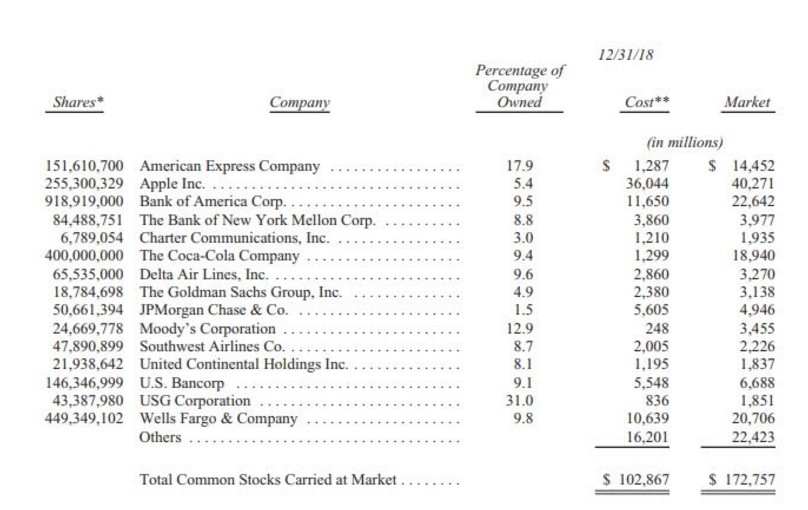

- Company Fundamentals: Look for companies with strong financial health, solid earnings, and a proven track record of growth.

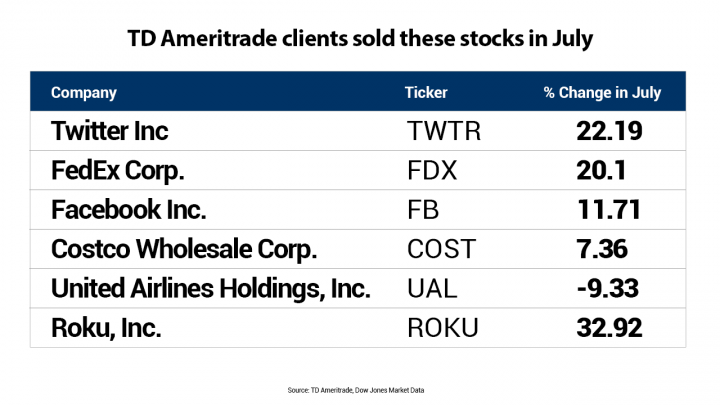

- Technical Analysis: Study the stock’s price movement and volume to identify trends and patterns.

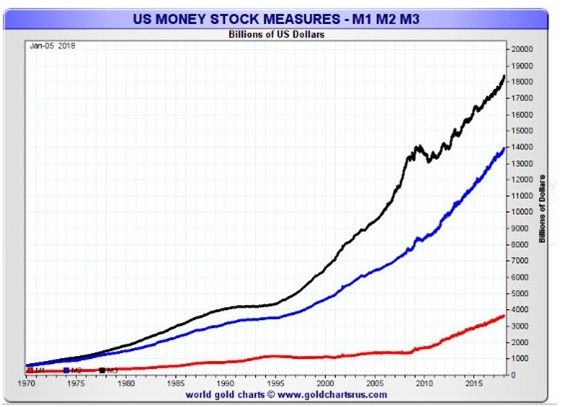

- Market Trends: Keep an eye on broader market conditions and economic indicators that can impact your investments.

- Diversification Diversifying your portfolio can help mitigate risks and increase your chances of generating higher profits. Here’s how to diversify effectively:

- Sector Rotation: Invest in different sectors of the market, such as technology, healthcare, and consumer goods, to capitalize on growth opportunities across various industries.

- Geographic Diversification: Include stocks from different countries to benefit from varying economic conditions and currency movements.

- Asset Allocation: Balance your investments between stocks, bonds, and other asset classes to create a well-rounded portfolio.

- Time in the Market Time is a critical factor in achieving significant stock profits. Here’s why:

- Compound Interest: The longer you hold your investments, the more compounding interest you’ll earn.

- Market Cycles: The stock market goes through cycles, and staying invested during downturns can lead to higher returns in the long run.

- Tax-Efficient Investing Understanding the tax implications of your investments can help you maximize your profits. Here are a few tips:

- Capital Gains Tax: Be aware of the capital gains tax rates and consider holding investments for more than a year to qualify for lower rates.

- Tax-Loss Harvesting: Sell underperforming stocks at a loss to offset capital gains taxes on your gains.

- Case Study: Apple (AAPL)

Consider Apple Inc. (AAPL), a technology giant with a strong track record of growth. Over the past decade, AAPL has provided investors with substantial returns. By investing

10,000 in AAPL in 2010 and reinvesting dividends, your investment would be worth over 200,000 today.

Conclusion: Maximizing stock profit requires a combination of research, analysis, diversification, time in the market, and tax-efficient investing. By following these strategies, you can increase your chances of achieving substantial returns and growing your wealth over time. Remember, the stock market is unpredictable, so stay informed and be prepared to adapt your strategy as needed.

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....