As we delve into the heart of June 2025, the landscape of the US stock market is as dynamic as ever. This article aims to dissect the current market sentiment surrounding US stocks, providing insights into the factors influencing investor decisions and the potential directions the market may take.

Market Overview

The US stock market has been a beacon of resilience and growth over the years, attracting investors from around the globe. In June 2025, the market is experiencing a blend of optimism and cautiousness, primarily driven by several key factors:

1. Economic Growth and Stability Economic indicators suggest that the US economy is on a steady growth path. Low unemployment rates, strong consumer spending, and robust corporate earnings have contributed to a positive outlook. This economic stability has bolstered investor confidence and driven the stock market upwards.

2. Technology Sector Dominance The technology sector continues to be a major driver of the US stock market. Companies like Apple, Google, and Amazon have seen significant growth, with their stocks reaching all-time highs. This trend is expected to continue, especially as these companies expand into new markets and technologies.

3. Interest Rates and Inflation Interest rates remain low, which is favorable for stock prices. However, concerns about inflation have sparked some uncertainty. Investors are closely monitoring inflation data and central bank policies to gauge the potential impact on the market.

4. Geopolitical Factors Global events, such as political tensions and trade disputes, can have a significant impact on the US stock market. In June 2025, the market is closely watching these geopolitical developments to assess any potential risks.

Investor Sentiment Analysis

1. Optimism in Technology and Healthcare Investors are increasingly bullish on the technology and healthcare sectors. These sectors are seen as resilient and capable of generating strong returns, even in times of economic uncertainty. Companies like Microsoft and Johnson & Johnson have seen a surge in investor interest.

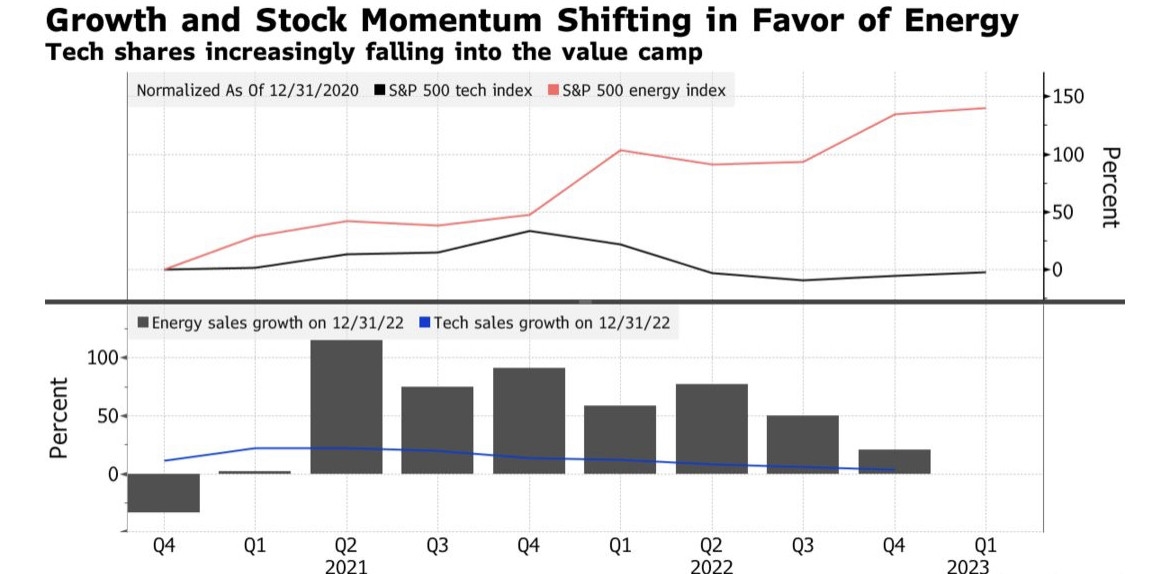

2. Caution in Energy and Financials On the flip side, investors are showing caution in the energy and financial sectors. Concerns about rising oil prices and regulatory changes have led to a more conservative approach towards these sectors.

3. Diversification and Risk Management With market volatility remaining a concern, investors are focusing on diversification and risk management. This includes investing in a mix of stocks, bonds, and other assets to spread out risk and protect their portfolios.

Case Studies

1. Apple's Growth Story Apple has been a standout performer in the technology sector. Its strong product pipeline, global presence, and innovative approach have driven significant growth. In June 2025, Apple's stock is trading at an all-time high, reflecting investor optimism.

2. Johnson & Johnson's Resilience Johnson & Johnson, a leader in the healthcare sector, has demonstrated resilience in the face of market volatility. Its diversified product portfolio and strong brand reputation have made it a favorite among investors.

Conclusion

The current market sentiment in the US stock market in June 2025 is characterized by a mix of optimism and cautiousness. Economic growth, technology sector dominance, and geopolitical factors are shaping investor decisions. As always, it is crucial for investors to stay informed and manage their portfolios accordingly.

can foreigners buy us stocks

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....