In a significant move that could reshape the future of autonomous vehicles, the U.S. government has recently announced the easing of self-driving car regulations. This decision has been warmly welcomed by industry leaders, particularly Tesla, whose stock has seen a notable surge following the news. In this article, we delve into the implications of this regulatory change and its potential impact on Tesla's market position.

The Regulatory Shift

The U.S. Department of Transportation's (DOT) National Highway Traffic Safety Administration (NHTSA) has proposed changes to the existing guidelines for autonomous vehicles, aiming to accelerate the development and deployment of self-driving technology. These changes include a more flexible approach to testing and validation, allowing companies to gather more real-world data without being bogged down by stringent regulations.

Tesla's Stock Surge

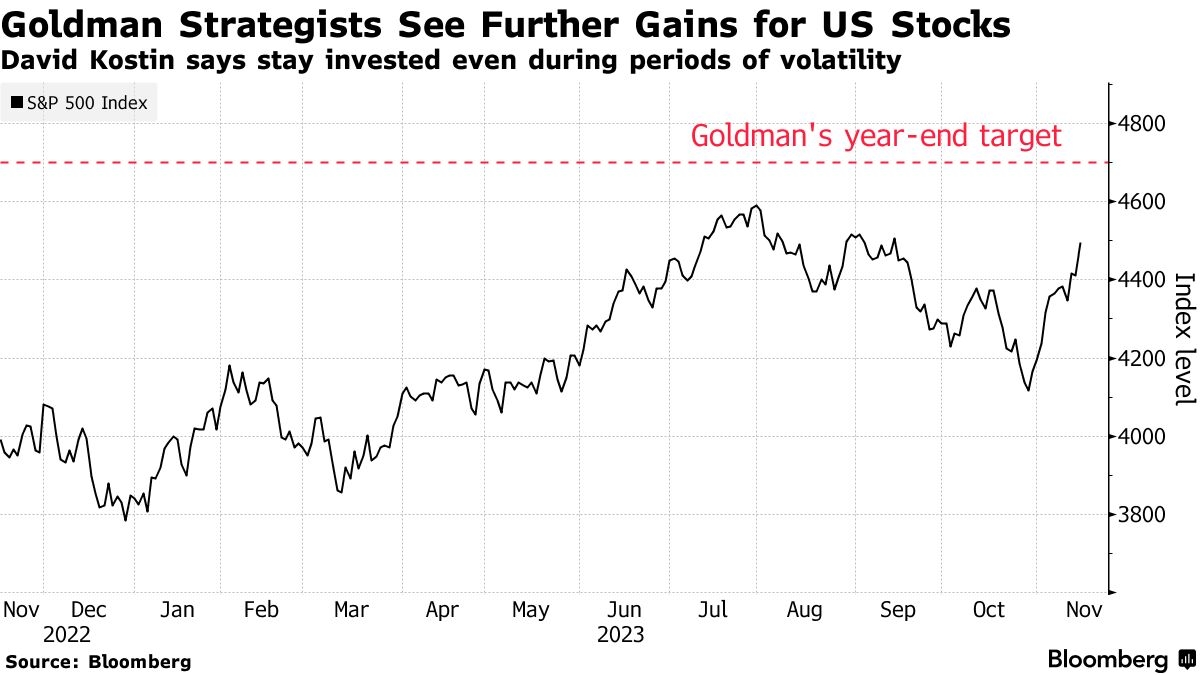

The easing of self-driving car rules has had an immediate and positive impact on Tesla's stock. Shares of the electric vehicle manufacturer have seen a significant increase, reflecting investors' confidence in the company's ability to capitalize on the regulatory shift. Tesla has long been at the forefront of autonomous vehicle technology, and this news has only bolstered its position as a leader in the industry.

Implications for Tesla

The easing of self-driving car rules presents several opportunities for Tesla. Firstly, it allows the company to accelerate its testing and deployment of autonomous vehicles, potentially leading to a faster roll-out of its Full Self-Driving (FSD) feature. This feature is expected to significantly enhance the value proposition of Tesla's vehicles, making them more attractive to consumers.

Secondly, the regulatory change could also open up new markets for Tesla. With less restrictive regulations, the company may be able to expand its operations into countries with previously strict autonomous vehicle policies. This could lead to increased sales and revenue growth.

Case Studies: Autonomous Vehicle Deployments

Several companies have already started deploying autonomous vehicles in various settings. For instance, Waymo, Alphabet's self-driving car subsidiary, has been operating autonomous ride-sharing services in Phoenix, Arizona. These services have demonstrated the feasibility and safety of self-driving technology in real-world conditions.

Similarly, Tesla's own FSD beta program has been gaining traction among early adopters. While still in its early stages, the program has provided valuable insights into the capabilities and limitations of autonomous driving technology.

Conclusion

The easing of self-driving car rules in the U.S. is a significant development that could have far-reaching implications for the industry. Tesla, with its robust autonomous vehicle technology and strong market position, stands to benefit greatly from this regulatory change. As the company continues to innovate and expand its autonomous vehicle offerings, investors can expect to see further growth in Tesla's stock.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....