In the fast-paced world of financial markets, the Dow Jones Industrial Average (DJIA) is a key indicator of market performance. When the Dow experiences a loss, it often captures the attention of investors and media alike. In this article, we'll delve into the latest Dow loss, its potential causes, and what it means for the market moving forward.

What Is the Dow Loss Today?

As of [insert date], the Dow Jones Industrial Average has experienced a significant loss. The index closed down by [insert percentage], marking a challenging day for investors. This loss follows a series of ups and downs in the market, raising questions about the current state of the economy and the future of the stock market.

Causes of the Dow Loss

Several factors have contributed to the Dow's latest loss. Here are some of the key reasons:

- Global Economic Concerns: The ongoing trade tensions between the United States and China have created uncertainty in the global economy. This uncertainty has led to a decrease in investor confidence and, consequently, a drop in the Dow.

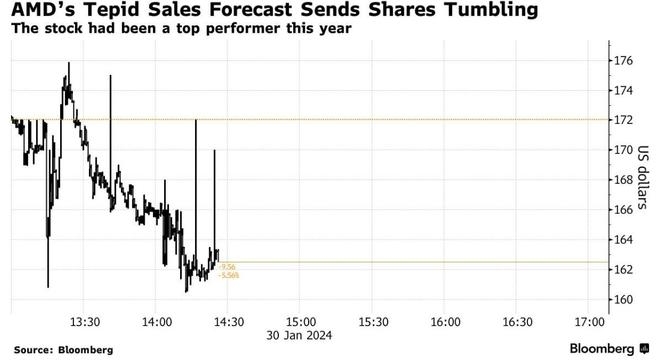

- Corporate Earnings Reports: Several major companies have recently released their earnings reports, and many have fallen short of expectations. This has added to the downward pressure on the market.

- Interest Rate Hikes: The Federal Reserve's decision to raise interest rates has made borrowing more expensive, which can negatively impact corporate profits and consumer spending.

Impact on the Market

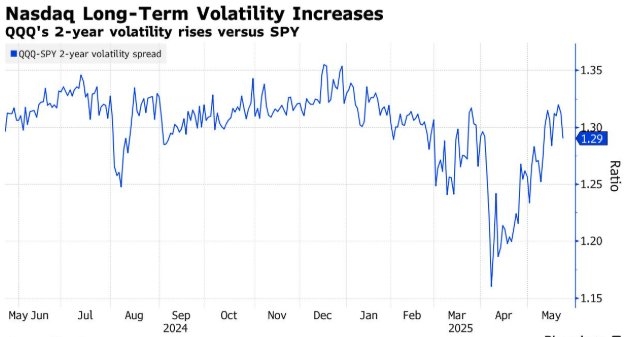

The Dow's latest loss has had a ripple effect on the broader market. Many other indexes, such as the S&P 500 and the NASDAQ, have also experienced declines. This suggests that the market is facing broader challenges, rather than just isolated issues.

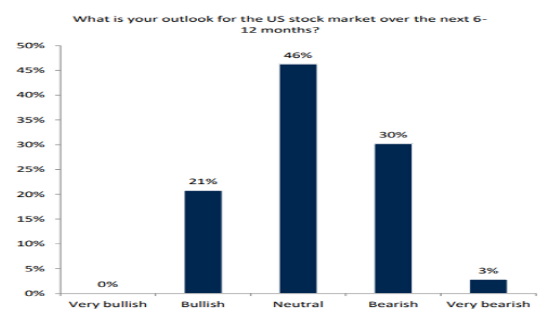

What Does the Future Hold?

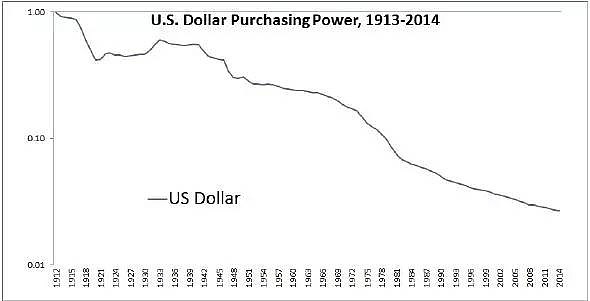

The future of the market remains uncertain. While the latest Dow loss is a cause for concern, it's important to remember that the stock market is cyclical and has historically recovered from downturns. However, investors should be cautious and stay informed about the latest market developments.

Case Study: The 2008 Financial Crisis

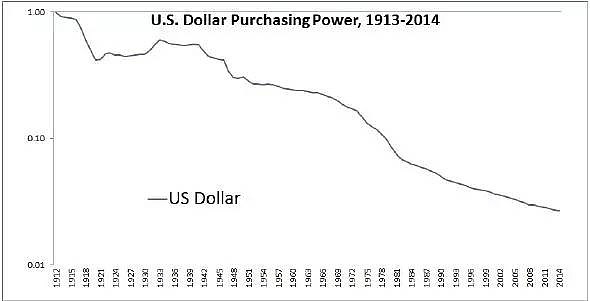

To put the current market situation into perspective, let's look at the 2008 financial crisis. At the time, the Dow experienced a massive loss, plummeting from over 14,000 points to around 6,500 points in just a few months. However, the market eventually recovered, and the Dow has since reached new highs.

This case study demonstrates that while the stock market can be volatile, it also has the potential to recover from significant losses. Investors should focus on long-term strategies and not panic during short-term market fluctuations.

Conclusion

The Dow's latest loss is a reminder of the volatility and uncertainty inherent in the stock market. While it's important to be aware of the risks, it's also crucial to stay informed and maintain a long-term perspective. By understanding the factors that contribute to market fluctuations and being prepared for potential downturns, investors can navigate the market with confidence.

can foreigners buy us stocks

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....