The stock market crash of 2008 was a pivotal moment in financial history, sending shockwaves across the globe. But how does this crash still affect us today? Despite more than a decade having passed, its repercussions are still felt in various aspects of our lives. This article delves into the lasting impact of the 2008 crash on the economy, investors, and society.

Economic Repercussions

Economic Slowdown

The 2008 crash led to a severe economic downturn. Unemployment rates soared, and many businesses faced bankruptcy. Although the economy has since recovered, the scars are still evident. The Great Recession caused long-term damage to economic growth, and recovery efforts have been slower than anticipated.

Debt Levels

To stimulate the economy, governments around the world increased their debt levels. This increase in debt has made many nations more vulnerable to economic shocks. Today, the global debt has reached unprecedented levels, raising concerns about the sustainability of this growth model.

Investment Implications

Risk Aversion

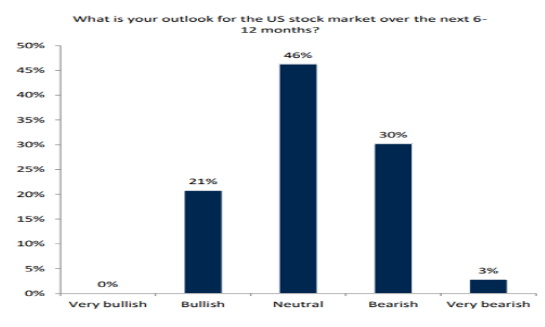

The 2008 crash has led to a shift in investor behavior. Investors are now more risk-averse, with a preference for safe investments such as bonds and fixed-income securities. This shift has affected the stock market, where volatility has increased.

Investment Strategies

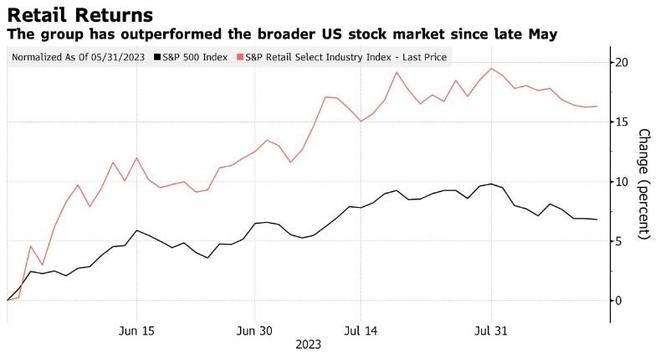

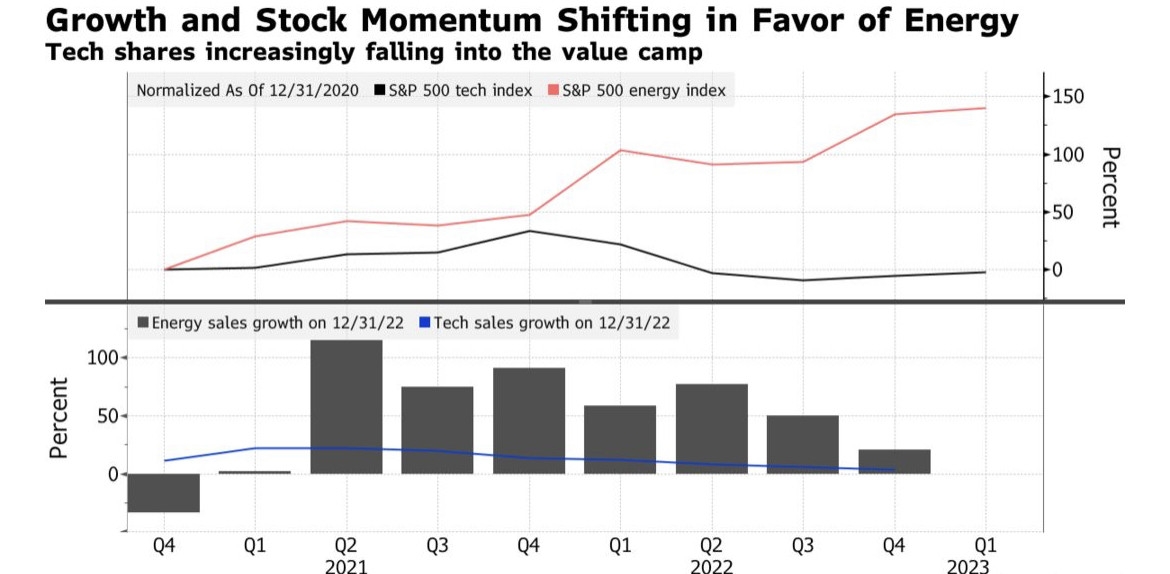

Many investors have changed their investment strategies to mitigate risks. They are now focusing on diversification, seeking out assets in different sectors and regions to reduce exposure to market fluctuations. Additionally, investors are more likely to seek advice from financial advisors before making investment decisions.

Social Impact

Income Inequality

The 2008 crash exacerbated income inequality. While the stock market recovered, the middle class and lower-income individuals did not see the same benefits. This has led to increased social unrest and political tensions.

Retirement Concerns

Baby boomers, who were nearing retirement age during the crash, were severely impacted. Many saw their retirement savings erode, and this has led to concerns about their ability to maintain a comfortable lifestyle in retirement.

Case Studies

The Housing Market

The housing market crash was a major consequence of the 2008 financial crisis. Many homeowners faced foreclosure, and the real estate market remained depressed for years. Even today, the housing market is still recovering, with prices still not reaching pre-crisis levels.

Bank Failures

Several major banks were on the brink of collapse during the crisis. The government stepped in to bail out these institutions, but this raised concerns about the moral hazard created by bailouts. Today, regulators are still implementing stricter rules to prevent such crises from occurring again.

Conclusion

The 2008 stock market crash has had a profound and lasting impact on the world. Its repercussions are still evident in various aspects of our lives, from economic policy to investor behavior and social stability. Understanding these impacts is crucial in navigating the financial landscape and preparing for future crises.

can foreigners buy us stocks

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....