In the dynamic world of the stock market, volatility is a constant factor that can create both opportunities and risks for investors. As we approach August 2025, it's crucial to identify the most volatile US stocks that could impact your portfolio. This article delves into the top picks for the month, highlighting their potential for significant price swings and providing insights into what might drive their volatility.

Tesla, Inc. (TSLA) - The Electric Vehicle Pioneer

Tesla, Inc. (NASDAQ: TSLA) has been a cornerstone of the electric vehicle (EV) revolution and continues to be one of the most volatile stocks in the market. With its innovative technologies and aggressive expansion plans, TSLA often sees dramatic price movements. Factors such as production milestones, regulatory changes, and global supply chain issues can significantly influence its stock price.

Amazon.com, Inc. (AMZN) - The E-Commerce Giant

Amazon.com, Inc. (NASDAQ: AMZN) is another stock known for its volatility. As the world's largest e-commerce platform, AMZN is highly sensitive to changes in consumer behavior, competition, and broader economic trends. Its stock price can fluctuate based on earnings reports, market share updates, and strategic shifts in its business model.

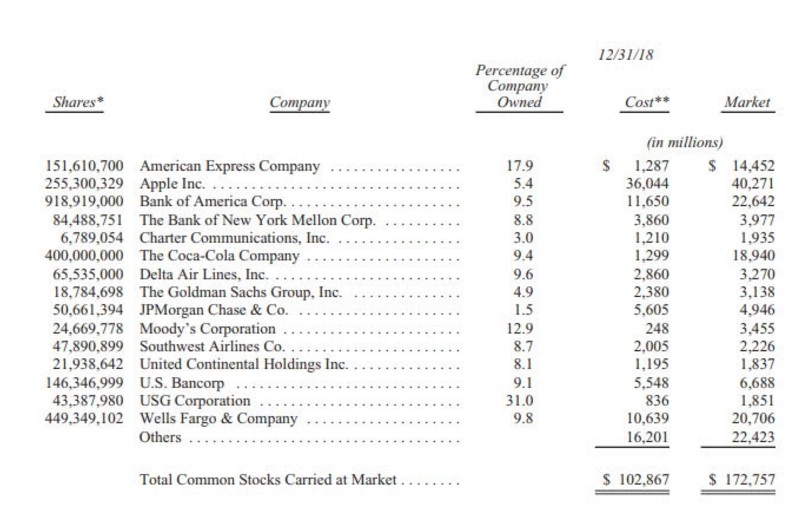

Apple Inc. (AAPL) - The Tech Giant

Apple Inc. (NASDAQ: AAPL) is a tech behemoth that often sees volatile trading. With a diverse product portfolio including iPhones, iPads, and Macs, AAPL is influenced by global supply chain disruptions, new product launches, and consumer demand. The stock's price movements are often magnified by its market capitalization, making it a significant mover in the broader market.

NVIDIA Corporation (NVDA) - The GPU Powerhouse

NVIDIA Corporation (NASDAQ: NVDA) is a leading player in the graphics processing unit (GPU) market. Its stock is highly volatile due to its exposure to the gaming, cryptocurrency, and data center sectors. NVDA's stock price can be affected by technological advancements, regulatory decisions, and the overall health of the tech industry.

Case Study: Beyond Meat, Inc. (BYND)

A prime example of a volatile stock is Beyond Meat, Inc. (NASDAQ: BYND). This company, known for its plant-based meat alternatives, experienced a meteoric rise in popularity and stock price. However, its stock has been highly volatile, driven by factors such as market competition, regulatory changes, and investor sentiment. This case study underscores the importance of understanding the factors that can impact a stock's volatility.

Conclusion

As we navigate the stock market in August 2025, it's essential to keep an eye on the most volatile US stocks. From Tesla to Amazon, Apple, NVIDIA, and Beyond Meat, these companies have the potential to see significant price movements. By staying informed and analyzing the factors that drive their volatility, investors can make more informed decisions and potentially capitalize on these opportunities.

can foreigners buy us stocks

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....