In recent years, Chinese companies have been making a significant impact on the US stock market. This trend has been driven by a variety of factors, including China's economic growth, the increasing interconnectedness of global markets, and the desire of US investors to diversify their portfolios. This article provides an overview of Chinese companies listed on the US stock market, their impact on the market, and the opportunities and challenges they present.

Rising Influence of Chinese Companies

Chinese companies have been increasingly listed on US stock exchanges, particularly the New York Stock Exchange (NYSE) and the NASDAQ. Some of the most prominent Chinese companies listed in the US include Alibaba Group Holding Ltd., Tencent Holdings Ltd., and Baidu Inc. These companies represent a range of industries, including technology, e-commerce, and finance.

Alibaba: A Leader in E-commerce

Alibaba Group Holding Ltd. is one of the most influential Chinese companies on the US stock market. As the world's largest e-commerce company, Alibaba has revolutionized the way people shop and do business. Its listing on the NYSE in 2014 was one of the largest IPOs in history, raising $21.8 billion. Alibaba's success in the US market is a testament to the company's strong brand and innovative business model.

Tencent: A Leader in Technology and Social Media

Tencent Holdings Ltd. is another major Chinese company listed on the US stock market. Tencent is a leading provider of social networking services, gaming, and mobile payment solutions. Its WeChat platform, with over 1 billion monthly active users, has become an essential part of daily life in China. Tencent's listing on the Hong Kong Stock Exchange in 2014 and its secondary listing on the NYSE in 2018 has made it one of the most valuable companies in the world.

Baidu: A Leader in Internet Search

Baidu Inc. is China's leading search engine and one of the most prominent Chinese companies on the US stock market. Baidu offers a wide range of online services, including search, advertising, cloud computing, and AI. Its listing on the NASDAQ in 2005 was the first time a Chinese company was listed on a major US stock exchange. Baidu's success in the US market has been driven by its strong brand and innovative technology.

Opportunities and Challenges

The presence of Chinese companies on the US stock market presents both opportunities and challenges. On the one hand, US investors can gain exposure to the rapidly growing Chinese economy and some of the most innovative companies in the world. On the other hand, investing in Chinese companies can be challenging due to regulatory risks, currency fluctuations, and cultural differences.

Case Study: Huawei

One notable case study is Huawei Technologies Co., Ltd., a Chinese multinational telecommunications equipment and consumer electronics company. Huawei has been banned from doing business with certain US companies due to national security concerns. This ban has had a significant impact on Huawei's operations and has raised questions about the risks associated with investing in Chinese companies.

Conclusion

Chinese companies have become an integral part of the US stock market, offering US investors access to some of the most innovative and successful companies in the world. While investing in these companies presents opportunities for significant returns, it also comes with risks. As the relationship between China and the US continues to evolve, it will be important for investors to stay informed and make informed decisions.

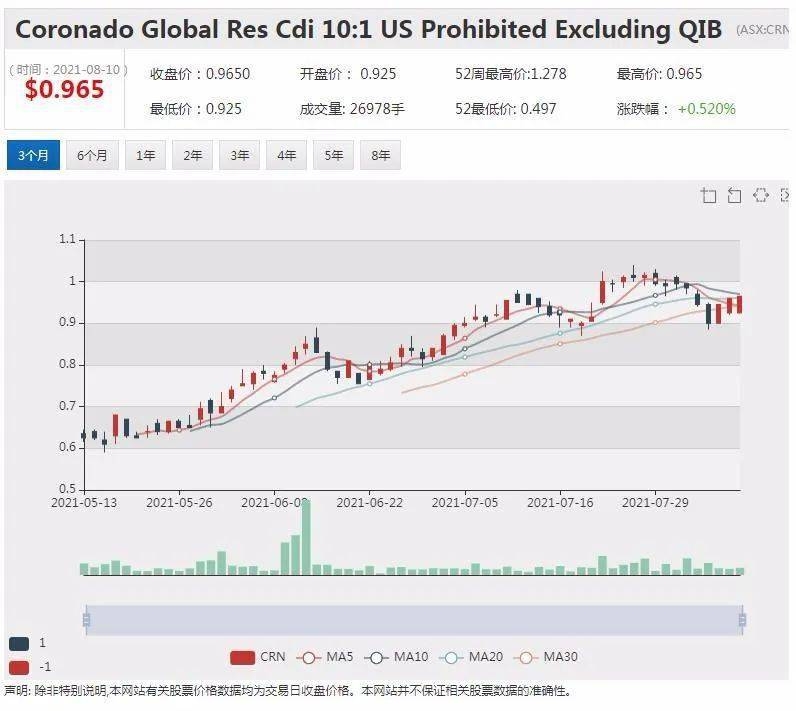

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....