In today's volatile market, the question of whether to sell your US stocks is a critical one. With numerous factors at play, it's essential to weigh the pros and cons before making a decision. This article delves into the key considerations and potential scenarios where selling your US stocks might be the right move.

Understanding the Market

The stock market is a complex and unpredictable entity, influenced by economic indicators, geopolitical events, and investor sentiment. Before deciding to sell your stocks, it's crucial to have a clear understanding of the market's current state.

1. Stock Performance

Evaluate the performance of your stocks. If they have consistently underperformed, it may be an indication that it's time to cut your losses. Conversely, if your stocks are showing strong growth potential, holding onto them might be a wise decision.

2. Market Trends

Analyze market trends to identify any shifts that could impact your stocks. For instance, if the market is showing signs of a bearish trend, it might be prudent to sell before the decline worsens.

Personal Financial Goals

Your personal financial goals play a significant role in determining whether to sell your US stocks. Consider the following:

1. Emergency Fund

Ensure that you have an adequate emergency fund in place before considering selling stocks. If you need cash for unforeseen expenses, liquidating stocks could be a viable option.

2. Retirement Planning

If you're nearing retirement age, reassess your retirement plan. Selling stocks to ensure a stable income source might be a smart move.

Risk Tolerance

Your risk tolerance is a crucial factor in investment decisions. If you're risk-averse, it may be time to reconsider your portfolio, including US stocks.

Tax Implications

Be aware of the potential tax implications of selling your US stocks. Capital gains tax is applicable on profits made from the sale of stocks. Consult with a financial advisor to understand the tax implications based on your specific situation.

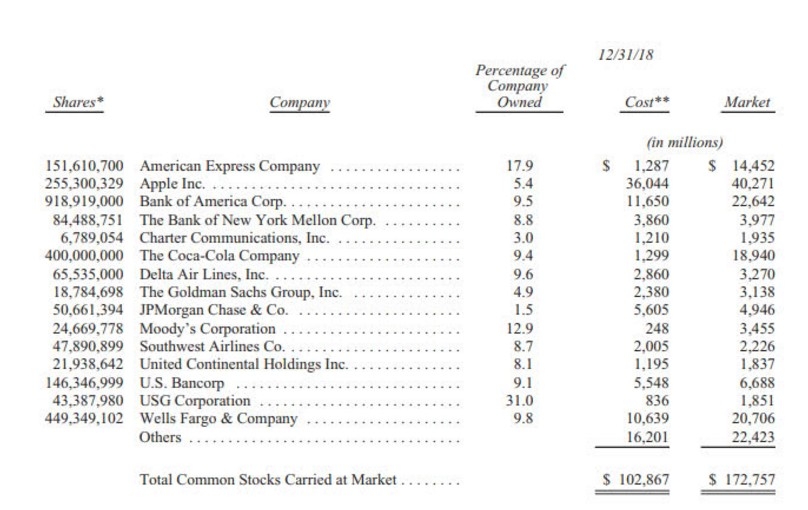

Diversification

Diversification is key to managing risk in your investment portfolio. If your portfolio is heavily concentrated in US stocks, consider selling some to achieve a more balanced and diversified portfolio.

Market Volatility

Market volatility can create both opportunities and risks. In times of high volatility, it's crucial to stay calm and evaluate the long-term prospects of your investments.

Case Studies

Consider the following case studies to understand the potential outcomes of selling US stocks:

1. Tech Stocks in 2022

In 2022, the tech industry experienced a significant downturn. Investors who sold their tech stocks during this period likely mitigated their losses. However, those who held onto their investments saw a rebound in 2023.

2. Real Estate Stocks in 2020

The COVID-19 pandemic caused a downturn in the real estate sector. Investors who sold their real estate stocks during this period might have avoided further losses. However, those who held onto their investments saw a recovery in 2021.

In conclusion, deciding whether to sell your US stocks requires careful consideration of various factors, including stock performance, market trends, personal financial goals, risk tolerance, tax implications, and diversification. Evaluate these factors based on your unique situation and consult with a financial advisor to make an informed decision.

can foreigners buy us stocks

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....