In the world of finance, stock futures play a crucial role in risk management and investment strategies. This article aims to provide a comprehensive guide to stock futures, explaining what they are, how they work, and their importance in the financial markets.

What are Stock Futures?

Stock futures are financial contracts that obligate the buyer to purchase an asset, or the seller to sell an asset, at a predetermined future date and price. These contracts are standardized and traded on regulated exchanges. The assets involved in stock futures can be stocks, indexes, or commodities.

How Do Stock Futures Work?

Stock futures operate similarly to other futures contracts. Here’s a basic overview of how they work:

- Contracts: A stock futures contract is an agreement between two parties to buy or sell an asset at a specified price on a future date.

- Expiration: Each stock futures contract has a specific expiration date. Traders must decide whether to hold their position until expiration or close it before the expiration date.

- Leverage: Stock futures are highly leveraged, meaning traders can control a large amount of stock with a relatively small amount of capital.

- Markets: Stock futures are traded on exchanges like the Chicago Mercantile Exchange (CME) and the New York Mercantile Exchange (NYMEX).

Benefits of Stock Futures

- Hedging: Stock futures are a popular tool for hedging against market risk. Traders can protect their portfolio from potential losses by taking opposite positions in the futures market.

- Speculation: Stock futures allow traders to speculate on the future price movements of assets. This can be a lucrative strategy if executed correctly.

- Leverage: The high leverage offered by stock futures allows traders to increase their potential returns on investment.

Risks of Stock Futures

- Leverage: While leverage can amplify returns, it can also amplify losses. Traders must be cautious when using leverage in the futures market.

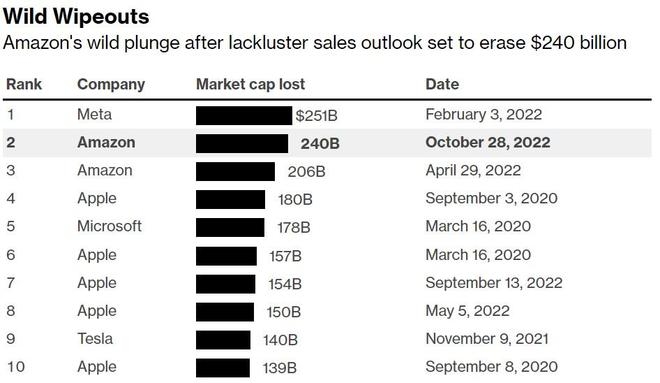

- Volatility: Stock futures can be highly volatile, leading to rapid price movements and potential losses.

- Complexity: Understanding and trading stock futures requires knowledge of market dynamics and risk management strategies.

Case Study: Apple Stock Futures

Let’s consider a hypothetical scenario involving Apple stock futures. Suppose a trader believes that Apple’s stock price will increase over the next three months. To capitalize on this belief, the trader buys Apple stock futures at a price of $150.

If the stock price does, in fact, rise to

Conclusion

Stock futures are an essential tool for traders and investors looking to manage risk and capitalize on market opportunities. Understanding the mechanics and risks of stock futures is crucial for successful trading. As always, it is important to conduct thorough research and seek professional advice before entering the futures market.

can foreigners buy us stocks

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....