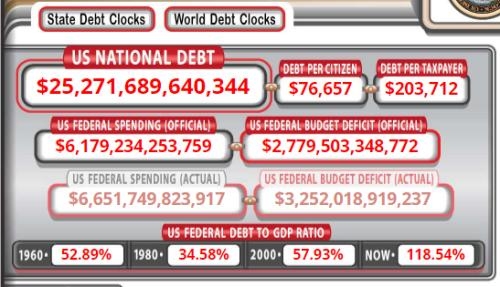

Investing in U.S. stocks from Canada can be a lucrative opportunity, but it's crucial to understand the tax implications. One of the most significant considerations is the Canadian tax on US stocks. This article delves into the details, explaining how Canadian investors can navigate this tax system effectively.

What is the Canadian Tax on US Stocks?

When Canadian investors purchase U.S. stocks, they are subject to Canadian tax laws. The Canadian tax system is unique, as it taxes investors on their worldwide income, including dividends from U.S. stocks. This means that any dividends received from U.S. companies are subject to Canadian income tax.

Tax Rates on Dividends from US Stocks

The tax rate on dividends from U.S. stocks in Canada depends on the investor's marginal tax rate. The Canada Revenue Agency (CRA) provides a tax credit to reduce the tax burden on these dividends. This tax credit is known as the Foreign Tax Credit (FTC).

Calculating the Tax on Dividends

To calculate the tax on dividends from U.S. stocks, follow these steps:

- Determine your marginal tax rate.

- Multiply the dividend amount by your marginal tax rate.

- Subtract the Foreign Tax Credit from the calculated tax amount.

For example, let's say you receive a dividend of

Reporting Dividends on Your Tax Return

It's essential to report dividends from U.S. stocks on your Canadian tax return. The CRA requires investors to report these dividends using Form T3, Statement of Investment Income. This form helps the CRA track your worldwide income and ensure compliance with tax laws.

Case Study: John's Dividend Investment

Let's consider a hypothetical case involving John, a Canadian investor. John purchased shares of a U.S. technology company and received a dividend of

Additional Considerations

While the Canadian tax on US stocks can be complex, there are several strategies investors can employ to minimize their tax burden:

- Use of Tax-Free Savings Accounts (TFSA): Investing in U.S. stocks within a TFSA can help defer taxes on dividends until the funds are withdrawn.

- Tax-Efficient Portfolio Management: Diversifying your investments across various asset classes can help optimize your tax situation.

- Seek Professional Advice: Consulting with a tax professional or financial advisor can provide personalized guidance tailored to your specific circumstances.

In conclusion, understanding the Canadian tax on US stocks is crucial for Canadian investors. By familiarizing yourself with the tax system and utilizing available strategies, you can effectively manage your tax obligations while capitalizing on investment opportunities in the U.S.

can foreigners buy us stocks

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....