Are you looking to invest in Dräger, a leading company in the medical and safety equipment industry? Investing in foreign stocks can be a bit daunting, but with the right steps, you can easily purchase Dräger stock in the US market. In this article, we'll guide you through the process of buying Dräger stock, from understanding the company to executing the trade.

Understanding Dräger

Drägerwerk AG & Co. KGaA, commonly known as Dräger, is a German company specializing in medical and safety equipment. Their products range from respiratory protection to monitoring and analysis devices. Dräger has a strong reputation for innovation and quality, making it a popular choice for investors looking for a stable, long-term investment.

Choosing a Broker

The first step in buying Dräger stock is to choose a brokerage firm. There are numerous brokerage firms available in the US market, each offering different services and fees. Some popular brokerage firms for international stock purchases include Fidelity, Charles Schwab, and TD Ameritrade.

When selecting a broker, consider the following factors:

- Research and Tools: Look for a broker that offers comprehensive research tools and resources to help you make informed decisions.

- Fees: Compare the fees associated with purchasing foreign stocks, as some brokers may charge higher fees for international transactions.

- Customer Service: Ensure the broker has reliable customer service, especially if you encounter any issues during the buying process.

Opening an Account

Once you've chosen a broker, you'll need to open an account. This process typically involves providing personal information, verifying your identity, and linking a bank account. Be prepared to provide documents such as a driver's license, Social Security number, and proof of address.

Finding Dräger Stock

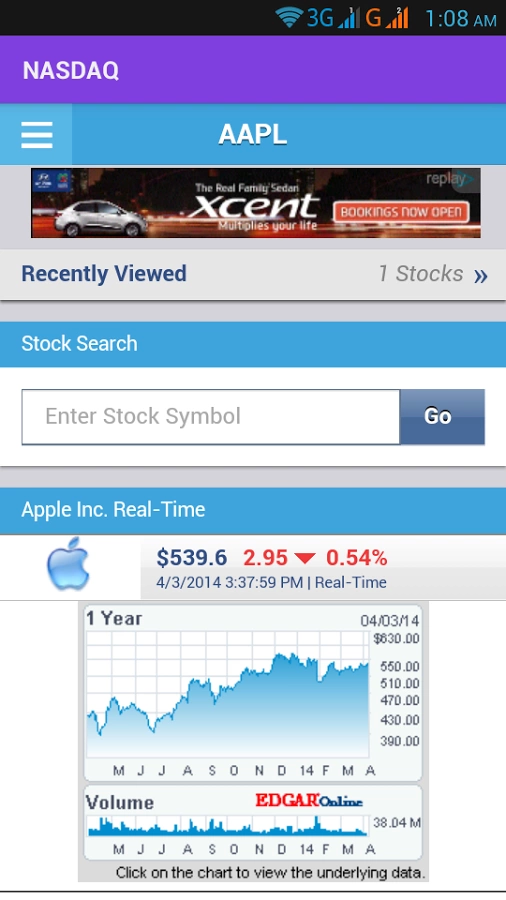

To find Dräger stock, log in to your brokerage account and navigate to the "Search" or "Symbol" function. Enter "DRAGF" (Dräger's US ticker symbol) to view the stock's details.

Placing Your Order

Now that you've found Dräger stock, it's time to place your order. You can choose from various order types, including market orders, limit orders, and stop orders. A market order will execute immediately at the current market price, while a limit order allows you to specify the maximum price you're willing to pay.

Before placing your order, consider the following:

- Risk Management: Set a stop-loss order to limit your potential losses.

- Investment Strategy: Determine the number of shares you want to purchase based on your investment strategy and budget.

Monitoring Your Investment

After purchasing Dräger stock, it's essential to monitor your investment. Keep an eye on the company's financial reports, market trends, and any news that may impact the stock's performance.

Case Study

Let's say you've decided to invest

In this example, proper research and investment strategy played a crucial role in maximizing your returns.

By following these steps, you can easily buy Dräger stock in the US market. Remember to do your due diligence, choose a reliable broker, and stay informed about the market to make the most of your investment opportunities.

can foreigners buy us stocks

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....