Investing in the stock market can be a daunting task, especially for beginners. With thousands of companies to choose from, it's hard to know where to start. That's where blue chip stocks come into play. These companies are known for their stability, strong financial performance, and long-standing track records. In this article, we will explore what blue chip stocks are, their benefits, and how to invest in them.

What are Blue Chip Stocks?

Blue chip stocks are shares of well-established companies with a long history of reliable performance. These companies are often leaders in their respective industries and are known for their stability and profitability. To be considered a blue chip stock, a company typically needs to meet certain criteria, such as having a strong financial position, a high dividend yield, and a solid reputation in the market.

The Benefits of Investing in Blue Chip Stocks

Investing in blue chip stocks offers several advantages:

- Stability: Blue chip companies are less likely to be affected by market volatility, making them a safer investment option.

- Dividends: Many blue chip stocks pay regular dividends, providing investors with a steady income stream.

- Growth Potential: Despite their stability, blue chip companies often have significant growth potential, as they continue to innovate and expand their market presence.

- Long-Term Performance: Over the long term, blue chip stocks tend to outperform the market, providing investors with a solid return on their investment.

How to Invest in Blue Chip Stocks

Investing in blue chip stocks is relatively straightforward. Here's a step-by-step guide:

- Research: Start by researching different blue chip companies and their industries. Look for companies with a strong financial position, a high dividend yield, and a solid reputation.

- Diversify: Diversify your portfolio by investing in multiple blue chip stocks across different industries. This will help to reduce your risk if one stock performs poorly.

- Open a Brokerage Account: Open a brokerage account to purchase blue chip stocks. There are many online brokers to choose from, each with its own fees and features.

- Buy Stocks: Once you have your brokerage account set up, you can buy blue chip stocks using your account. Simply enter the stock symbol and the number of shares you wish to purchase.

- Monitor Your Investments: Regularly monitor your blue chip stocks to ensure they are performing as expected. Adjust your portfolio as needed to maintain a healthy balance of investments.

Case Studies

To illustrate the benefits of investing in blue chip stocks, let's take a look at two popular companies:

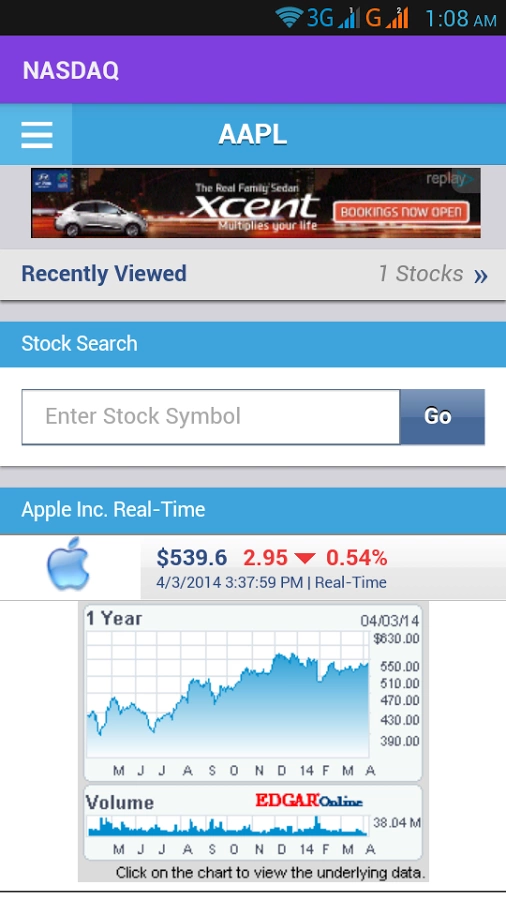

- Apple Inc. (AAPL): As one of the world's largest technology companies, Apple is a prime example of a blue chip stock. With a strong financial position, a high dividend yield, and a reputation for innovation, Apple has consistently delivered strong returns for investors.

- Procter & Gamble (PG): Procter & Gamble is a leading consumer goods company with a long history of profitability. As a blue chip stock, P&G offers investors stability, dividends, and growth potential.

In conclusion, blue chip stocks are a great investment option for those looking for stability, dividends, and long-term growth. By doing your research, diversifying your portfolio, and staying informed, you can make smart investments in blue chip stocks.

new york stock exchange

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....