In today's globalized economy, cross-border investments have become increasingly common. Chinese investors, in particular, are showing a growing interest in purchasing US stocks. But can they? This guide will delve into the ins and outs of this investment opportunity, providing valuable insights for those considering it.

Understanding the Market

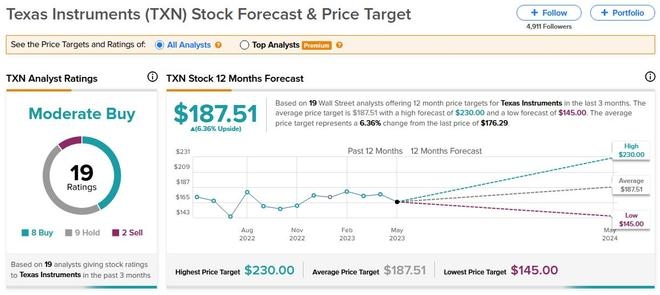

The US stock market is one of the most robust and diversified in the world, offering a wide array of investment options. From tech giants to established blue-chip companies, there's something for every investor's taste. The NASDAQ and the S&P 500 are among the most popular indices for Chinese investors.

Eligibility for Chinese Investors

Chinese investors can buy US stocks through several channels. The most common methods include:

Through a Brokerage Firm: Many Chinese investors use brokerage firms that offer access to the US stock market. These firms often provide comprehensive services, including research, trading, and financial advice.

Through a Mutual Fund: Investing in a mutual fund that includes US stocks can be an easier and less risky way for Chinese investors to gain exposure to the US market.

Through a Foreign Exchange-Traded Fund (ETF): ETFs are a popular choice for investors looking to diversify their portfolios. They track the performance of a specific index, such as the S&P 500, and can be bought and sold like stocks.

Regulatory Considerations

It's crucial for Chinese investors to be aware of the regulatory requirements when purchasing US stocks. The following are some key considerations:

Tax Implications: Chinese investors should be aware of the tax obligations associated with owning US stocks. The US government requires foreign investors to file Form 8938 if they have a financial interest in certain foreign assets.

Reporting Requirements: Foreign investors must comply with the Foreign Account Tax Compliance Act (FATCA), which requires financial institutions to report information about the foreign financial accounts of their clients.

Benefits of Investing in US Stocks

Investing in US stocks can offer several benefits for Chinese investors:

Diversification: The US stock market provides a diverse range of sectors and industries, allowing Chinese investors to diversify their portfolios and reduce risk.

Potential for High Returns: The US stock market has historically offered higher returns than many other markets, making it an attractive investment option for those seeking long-term growth.

Access to World-Class Companies: The US is home to many of the world's largest and most successful companies, offering Chinese investors exposure to innovative and established businesses.

Case Study: Alibaba and Tencent

Two prominent examples of Chinese companies that have made significant investments in the US stock market are Alibaba and Tencent. Alibaba, one of the world's largest e-commerce platforms, listed on the New York Stock Exchange in 2014. Tencent, a leading provider of internet services in China, has also invested in numerous US companies, including Spotify and Square.

Conclusion

For Chinese investors looking to diversify their portfolios and gain exposure to the world's largest and most dynamic market, investing in US stocks is a viable option. However, it's essential to understand the regulatory requirements and risks involved. With the right approach and a well-diversified portfolio, Chinese investors can potentially benefit from the numerous opportunities available in the US stock market.

new york stock exchange

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....