In the vast landscape of the insurance industry, the question of how many life insurance companies are stock companies often arises. This article delves into this query, exploring the characteristics of stock companies, their role in the life insurance sector, and providing insights into the number of such entities in operation today.

Understanding Stock Companies

To begin, let's clarify what a stock company is. A stock company, also known as a corporation, is a type of business organization where ownership is divided into shares of stock. These shares can be bought and sold on public stock exchanges. The primary characteristic of a stock company is that it has a separate legal entity from its owners, known as shareholders.

The Role of Stock Companies in Life Insurance

Stock companies play a significant role in the life insurance industry. They offer a range of life insurance products, including term life, whole life, and universal life insurance. These companies are regulated by state insurance departments and are subject to strict financial and operational standards.

The Number of Stock Life Insurance Companies

As of the latest available data, there are approximately 100 stock life insurance companies operating in the United States. This figure includes both well-established companies with a long history and newer entrants in the market. These companies vary in size, with some being part of large financial conglomerates and others operating as standalone entities.

Case Studies

To provide a clearer picture, let's look at a couple of case studies:

Prudential Financial: One of the largest stock life insurance companies in the United States, Prudential Financial offers a wide range of life insurance products and services. With a market capitalization of over $50 billion, Prudential is a significant player in the industry.

MetLife: Another major stock life insurance company, MetLife, provides a comprehensive suite of life insurance products and services. With a market capitalization of over $80 billion, MetLife is one of the most prominent players in the industry.

Key Takeaways

- Stock Life Insurance Companies: Approximately 100 stock life insurance companies operate in the United States.

- Role: These companies offer a wide range of life insurance products and services, and they are regulated by state insurance departments.

- Market Presence: Some of the largest stock life insurance companies, such as Prudential Financial and MetLife, have a significant market presence.

In conclusion, the life insurance industry is home to numerous stock companies, each playing a vital role in providing consumers with essential financial protection. Understanding the number and characteristics of these companies can help individuals make informed decisions when selecting life insurance coverage.

new york stock exchange

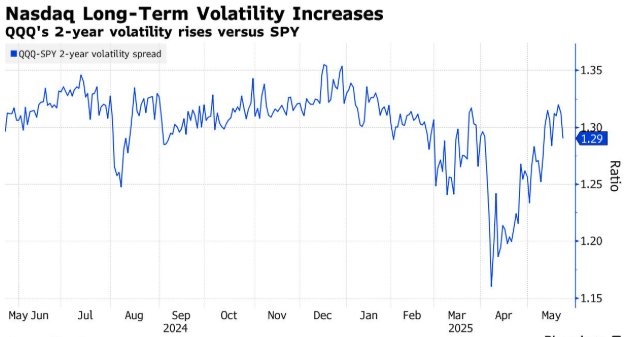

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....