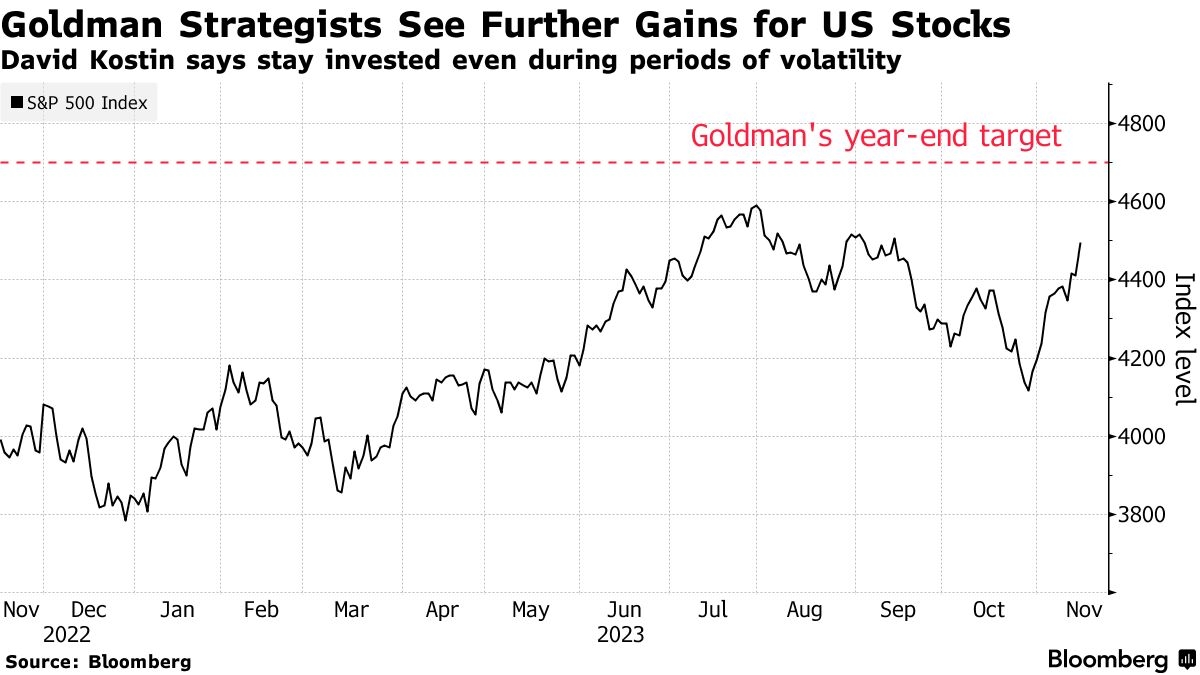

The S&P 500, often referred to as the "SP500," is a widely followed index that tracks the performance of 500 large companies listed on stock exchanges in the United States. While the trading day for these companies typically ends at 4:00 PM Eastern Time, the action doesn't stop there. The SP500 post market period offers investors and traders a unique opportunity to stay informed and potentially capitalize on market movements that occur after the regular trading hours.

Understanding the SP500 Post Market

The SP500 post market period begins immediately after the regular trading session ends and continues until the market closes. During this time, traders can access real-time data and news that may impact the index and its constituent stocks. This includes earnings reports, corporate news, economic data, and other significant events that can influence market sentiment.

Key Features of SP500 Post Market

- Real-Time Data: The SP500 post market provides real-time data, allowing traders to make informed decisions based on the latest information.

- Earnings Reports: Many companies release their earnings reports after the regular trading session. These reports can significantly impact the SP500 and its constituent stocks.

- Corporate News: News about mergers, acquisitions, and other corporate events can move the market. The SP500 post market is a critical time to stay updated on these developments.

- Economic Data: Economic reports, such as unemployment rates and inflation data, can influence market sentiment and trading decisions.

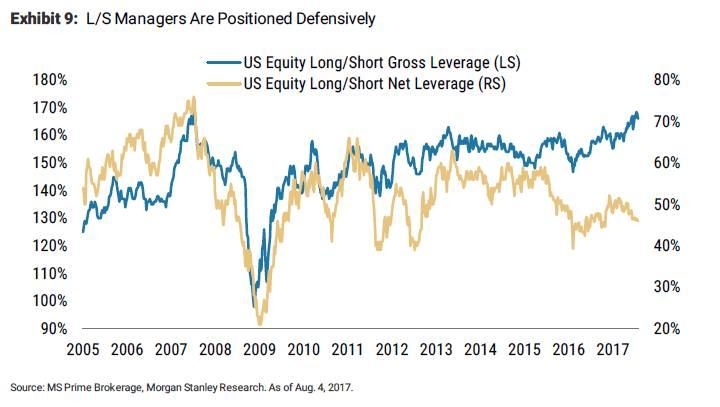

- Futures Contracts: The SP500 post market is also a crucial time for futures contracts. These contracts can provide insights into market expectations and potential movements.

How to Access SP500 Post Market Information

Several platforms offer real-time SP500 post market data and news. These include financial news websites, stock market apps, and brokerage platforms. Many of these platforms offer free access to basic information, while more advanced features may require a subscription.

Case Study: SP500 Post Market Movement

Let's consider a hypothetical scenario. Company XYZ, a constituent of the SP500, releases its earnings report after the regular trading session. The report shows stronger-than-expected results, leading to a surge in the company's stock price. This movement can have a ripple effect on the SP500, potentially causing the index to rise or fall.

Traders who monitor the SP500 post market and are aware of the earnings report can react quickly to this information. By buying or selling stocks based on this information, they can potentially capitalize on the market movement.

Conclusion

The SP500 post market is a critical time for investors and traders to stay informed and react to market movements. By monitoring real-time data, earnings reports, and corporate news, traders can make informed decisions and potentially capitalize on market opportunities. Whether you're a seasoned investor or a beginner, understanding the SP500 post market can provide a significant advantage in the stock market.

new york stock exchange

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....