The baby boomer generation, born between 1946 and 1964, has been a driving force in the U.S. economy for decades. As this influential group approaches retirement, their financial decisions are poised to have a significant impact on the stock market. The "Great Boomer Selloff" is a term that refers to the potential wave of selling that could overwhelm the stock market as baby boomers liquidate their investments to fund their retirement. In this article, we will explore the implications of this selloff and its potential effects on the stock market.

Understanding the Boomer Selloff

The baby boomer generation is the largest demographic group in the U.S., and their collective financial power cannot be underestimated. As they approach retirement, many are expected to start selling off their investments to fund their retirement needs. This could lead to a significant selloff in the stock market, as baby boomers liquidate their assets to generate income.

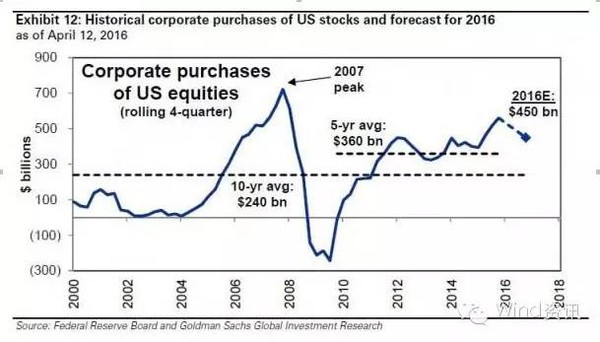

Several factors contribute to the potential impact of the Great Boomer Selloff. First, baby boomers have accumulated substantial wealth over the years, much of which is invested in the stock market. As they begin to withdraw from the workforce, they will need to access these funds to maintain their lifestyle. Second, the average retirement savings of baby boomers is lower than expected, which could force them to sell off assets at a time when the stock market is volatile.

The Potential Impact on the Stock Market

The Great Boomer Selloff could have several negative implications for the stock market. First, it could lead to a significant drop in stock prices, as the demand for stocks decreases. This could be particularly damaging for stocks that are heavily owned by baby boomers, such as those in the technology and healthcare sectors.

Second, the selloff could exacerbate market volatility, as investors react to the potential impact of the selloff on their portfolios. This could lead to a loss of confidence in the stock market, further driving down prices.

Third, the selloff could have a ripple effect on the broader economy, as reduced stock market wealth could lead to decreased consumer spending and investment. This could slow economic growth and potentially lead to a recession.

Case Studies and Historical Context

To understand the potential impact of the Great Boomer Selloff, it is helpful to look at historical examples. One notable example is the dot-com bubble of the late 1990s, which was driven by a wave of selling as investors sought to cash in on their gains before the market crashed. Similarly, the financial crisis of 2008 was partly fueled by a selloff in the housing market, as baby boomers and other investors sought to liquidate their assets to avoid losses.

In addition, we can look at the experiences of other countries that have faced similar demographic shifts. For example, Japan's "Lost Decade" of the 1990s was partly due to a wave of selling as the country's aging population sought to fund their retirement.

Conclusion

The Great Boomer Selloff is a potential threat to the stability of the stock market. As baby boomers approach retirement, their financial decisions could have a significant impact on the market. While it is difficult to predict the exact outcome, it is clear that the potential for a selloff is a concern for investors and policymakers alike. By understanding the factors that contribute to the selloff and its potential impact, we can better prepare for the challenges ahead.

new york stock exchange

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....