Introduction:

Understanding the Stock Market: Before we dive into the impact of holidays on stock prices, it's essential to have a basic understanding of the stock market. The stock market is a place where buyers and sellers trade shares of publicly-traded companies. Stock prices are influenced by various factors, including company performance, economic indicators, and investor sentiment.

The Role of Holidays: Holidays play a significant role in the stock market, as they can affect trading volume, market sentiment, and economic indicators. Here's how holidays can impact stock prices:

Reduced Trading Volume: During holidays, many investors and traders take time off, leading to a decrease in trading volume. This reduced activity can cause stock prices to become less volatile, as there are fewer buyers and sellers in the market. As a result, stock prices may remain relatively stable during holiday periods.

Market Sentiment: Holidays can influence market sentiment, both positively and negatively. For instance, if a holiday coincides with positive economic news, such as a strong jobs report, it may boost investor confidence and lead to higher stock prices. Conversely, if a holiday falls during a period of economic uncertainty, it may lead to lower stock prices as investors become more cautious.

Economic Indicators: Holidays can also impact economic indicators, which in turn can affect stock prices. For example, if a holiday falls during the release of a significant economic report, such as the Consumer Price Index (CPI) or Gross Domestic Product (GDP), the market may react to the data, leading to fluctuations in stock prices.

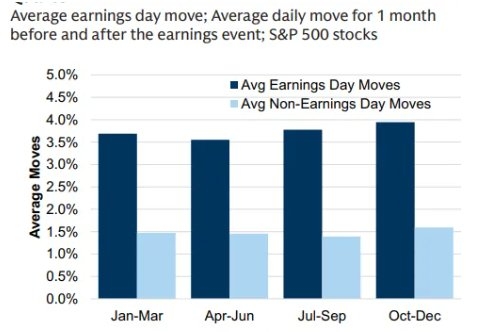

Corporate Earnings Reports: Holidays can also affect the release of corporate earnings reports. If a company's earnings report falls on a holiday, it may receive less attention from investors, potentially impacting the stock price. Conversely, if a company's earnings report falls on a non-holiday trading day, it may receive more scrutiny, leading to significant price movements.

Case Study: Thanksgiving Holiday Impact To illustrate the impact of holidays on stock prices, let's consider the Thanksgiving holiday. Thanksgiving typically falls on the fourth Thursday of November in the United States. During this holiday, trading volume tends to decrease as many investors take time off to spend time with family and friends.

In the past, the stock market has shown relatively stable prices during the Thanksgiving holiday. However, in some instances, the market has experienced significant volatility, particularly if there were major economic events or corporate earnings reports released around that time.

Conclusion: Holidays can have a notable impact on stock prices and the broader market. While trading volume may decrease during holidays, market sentiment and economic indicators can still influence stock prices. Understanding these dynamics can help investors make informed decisions and navigate the complexities of the stock market during holiday periods.

new york stock exchange

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....