In the dynamic world of financial markets, understanding the momentum of large cap stocks is crucial for investors seeking to capitalize on market trends. This article delves into the concept of "US large cap stocks momentum 5 days," offering a comprehensive analysis of market trends and investment strategies.

Understanding Large Cap Stocks

Large cap stocks refer to shares of companies with a market capitalization of over $10 billion. These companies are typically well-established and have a significant presence in their respective industries. Investing in large cap stocks often provides stability and diversification, making them a popular choice among investors.

Momentum: A Key Indicator

Momentum, in financial terms, refers to the rate of change in the price of a security over a specific period. It is a vital indicator for investors looking to identify potential trading opportunities. In this article, we will focus on the momentum of US large cap stocks over a 5-day period.

Analyzing 5-Day Momentum

The 5-day momentum of US large cap stocks can offer valuable insights into market trends. By analyzing the price movements over this period, investors can gain a better understanding of the market's direction and make informed decisions.

Key Factors Influencing 5-Day Momentum

Several factors influence the 5-day momentum of US large cap stocks. These include:

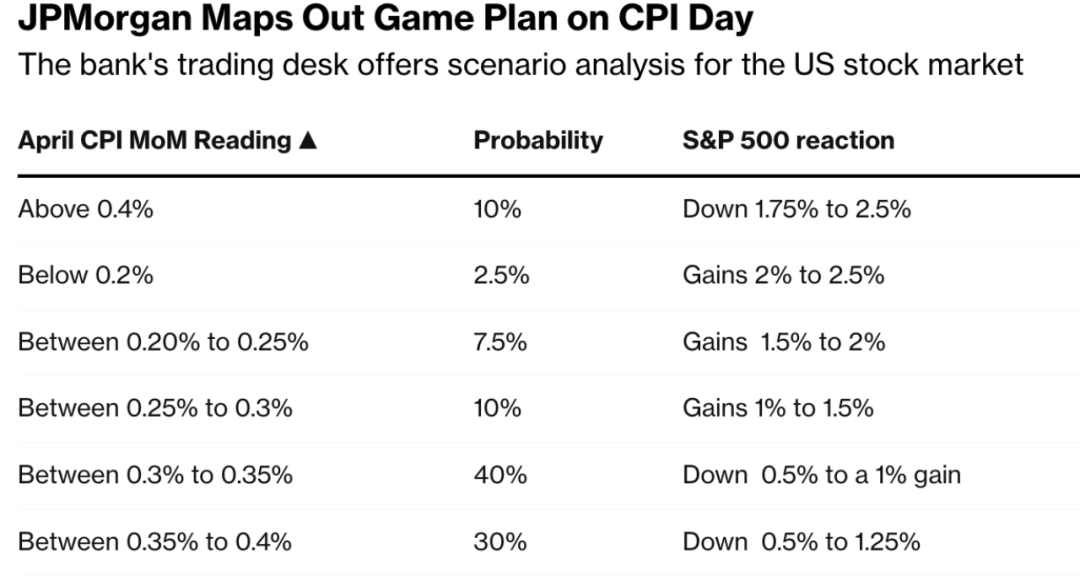

- Economic Data: Economic indicators, such as GDP growth, unemployment rates, and inflation, can significantly impact stock prices.

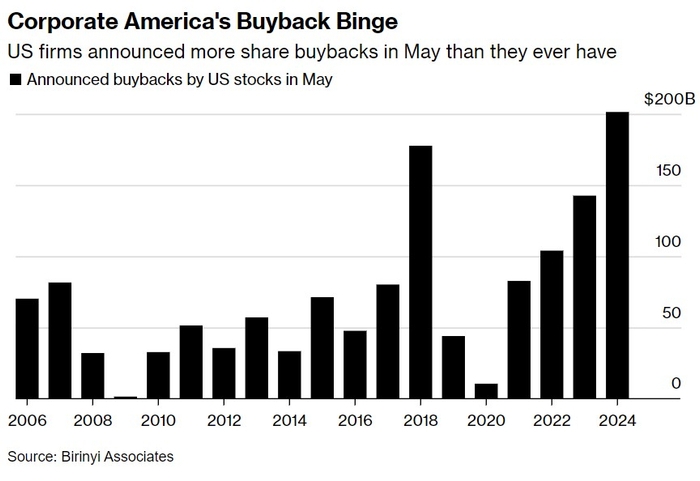

- Corporate Earnings: Strong earnings reports from large cap companies can boost investor confidence and drive up stock prices.

- Market Sentiment: The overall sentiment of investors towards the market can influence stock prices. Positive sentiment can lead to increased buying pressure, while negative sentiment can lead to selling pressure.

Case Study: Apple Inc.

Let's consider a case study involving Apple Inc., a leading technology company with a large market capitalization. Over the past 5 days, Apple's stock has shown strong momentum, driven by several factors:

- Robust Earnings: Apple reported impressive earnings, surpassing market expectations.

- Positive Market Sentiment: The overall market sentiment towards technology stocks has been positive, boosting investor confidence in Apple.

- Economic Factors: The US economy has shown signs of recovery, which has positively impacted the technology sector.

Conclusion

Understanding the 5-day momentum of US large cap stocks is essential for investors looking to capitalize on market trends. By analyzing key factors influencing momentum and considering real-world case studies, investors can make informed decisions and potentially achieve higher returns.

new york stock exchange

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....