In the vast landscape of the American stock market, US monopoly stocks stand out as some of the most lucrative and stable investments. These companies, with a near-monopolistic hold on their markets, have consistently proven their resilience and profitability over the years. This guide will delve into what makes these stocks so appealing, how to identify them, and why they should be a part of your investment portfolio.

Understanding Monopoly Stocks

Firstly, it's crucial to understand what defines a monopoly stock. These are companies that have a significant, often dominant, market share in their respective industries. This market power allows them to dictate prices, limit competition, and generate substantial profits. Historically, monopoly stocks have included giants like Microsoft, Coca-Cola, and Johnson & Johnson.

Key Features of US Monopoly Stocks

Market Leadership: A hallmark of US monopoly stocks is their dominant market position. This leadership is often the result of innovative products, strong brand recognition, and a loyal customer base.

High Profit Margins: Due to their market power, monopoly stocks tend to enjoy high profit margins. This profitability translates into strong earnings growth and substantial dividends for shareholders.

Stable Growth: Companies with a near-monopolistic position often experience stable and predictable growth. This consistency is a major draw for investors seeking long-term gains.

Innovation and Adaptability: While monopoly stocks maintain a strong hold on their markets, they also need to innovate and adapt to changing consumer preferences and market dynamics. This dual capability makes them even more attractive.

Identifying US Monopoly Stocks

Identifying US monopoly stocks requires research and analysis. Here are some key indicators to look for:

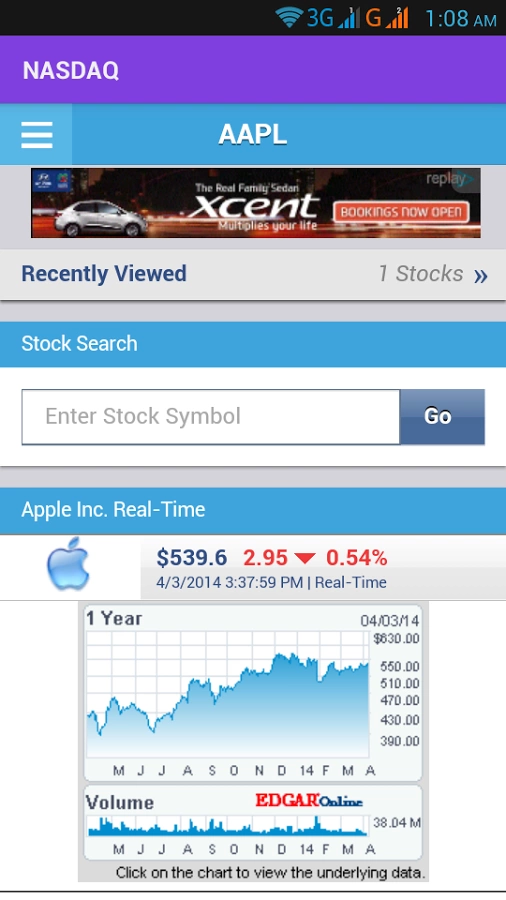

- Market Capitalization: Large market capitalizations are a good starting point. Companies like Apple and Amazon, with market caps in the trillions, are prime examples.

- Profitability: Examine the company's profit margins and revenue growth. Consistently high margins and stable revenue growth are positive signs.

- Brand Power: Look for companies with strong brand recognition and loyalty. Coca-Cola and Procter & Gamble are notable examples.

- Competitive Advantage: Assess the company's competitive position in its industry. Companies with proprietary technology, strong distribution networks, or government-granted monopolies often have a lasting competitive advantage.

Case Study: Microsoft

A prime example of a successful US monopoly stock is Microsoft. Over the years, Microsoft has maintained its dominant position in the software industry through innovation, strategic acquisitions, and a relentless pursuit of market leadership. Despite facing antitrust scrutiny in the past, Microsoft has continued to grow and innovate, making it a staple in any well-diversified investment portfolio.

Why Invest in US Monopoly Stocks?

Investing in US monopoly stocks offers several advantages:

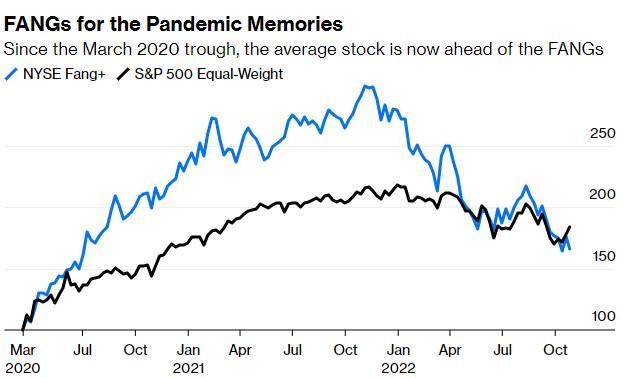

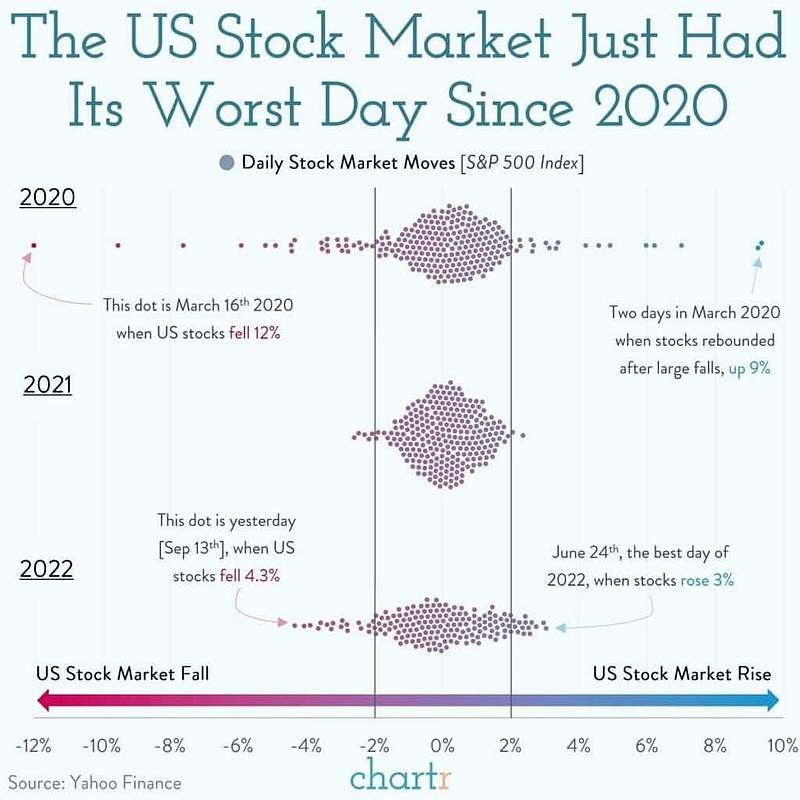

- Stability: These stocks are less susceptible to market volatility, offering a sense of security for long-term investors.

- Strong Dividends: Many monopoly stocks pay generous dividends, providing a steady income stream.

- Potential for Capital Appreciation: With a strong market position and consistent growth, monopoly stocks often appreciate in value over time.

In conclusion, US monopoly stocks are an excellent choice for investors seeking stability, dividends, and long-term growth. By understanding what defines these stocks and how to identify them, you can make informed investment decisions that align with your financial goals.

new york stock exchange

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....