In the financial markets, anticipation often shapes investor sentiment more than actual news. This was particularly evident as traders awaited the release of the Personal Consumption Expenditures (PCE) inflation data, a key economic indicator. The day before the release, US stock futures stabilized, reflecting a cautious optimism among investors.

Understanding the PCE Inflation Data

The PCE inflation data is a significant gauge of inflation in the United States. It measures the change in the price level of goods and services purchased by households, which is a critical component of the country's Gross Domestic Product (GDP). The data is closely watched by investors, policymakers, and economists because it helps to predict future inflation trends and monetary policy adjustments.

Stock Futures Stabilization

The stability in US stock futures ahead of the PCE inflation data release can be attributed to several factors. Firstly, investors were likely waiting for the data to make more informed decisions. Secondly, the recent volatility in the stock market may have led to a more cautious approach among traders. Lastly, the anticipation of potential monetary policy adjustments by the Federal Reserve could have influenced investor sentiment.

Impact of PCE Inflation Data on Stock Market

Historically, the PCE inflation data has had a significant impact on the stock market. When inflation is high, it can lead to higher interest rates, which can negatively impact stocks. Conversely, lower inflation can lead to lower interest rates, which can be positive for stocks. Therefore, the PCE inflation data release is often a key event for the stock market.

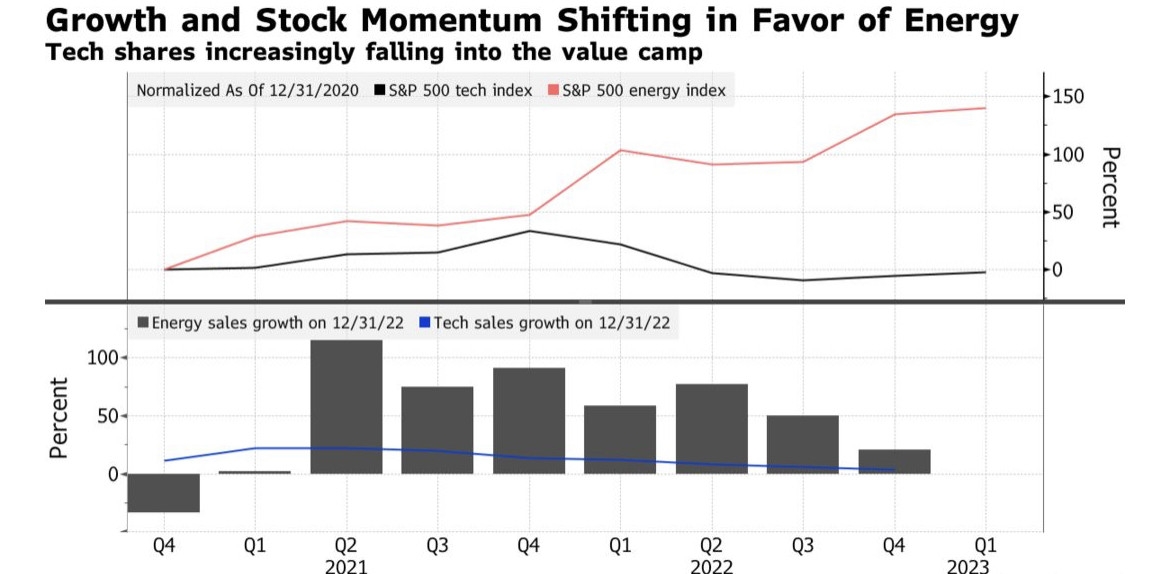

Recent Trends in PCE Inflation

Over the past few years, the PCE inflation rate has been relatively stable. However, there have been periods of higher inflation, particularly in 2021 and early 2022. These periods were driven by factors such as supply chain disruptions and increased demand for goods and services. The recent stability in the PCE inflation rate suggests that these factors may be abating.

Case Study: PCE Inflation Data and Stock Market Reaction

A notable case study is the PCE inflation data release in March 2021. At that time, the inflation rate was higher than expected, leading to a sell-off in the stock market. However, the Federal Reserve's statement that it would not rush to raise interest rates helped to stabilize the market. This illustrates the complex relationship between inflation data and the stock market.

Conclusion

The stabilization of US stock futures ahead of the PCE inflation data release reflects a cautious optimism among investors. The PCE inflation data is a critical economic indicator that can have a significant impact on the stock market. As such, it is closely watched by investors, policymakers, and economists. The recent stability in the PCE inflation rate suggests that the factors driving higher inflation may be abating.

new york stock exchange

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....