In the dynamic world of energy stocks, US natural gas penny stocks have emerged as a hidden gem for investors looking for high-risk, high-reward opportunities. These stocks, typically priced below $5 per share, offer a chance to capitalize on the evolving natural gas market while keeping your initial investment to a minimum. In this article, we will delve into the potential of these penny stocks, their risks, and how to identify the best opportunities in the US natural gas sector.

Understanding US Natural Gas Penny Stocks

First, let's clarify what we mean by "US natural gas penny stocks." These are stocks of companies that primarily engage in the exploration, production, or distribution of natural gas. Given the fluctuating prices of natural gas, these companies often experience rapid growth or decline, making penny stocks an attractive option for investors willing to take on the risk.

The Advantages of Investing in US Natural Gas Penny Stocks

- Potential for High Returns: While these stocks are often priced low, they have the potential to skyrocket in value. Many investors have made substantial profits by investing in successful penny stocks.

- Low Entry Barrier: The low price of these stocks allows investors with limited capital to participate in the energy sector.

- Access to Emerging Companies: Many US natural gas penny stocks are from small or emerging companies. Investing in these companies can provide exposure to new technologies, innovative projects, and future growth opportunities.

The Risks of Investing in US Natural Gas Penny Stocks

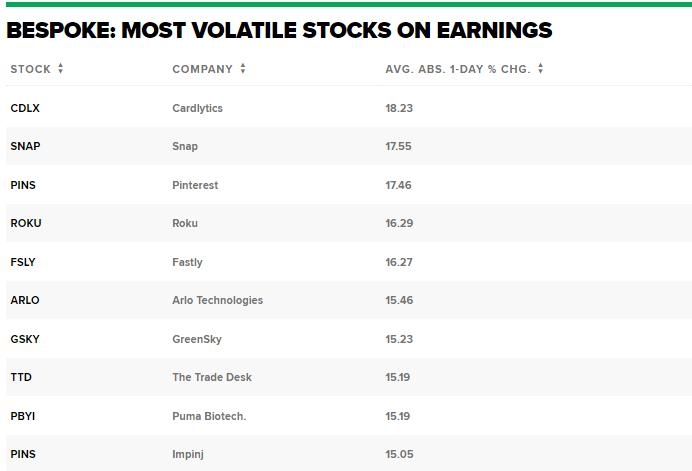

- High Volatility: The stock prices of these companies can be highly volatile, leading to rapid gains or losses.

- Lack of Regulatory Oversight: Unlike larger, established companies, penny stocks may receive less regulatory scrutiny, which can lead to higher risks.

- Financial and Operational Risks: Many penny stocks are from small companies that may have limited resources, poor financial health, or operational challenges.

How to Identify the Best US Natural Gas Penny Stocks

- Research and Due Diligence: Conduct thorough research on the company, including its financials, management team, projects, and industry position.

- Analyze Market Trends: Keep an eye on natural gas prices, regulatory news, and technological advancements in the energy sector.

- Seek Expert Advice: Consult with financial advisors or industry experts who have experience in the energy sector and investing in penny stocks.

Case Studies: Successful US Natural Gas Penny Stocks

- Lone Peak Resources (LPKF): This company specializes in the exploration and production of natural gas in the Appalachian Basin. Its shares have seen significant growth in recent years.

- Buckeye Partners (BPL): Although not a pure penny stock, Buckeye Partners has experienced substantial growth as a leading provider of midstream energy services. Its stock price has surged from around

10 to over 100 in the past decade.

In conclusion, US natural gas penny stocks present a unique opportunity for investors to gain exposure to the energy sector with a relatively low initial investment. However, it's crucial to conduct thorough research, understand the risks, and remain vigilant to capitalize on these potential opportunities.

new york stock exchange

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....