In the vast world of investing, the term "FI US stocks" has gained significant attention. But what exactly does it mean? FI, or Financial Independence, refers to the point at which your passive income is sufficient to cover your living expenses, allowing you to retire early or simply live life on your terms. US stocks, on the other hand, are shares of publicly-traded companies based in the United States. Combining these two concepts, FI US stocks represent a unique opportunity for investors seeking financial freedom.

Understanding FI US Stocks

What Makes FI US Stocks Attractive?

1. Diversification: One of the primary benefits of investing in US stocks is the ability to diversify your portfolio. By investing in a variety of companies across different industries, you can reduce your exposure to market risks.

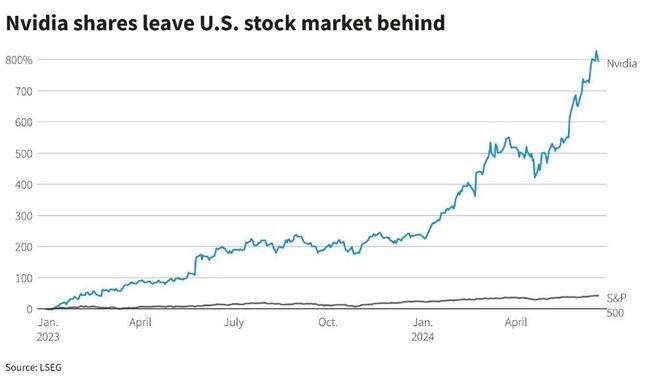

2. Growth Potential: The US stock market has historically offered one of the highest returns among global markets. Investing in US stocks can provide substantial growth potential for your portfolio.

3. Tax Advantages: Depending on your investment strategy, you may be able to take advantage of tax-efficient investments such as Roth IRAs or 401(k)s, which can help maximize your returns.

4. Access to Innovation: The US is home to some of the most innovative companies in the world. Investing in US stocks allows you to participate in the growth of these companies and potentially benefit from their technological advancements.

How to Invest in FI US Stocks

1. Research and Due Diligence: Before investing in any stock, it's crucial to conduct thorough research. This includes analyzing the company's financial statements, understanding its business model, and assessing its competitive position in the market.

2. Asset Allocation: A well-diversified portfolio should include a mix of stocks, bonds, and other assets. Allocate a portion of your portfolio to US stocks to achieve a balanced investment strategy.

3. Regular Rebalancing: Market conditions can change rapidly, so it's important to regularly rebalance your portfolio to maintain your desired asset allocation.

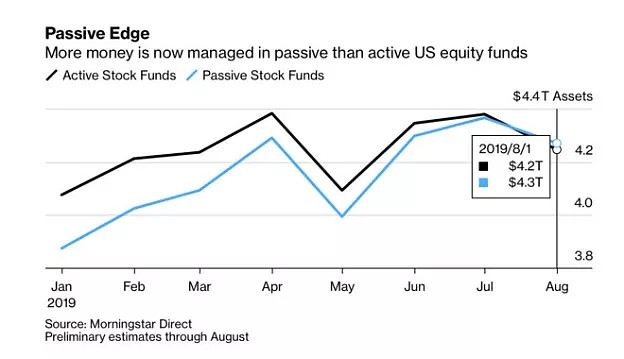

4. Consider Low-Cost Index Funds: Index funds offer a cost-effective way to invest in a basket of US stocks. They provide exposure to the overall market without the need for individual stock selection.

Case Study: The Success of Amazon

One of the most notable examples of a company that has delivered exceptional returns is Amazon. By investing in Amazon's stock early on, investors would have seen substantial growth over the years. This case study highlights the potential of investing in US stocks for long-term growth.

Conclusion

Investing in FI US stocks can be a powerful tool for achieving financial independence. By understanding the benefits, conducting thorough research, and maintaining a diversified portfolio, investors can position themselves for long-term success. Remember, investing in the stock market carries risks, so it's important to approach it with a long-term perspective and seek professional advice if needed.

new york stock exchange

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....