As we delve into 2025, investors are increasingly questioning whether U.S. stocks are overvalued. The stock market has experienced significant growth over the past few years, raising concerns about its sustainability. In this article, we'll analyze various factors to determine if U.S. stocks are indeed overvalued and what it means for investors.

Historical Stock Market Trends

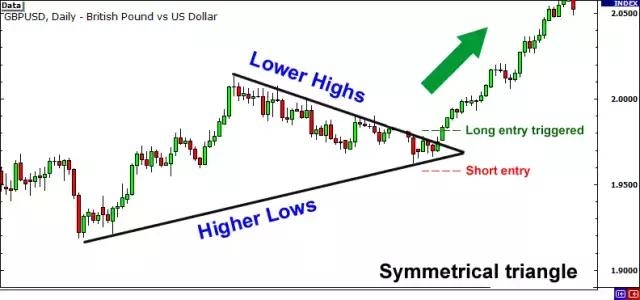

To understand the current state of the U.S. stock market, it's essential to look at historical trends. Over the past decade, the S&P 500 has experienced a remarkable bull run, with the index reaching record highs multiple times. However, this growth has been accompanied by rising valuations, leading some experts to question whether stocks are overvalued.

Economic Indicators

One of the key factors influencing stock valuations is economic indicators. Currently, the U.S. economy is performing well, with low unemployment rates and steady GDP growth. However, some experts warn that inflation is a growing concern, which could potentially impact stock valuations.

Market Valuation Metrics

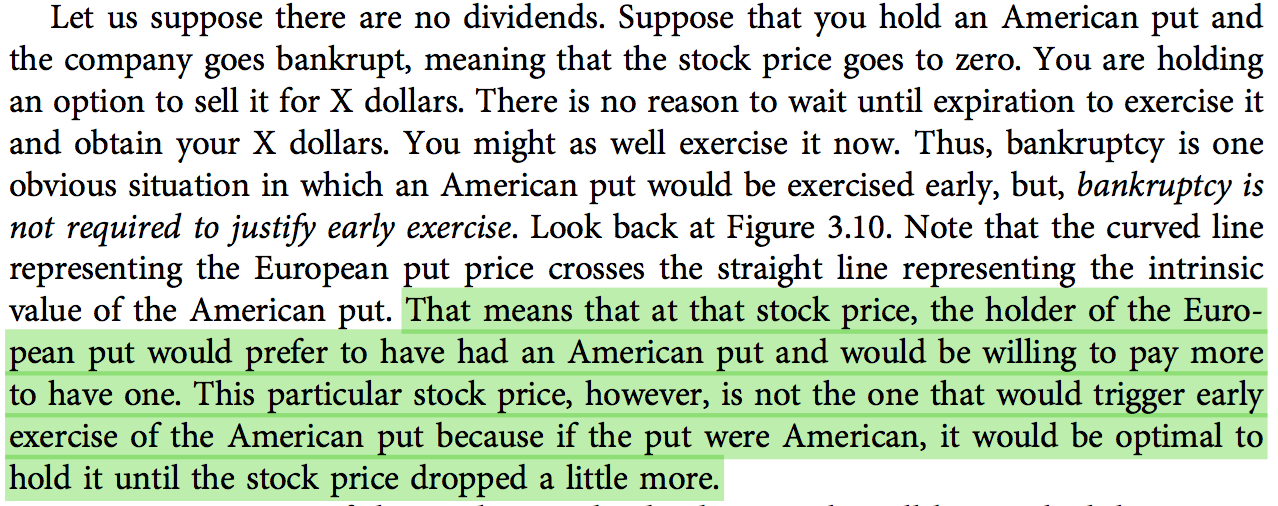

Several market valuation metrics can help us assess whether U.S. stocks are overvalued. The Price-to-Earnings (P/E) ratio is a commonly used metric, which compares a company's stock price to its earnings per share. As of 2025, the S&P 500's P/E ratio is at a level that is higher than its historical average. This suggests that stocks may be overvalued.

Dividend Yield

Another metric to consider is the dividend yield. The dividend yield is the percentage return on an investment, calculated by dividing the annual dividend per share by the stock price. Currently, the dividend yield for the S&P 500 is lower than its historical average, indicating that stocks may be overvalued.

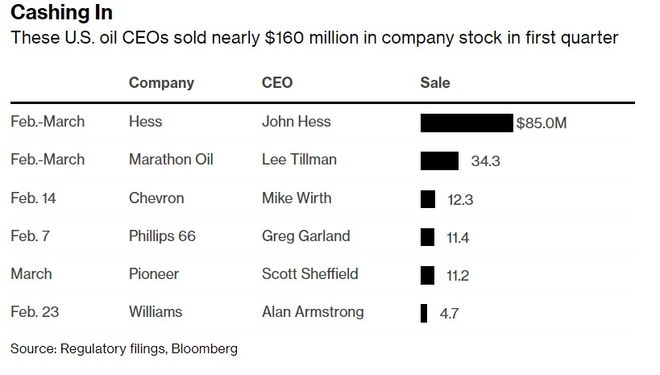

Sector Analysis

Analyzing individual sectors can also provide insights into the overall valuation of U.S. stocks. For instance, technology stocks have been driving much of the recent growth in the S&P 500. However, some technology stocks have sky-high valuations, which could be a concern for investors.

Case Studies

Let's take a look at a couple of case studies to illustrate the potential risks associated with overvalued stocks. Tesla (TSLA) and NVIDIA (NVDA) are two companies that have seen significant growth in recent years. However, their valuations are now at levels that some experts consider unsustainable. If these companies experience a downturn, it could have a significant impact on the broader stock market.

Conclusion

In conclusion, the current state of the U.S. stock market raises concerns about overvaluation. While economic indicators suggest that the U.S. economy is performing well, market valuation metrics and sector analysis indicate that stocks may be overvalued. Investors should be cautious and consider diversifying their portfolios to mitigate potential risks.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....