Are you a Canadian investor looking to expand your portfolio by buying US stocks? If so, you've come to the right place. This article will provide you with a comprehensive guide on everything you need to know about buying US stocks from Canada. From understanding the tax implications to identifying the best stocks to invest in, we've got you covered.

Understanding the Basics

Before diving into the details, let's first understand the basics of buying US stocks from Canada. When you buy a US stock, you are essentially purchasing a share of ownership in a company listed on a US stock exchange, such as the New York Stock Exchange (NYSE) or the NASDAQ.

Opening a Brokerage Account

To buy US stocks, you'll need to open a brokerage account. This can be done online through a reputable brokerage firm that offers international trading services. Some popular options for Canadians include TD Ameritrade, E*TRADE, and Questrade.

Understanding Tax Implications

One of the most important considerations when buying US stocks is the tax implications. While Canadian investors are subject to Canadian income tax on their US stock dividends, they can often claim a foreign tax credit to offset the tax paid in the US.

Dividend Tax Credit

Under the Canada-US Tax Treaty, Canadian investors are eligible for a foreign tax credit on US-source dividends. This credit can help reduce the tax burden on your US stock dividends.

Withholding Tax

It's important to note that US companies withholds 30% tax on dividend payments to non-US residents. However, Canadian investors can often reduce this withholding tax by filling out a W-8BEN form with the company.

Identifying the Best Stocks to Invest In

Now that you understand the basics of buying US stocks, let's discuss how to identify the best stocks to invest in. Here are some key factors to consider:

Market Capitalization

Market capitalization refers to the total value of a company's outstanding shares. Generally, larger companies are considered less risky than smaller ones.

Earnings Growth

Look for companies with a history of strong earnings growth. This indicates that the company is performing well and has the potential to continue growing in the future.

Dividend Yield

Dividend yield is the percentage of a company's annual dividend payment relative to its stock price. A higher dividend yield can be a sign of a stable, mature company.

Sector and Industry

Consider the sector and industry in which the company operates. Some sectors, such as technology and healthcare, are known for their strong growth potential.

Case Study: Apple Inc.

One of the most popular US stocks among Canadian investors is Apple Inc. (AAPL). With a market capitalization of over $2 trillion, Apple is one of the largest companies in the world. The company has a strong history of earnings growth and a generous dividend yield. Additionally, Apple operates in the technology sector, which is known for its growth potential.

Conclusion

Buying US stocks from Canada can be a great way to diversify your portfolio and potentially increase your returns. By understanding the basics, considering the tax implications, and identifying the best stocks to invest in, you can make informed investment decisions. Remember to consult with a financial advisor before making any investment decisions.

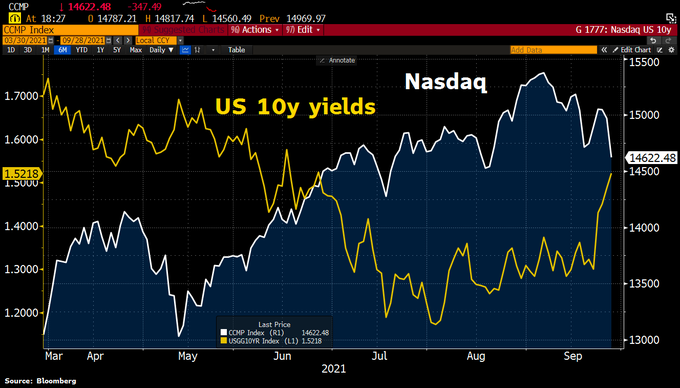

us stock market today live cha

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....