Investing in US stocks can be a lucrative venture for individuals looking to diversify their investment portfolios. However, it's crucial to understand the market dynamics and the potential risks involved. This article will provide a comprehensive guide on whether you should invest in US stocks, the benefits, risks, and key considerations to make an informed decision.

Understanding the US Stock Market

The US stock market is the largest and most liquid in the world, with a wide range of companies listed across various sectors. The two major stock exchanges are the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges offer a platform for investors to buy and sell shares of publicly-traded companies.

Benefits of Investing in US Stocks

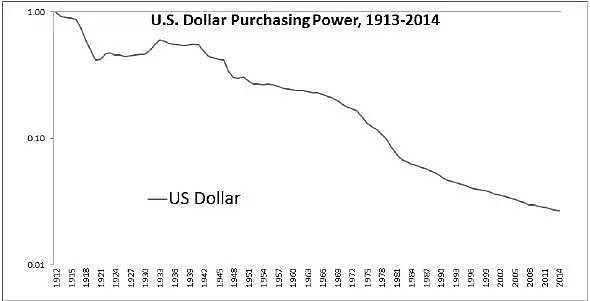

- Potential for High Returns: Historically, investing in US stocks has provided higher returns compared to other asset classes, such as bonds or cash.

- Diversification: By investing in a variety of US stocks, you can reduce your exposure to market volatility and potential losses.

- Access to Innovation: The US is home to some of the most innovative companies in the world, offering opportunities to invest in cutting-edge technologies and industries.

- Dividend Income: Many US companies offer dividends, providing investors with a regular income stream.

Risks of Investing in US Stocks

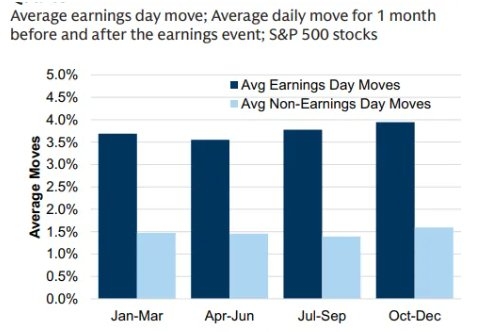

- Market Volatility: The stock market can be unpredictable, and prices can fluctuate significantly over short periods.

- Economic Factors: Economic downturns, political instability, and other global events can impact the performance of US stocks.

- Company-Specific Risks: Individual companies may face challenges, such as poor management, product recalls, or legal issues, which can negatively impact their stock price.

Key Considerations Before Investing in US Stocks

- Investment Goals: Determine your investment goals, whether it's long-term growth, income generation, or capital preservation.

- Risk Tolerance: Assess your risk tolerance and ensure it aligns with the potential risks of investing in US stocks.

- Diversification: Consider diversifying your portfolio across different sectors and geographical regions to reduce risk.

- Research and Due Diligence: Conduct thorough research on the companies you're interested in, including their financial health, management team, and competitive position.

- Investment Strategy: Develop a clear investment strategy and stick to it, avoiding impulsive decisions based on market sentiment.

Case Study: Apple Inc.

A prime example of a successful US stock investment is Apple Inc. Since its initial public offering (IPO) in 1980, Apple has become one of the world's most valuable companies. By consistently delivering innovative products and strong financial performance, Apple has generated significant returns for investors.

Conclusion

Investing in US stocks can be a rewarding endeavor, but it's essential to understand the market dynamics and potential risks involved. By conducting thorough research, diversifying your portfolio, and sticking to a well-defined investment strategy, you can increase your chances of success. Remember, investing in stocks should be part of a well-rounded financial plan and not a get-rich-quick scheme.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....