In recent years, the stock market has seen unprecedented growth, raising questions about whether US stocks are currently in a bubble. This article delves into the factors contributing to the rise in stock prices, examines the potential risks, and explores historical parallels to provide a comprehensive analysis.

Market Dynamics and Factors Contributing to Stock Price Growth

Several factors have contributed to the surge in US stock prices. Firstly, low-interest rates have made borrowing cheaper, encouraging investors to seek higher returns in the stock market. Additionally, quantitative easing by central banks has flooded the market with liquidity, further driving up stock prices.

The strong economic recovery post-pandemic has also played a significant role. Corporate earnings have been robust, and technology companies have seen a surge in demand, driving up their stock prices. Moreover, tax cuts and government stimulus have provided a boost to the economy, leading to increased investor confidence.

Potential Risks and Indicators of a Bubble

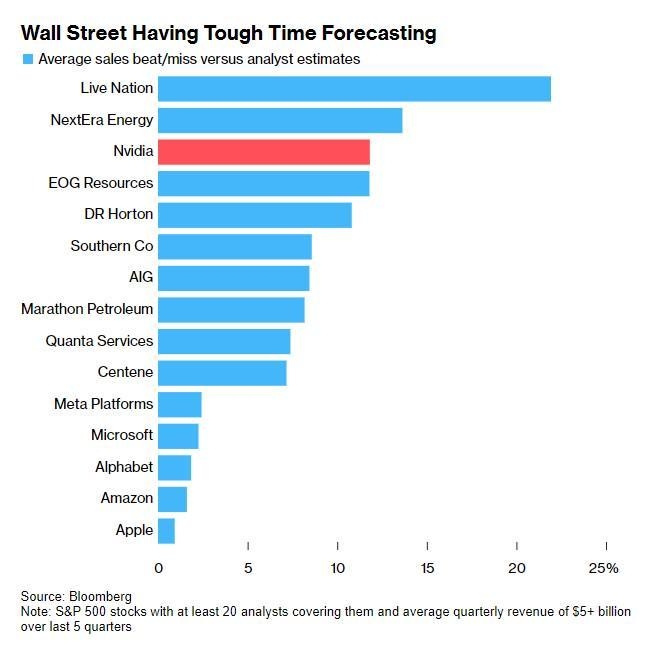

Despite the positive outlook, there are concerns that the current stock market could be in a bubble. Valuation metrics such as the price-to-earnings (P/E) ratio and price-to-book (P/B) ratio have reached historic highs, suggesting that stocks may be overvalued. Additionally, high levels of debt among corporations and individuals could pose a risk if the economy were to experience a downturn.

Another indicator of a potential bubble is the frenzy of speculative trading in certain sectors, such as cryptocurrencies and tech stocks. The rapid rise and fall of these assets have raised concerns about excessive risk-taking and potential market manipulation.

Historical Parallels and Lessons Learned

Looking at historical precedents, the dot-com bubble of the late 1990s and the housing market bubble preceding the 2008 financial crisis serve as cautionary tales. In both cases, investors became overly optimistic, leading to a rapid increase in asset prices that eventually burst, causing significant market turmoil.

The lessons learned from these bubbles highlight the importance of rigorous analysis and risk management. Investors should avoid overleveraging and speculative trading, and instead focus on fundamental analysis and diversification to mitigate potential losses.

Case Studies: Tech Stocks and Cryptocurrencies

To illustrate the potential risks associated with speculative trading, let's consider two case studies: tech stocks and cryptocurrencies.

The dot-com bubble saw a surge in tech stocks, with many investors pouring money into unprofitable companies based on the promise of future growth. When the bubble burst in 2000, many investors lost significant amounts of money. Similarly, the cryptocurrency boom of 2017-2018 saw a rapid increase in the value of various digital currencies. However, the market has since experienced a significant correction, with many investors facing substantial losses.

These case studies underscore the importance of careful evaluation and risk assessment before investing in highly speculative assets.

Conclusion

While the US stock market has seen significant growth in recent years, concerns about a potential bubble remain. Investors should remain vigilant and focus on risk management and fundamental analysis to protect their investments. By learning from historical precedents and avoiding speculative trading, investors can navigate the current market environment with greater confidence.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....