Are you interested in expanding your investment portfolio to include Canadian stocks, but unsure if it's possible from the United States? The answer is a resounding yes! Investing in Canadian stocks from the US is not only feasible but also offers numerous benefits. In this article, we will explore the process of buying Canadian stocks in the US, including the necessary steps and considerations to make an informed decision.

Understanding the Canadian Stock Market

The Canadian stock market is one of the largest and most diversified in the world. It is home to many well-known companies across various sectors, including energy, technology, and financial services. By investing in Canadian stocks, you can gain exposure to a wide range of industries and benefit from the strong economic performance of the Canadian market.

How to Buy Canadian Stocks in the US

Open a Brokerage Account: The first step in buying Canadian stocks from the US is to open a brokerage account. Many reputable brokerage firms offer access to Canadian stocks, including TD Ameritrade, E*TRADE, and Charles Schwab. Be sure to research and compare the fees, commissions, and services offered by different brokers.

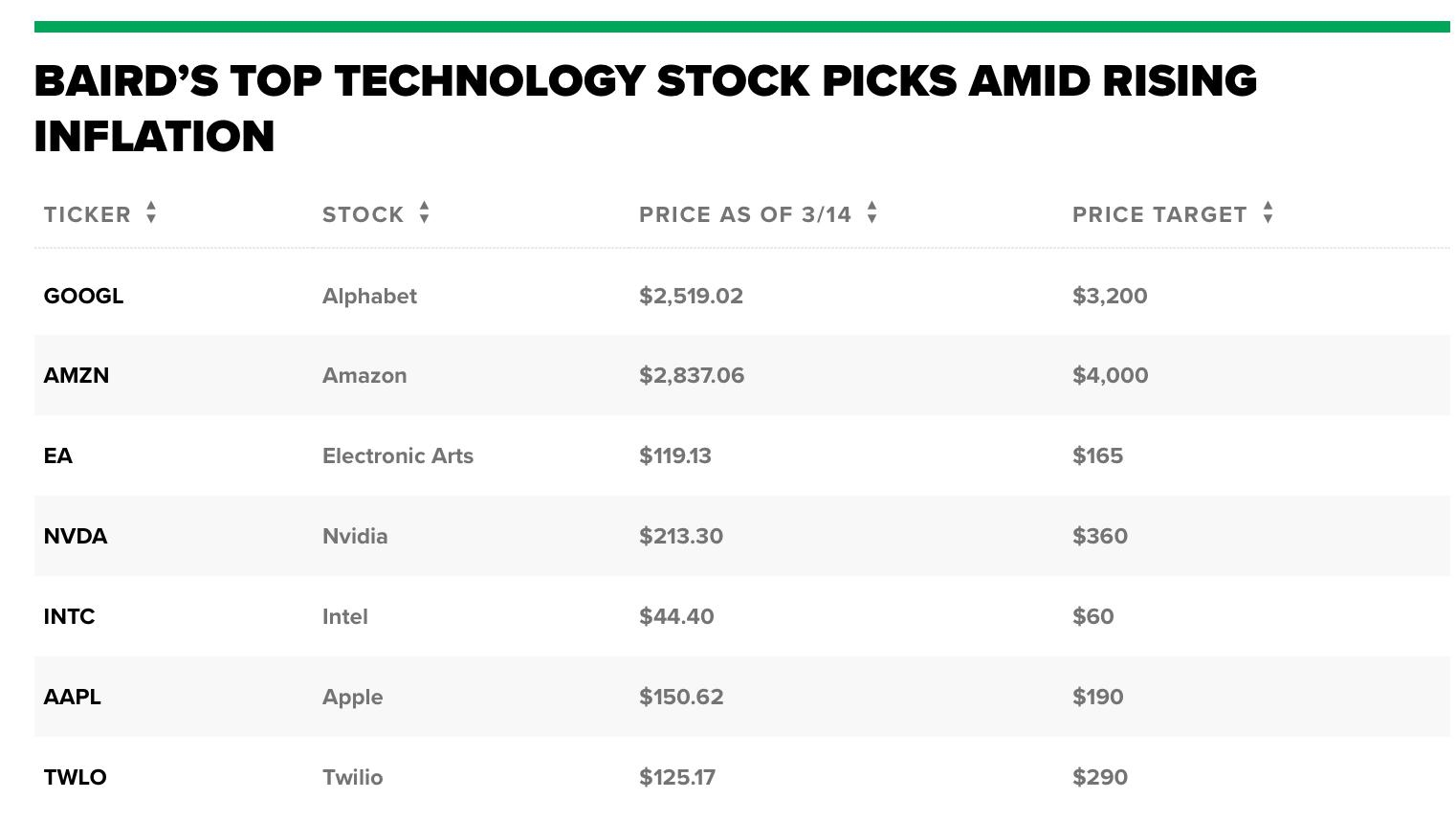

Research Canadian Stocks: Once you have a brokerage account, research the Canadian stocks you are interested in. Look for companies with strong fundamentals, a solid track record, and a promising future. Consider factors such as revenue growth, profit margins, and market capitalization.

Currency Conversion: When purchasing Canadian stocks, you will need to convert US dollars to Canadian dollars. This can be done through your brokerage firm, which will typically charge a small fee for the conversion. Keep in mind that exchange rates can fluctuate, which may affect the price of your investment.

Place Your Order: After researching and selecting a Canadian stock, place your order through your brokerage account. You can choose to buy shares, put in a limit order, or set up a dividend reinvestment plan (DRIP).

Monitor Your Investment: Once you have purchased Canadian stocks, it's important to monitor your investment regularly. Keep an eye on the company's performance, market trends, and economic indicators that may impact the stock's price.

Benefits of Buying Canadian Stocks in the US

Diversification: Investing in Canadian stocks can help diversify your portfolio, reducing your exposure to market volatility and potential losses.

Access to High-Quality Companies: The Canadian stock market is home to many high-quality companies with strong fundamentals and growth potential.

Currency Exposure: Investing in Canadian stocks can provide you with exposure to the Canadian dollar, which may offer diversification benefits and potentially enhance your returns.

Professional Support: Many brokerage firms offer research and support to help you make informed investment decisions.

Case Study: Investing in Canadian Energy Stocks

One popular sector in the Canadian stock market is energy. Companies such as Suncor Energy and Canadian Natural Resources offer exposure to the oil and gas industry, which has significant growth potential. By investing in these companies, investors can benefit from the rising demand for energy resources globally.

In conclusion, buying Canadian stocks from the US is a viable and attractive investment opportunity. By understanding the process and conducting thorough research, you can make informed decisions and potentially enhance your investment portfolio. Don't miss out on the benefits of investing in the Canadian stock market!

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....