In the dynamic world of financial markets, the Sh US stock price has become a focal point for investors and traders alike. This article delves into the intricacies of the Sh US stock price, offering a comprehensive analysis and key insights to help you navigate this complex landscape.

What is the Sh US Stock Price?

The Sh US stock price refers to the current market value of shares listed on the Shanghai Stock Exchange (SSE) that are denominated in US dollars. It represents the price at which these shares are bought and sold on the US market, providing a unique perspective on the performance of Chinese companies listed in the US.

Factors Influencing the Sh US Stock Price

Several factors contribute to the fluctuation of the Sh US stock price. These include:

- Economic Indicators: Economic data such as GDP growth, inflation rates, and employment figures can significantly impact the Sh US stock price. For instance, a strong GDP growth rate may indicate a positive outlook for the Chinese economy, potentially boosting the Sh US stock price.

- Market Sentiment: Investor sentiment plays a crucial role in determining the Sh US stock price. Factors such as geopolitical tensions, trade disputes, and political instability can lead to volatility in the market.

- Company Performance: The financial performance of individual companies listed on the SSE can also influence the Sh US stock price. Strong earnings reports and positive outlooks can drive up the stock price, while poor performance can lead to a decline.

- Currency Fluctuations: Exchange rate movements between the US dollar and the Chinese yuan can impact the Sh US stock price. A weaker yuan can make Chinese stocks more expensive for US investors, potentially leading to a decrease in the stock price.

Key Insights into the Sh US Stock Price

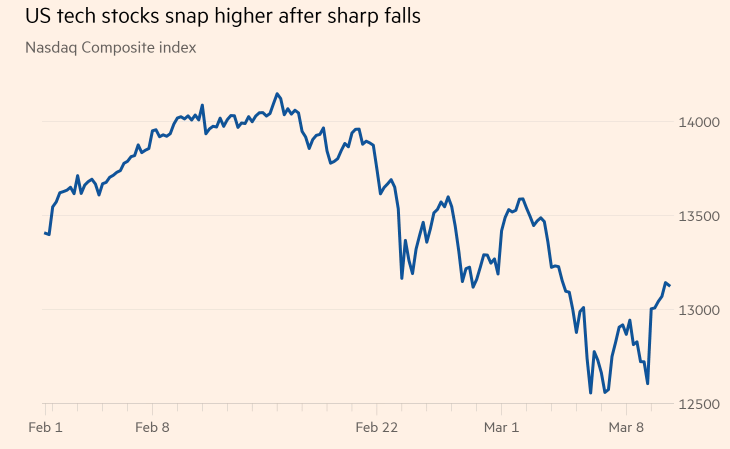

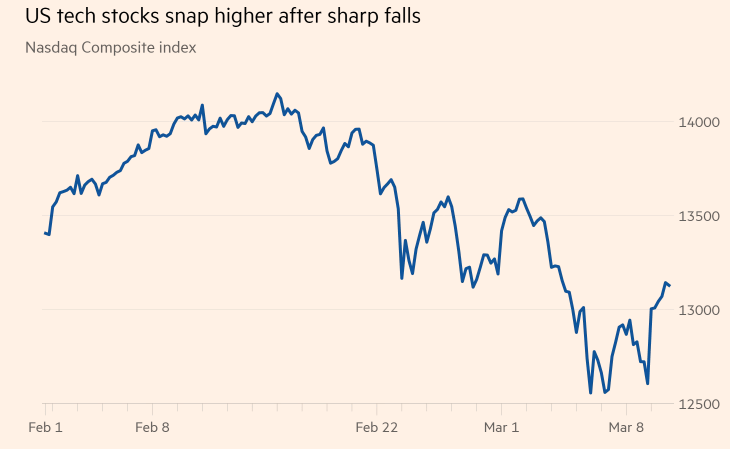

- Historical Performance: Over the past few years, the Sh US stock price has shown significant volatility, with periods of both strong growth and sharp declines. Understanding historical performance can help investors anticipate future trends.

- Sector Trends: Different sectors within the Sh US stock market have varying levels of performance. For instance, technology and consumer discretionary sectors have often outperformed other sectors.

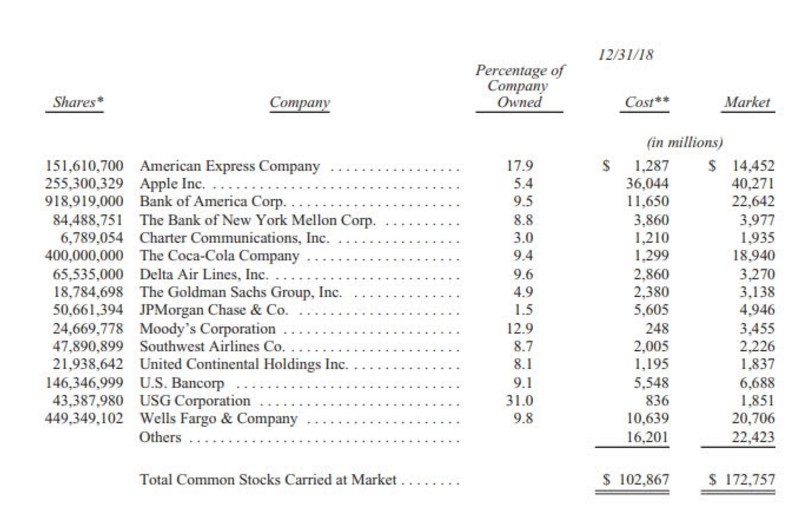

- Market Cap: The market capitalization of a company can provide insights into its size and potential growth prospects. Larger companies may offer more stability, while smaller companies may offer higher growth potential.

Case Study: Alibaba Group Holding Limited (BABA)

One notable example of a company listed on the SSE with a Sh US stock price is Alibaba Group Holding Limited (BABA). As one of the largest e-commerce platforms in the world, Alibaba has seen significant growth in its Sh US stock price over the years. Factors such as strong revenue growth, expansion into new markets, and a robust ecosystem of services have contributed to this growth.

Conclusion

Understanding the Sh US stock price is crucial for investors looking to invest in Chinese companies listed in the US. By analyzing the various factors influencing the Sh US stock price and staying informed about market trends and company performance, investors can make more informed decisions and potentially achieve better returns.

new york stock exchange

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....