In the ever-evolving world of finance, investors often find themselves weighing the benefits of international stock markets against those of the United States. The Total International Stock Index and the US stock market are two popular options, each offering unique advantages and challenges. This article aims to provide a comprehensive analysis of both, highlighting their differences and helping investors make informed decisions.

Understanding the Total International Stock Index

The Total International Stock Index, often referred to as the MSCI ACWI (All Country World Index), is a benchmark that measures the performance of stocks across the globe. It includes developed and emerging markets, providing investors with exposure to a diverse range of global economies. This index offers several advantages:

- Diversification: By investing in a variety of countries, investors can reduce their exposure to the risks associated with any single market.

- Growth Opportunities: Emerging markets, in particular, can offer significant growth potential due to their rapid economic development.

- Currency Exposure: Investing in international stocks can provide exposure to different currencies, potentially enhancing returns.

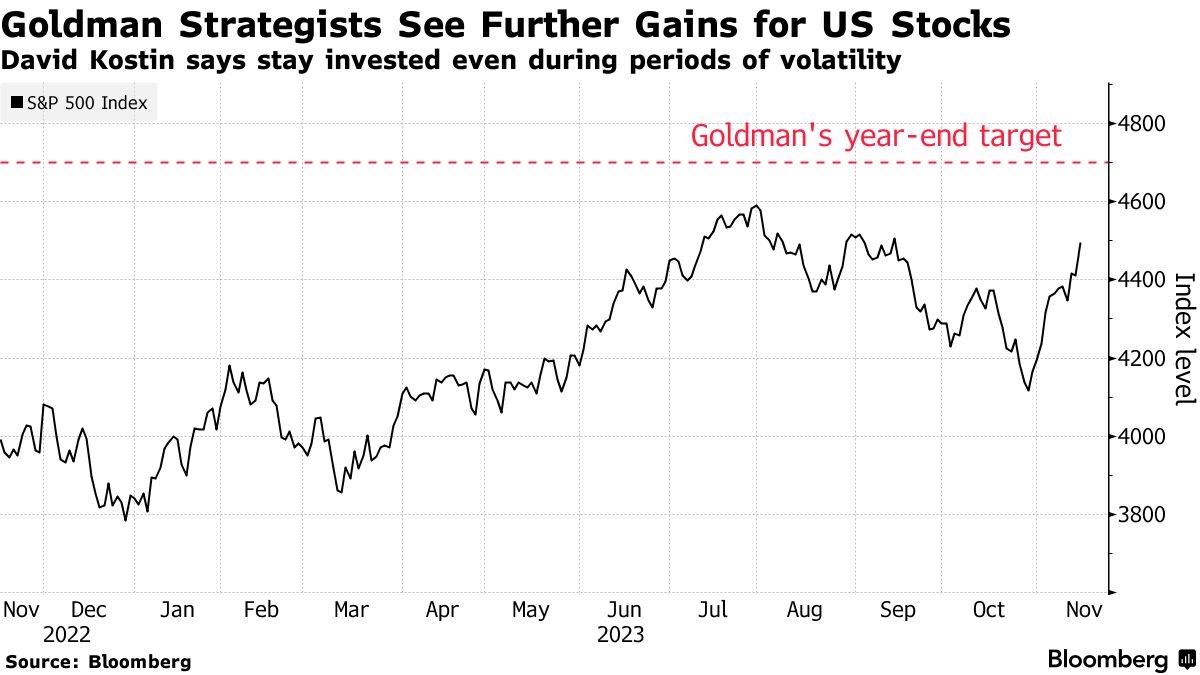

Comparing the US Stock Market

On the other hand, the US stock market is the largest and most developed in the world. It is home to many of the world's largest and most successful companies. Some of the key advantages of investing in the US stock market include:

- Market Size: The US stock market offers a wide range of investment options, including stocks, bonds, and mutual funds.

- Innovation: The US is known for its technological advancements, providing investors with access to innovative companies.

- Regulatory Environment: The US has a well-established regulatory framework that protects investors and promotes market transparency.

Key Differences Between the Total International Stock Index and the US Stock Market

While both the Total International Stock Index and the US stock market offer unique benefits, there are several key differences to consider:

- Risk Tolerance: The Total International Stock Index tends to be more volatile, particularly in emerging markets. Investors with a higher risk tolerance may prefer this option, while those seeking more stability may prefer the US stock market.

- Economic Factors: Economic conditions in different countries can have a significant impact on stock market performance. Investors should consider factors such as interest rates, inflation, and political stability when selecting between the Total International Stock Index and the US stock market.

- Currency Fluctuations: Investing in international stocks exposes investors to currency risk. Changes in exchange rates can impact returns, making currency fluctuations an important consideration.

Case Study: Apple Inc.

To illustrate the differences between the Total International Stock Index and the US stock market, let's consider the case of Apple Inc. (AAPL). Apple is one of the largest companies in the world and is listed on the US stock market.

- Total International Stock Index: If Apple were included in the Total International Stock Index, investors would have exposure to the company's performance across various global markets. This can be beneficial for diversification and accessing growth opportunities in emerging markets.

- US Stock Market: Investing directly in Apple's US stock provides investors with access to the company's innovation and potential growth. However, it may limit exposure to other international markets.

In conclusion, both the Total International Stock Index and the US stock market offer unique benefits and challenges. Investors should carefully consider their risk tolerance, investment goals, and market conditions when selecting the appropriate investment option. By understanding the key differences between these two options, investors can make informed decisions and achieve their financial objectives.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....