The Stock Market's Early Bird: Understanding US Steel's Pre-Market Activity

In the fast-paced world of stock trading, staying ahead of the curve is crucial. One such opportunity lies in the premarket trading session, where investors can gain insights into the day's market trends before the official trading hours begin. This article delves into the premarket activity of US Steel, offering valuable insights for those looking to capitalize on this early bird opportunity.

Understanding Pre-Market Trading

Premarket trading, also known as the pre-open session, occurs before the stock market opens. During this time, investors can buy and sell stocks, and the prices can fluctuate significantly. The premarket session typically starts around 4:00 AM EST and ends around 9:30 AM EST, just before the regular trading hours begin at 9:30 AM EST.

Why Focus on US Steel's Pre-Market Activity?

US Steel is one of the largest steel producers in the world, and its stock performance can have a significant impact on the broader market. By analyzing US Steel's premarket activity, investors can gain insights into the company's potential direction for the day and the overall market sentiment.

Key Indicators to Watch

When analyzing US Steel's premarket activity, there are several key indicators to keep an eye on:

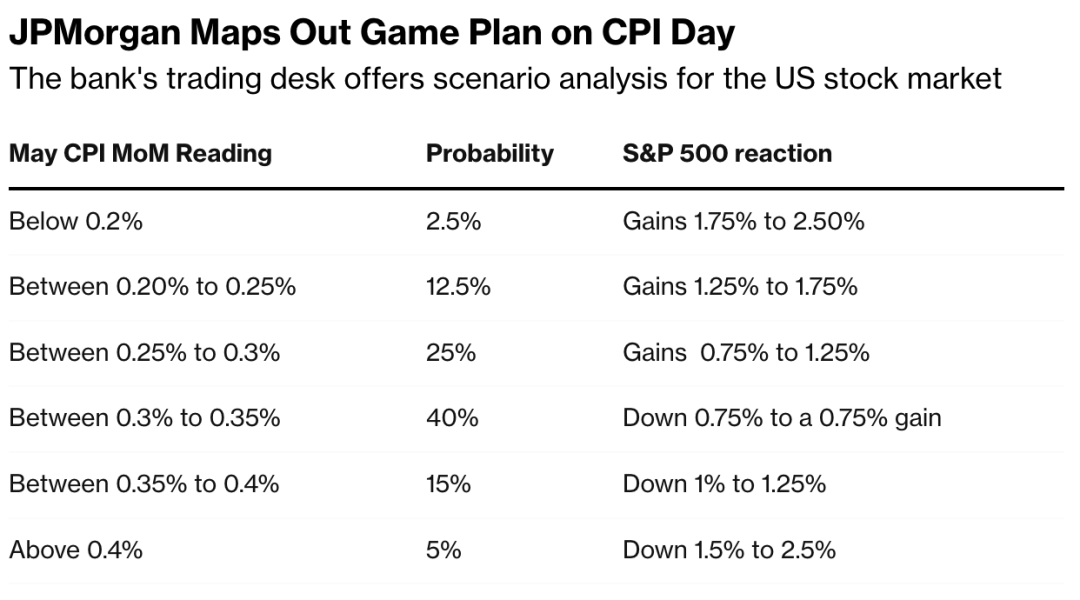

- Stock Price Movement: Pay close attention to the stock's price movement during the premarket session. Significant price changes can indicate potential market trends for the day.

- Volume: High trading volume during the premarket session can indicate strong interest in the stock, which may lead to further price movements during regular trading hours.

- News and Announcements: Stay updated on any news or announcements related to US Steel. This can include earnings reports, product launches, or any other significant events that may impact the company's stock price.

Case Study: The Impact of a Major Announcement

Let's consider a hypothetical scenario where US Steel announces a major expansion plan during the premarket session. This announcement could lead to a significant increase in the company's stock price, as investors react positively to the potential growth opportunities.

How to Capitalize on Pre-Market Activity

To capitalize on US Steel's premarket activity, investors can consider the following strategies:

- Set Price Alerts: Set price alerts for US Steel to notify you when the stock reaches a certain price level.

- Use Technical Analysis: Analyze the stock's price movement and volume patterns to identify potential trading opportunities.

- Stay Informed: Keep up with the latest news and announcements related to US Steel and the broader steel industry.

Conclusion

Understanding US Steel's premarket activity can provide valuable insights into the company's potential direction for the day and the overall market sentiment. By staying informed and utilizing the right strategies, investors can capitalize on this early bird opportunity and potentially gain an edge in the stock market.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....