The S&P 500 has long been a bellwether of the U.S. stock market, offering a snapshot of the health and trends within the financial sector. Whether you're an experienced investor or a novice looking to venture into the stock market, understanding the S&P 500 is crucial. This article aims to provide you with a comprehensive guide to the S&P 500, covering its history, composition, performance, and strategies for investing in it.

History and Composition of the S&P 500

The S&P 500 was first launched in 1957 by the Standard & Poor's Financial Services. It's a capitalization-weighted index, which means the size of each company's stock influences the index's total value. The index includes 500 of the largest companies in the U.S. across various sectors, such as technology, healthcare, financials, and energy.

The S&P 500 is designed to provide a broad-based measure of the stock market, offering a clear view of market trends and economic health. It's often used as a benchmark for investors, allowing them to compare their portfolios' performance against a widely recognized standard.

Performance of the S&P 500

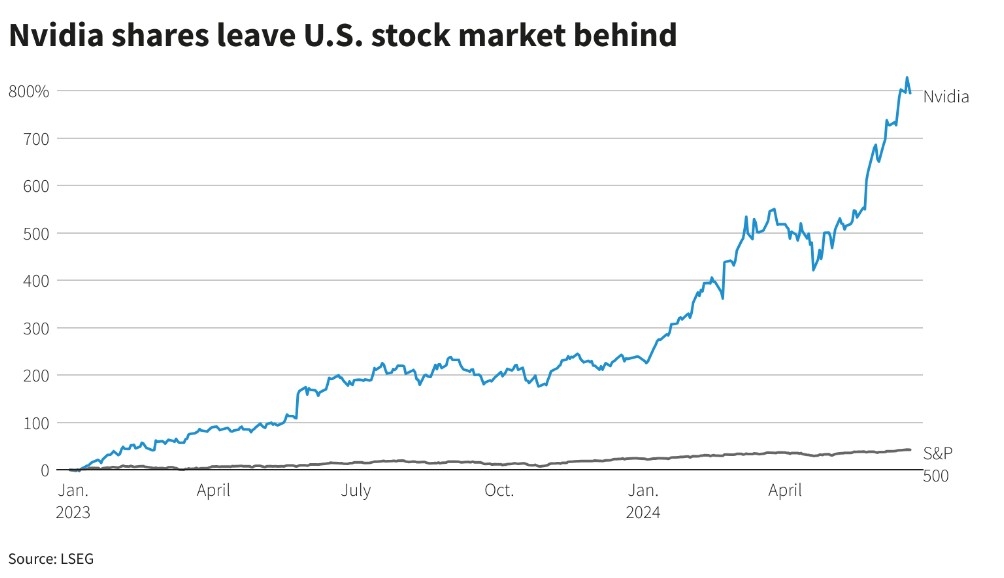

The S&P 500 has demonstrated remarkable performance over the years, delivering consistent returns to investors. From its inception in 1957 to 2020, the index returned an average of around 10% per year. This performance has been driven by the strong fundamentals of the constituent companies, as well as the broader economic growth in the U.S.

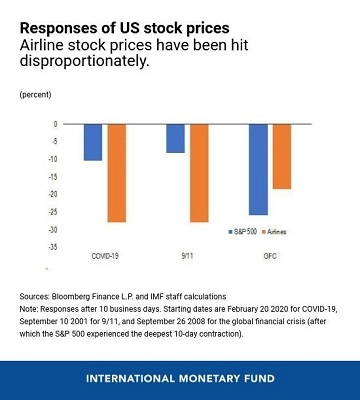

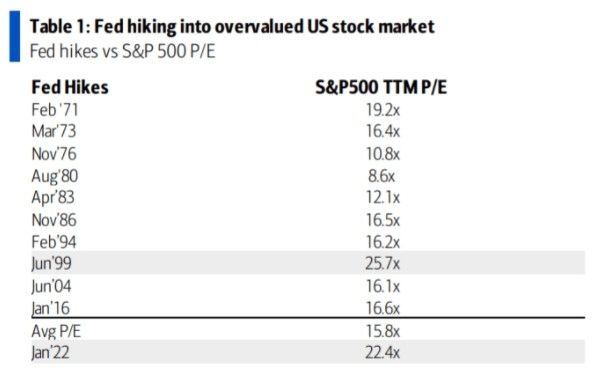

However, it's important to note that the S&P 500, like any investment, is subject to market volatility and risks. During periods of market downturns, the index may experience significant declines. For example, the S&P 500 dropped by about 50% during the 2008 financial crisis.

Strategies for Investing in the S&P 500

Investing in the S&P 500 can be done through various strategies, depending on your investment goals, risk tolerance, and time horizon.

1. Index Funds and ETFs:

The simplest and most cost-effective way to invest in the S&P 500 is through index funds or ETFs (exchange-traded funds). These funds track the performance of the S&P 500, allowing you to gain exposure to the index without having to pick individual stocks.

2. Dividend Stocks:

Some S&P 500 companies offer dividend payments, which can be a source of income for investors. Investing in dividend-paying stocks within the S&P 500 can provide both capital appreciation and regular income.

3. Sector Rotation:

Investors can also focus on specific sectors within the S&P 500 based on their expectations for future market trends. For example, during periods of strong economic growth, technology and healthcare sectors may outperform.

4. Diversification:

To reduce risk, investors can diversify their portfolios by investing in other asset classes or geographic regions. However, the S&P 500 remains a key component of a well-diversified portfolio due to its broad market exposure.

Conclusion

Understanding the S&P 500 is essential for investors looking to navigate the U.S. stock market. By familiarizing yourself with its history, composition, and performance, you can make informed decisions when investing in this important index. Remember to align your investment strategy with your financial goals and risk tolerance to maximize your chances of success.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....