In the fast-paced world of financial markets, US stock futures play a pivotal role. These instruments offer traders and investors the opportunity to speculate on the future movement of stocks without owning the actual shares. This guide delves into the intricacies of US stock futures, exploring their significance, key features, and potential benefits.

What are US Stock Futures?

US stock futures are derivative contracts that allow investors to bet on the future price movements of specific stocks. Unlike stock options, which provide the right but not the obligation to buy or sell, futures require the actual delivery of the underlying asset. These contracts are typically traded on exchanges and are based on the expected price of a particular stock at a future date.

Key Features of US Stock Futures

- Standardized Contracts: US stock futures are standardized, meaning they have predetermined terms and specifications. This standardization ensures liquidity and facilitates easy trading.

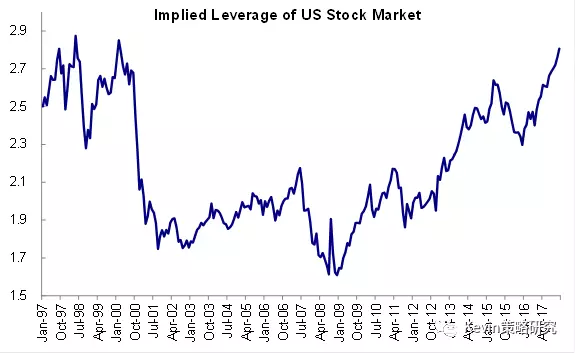

- Leverage: One of the primary advantages of stock futures is the ability to leverage. Traders can control a large position with a relatively small amount of capital.

- Short-Term Trading: Stock futures are well-suited for short-term trading, as they allow investors to speculate on short-term price movements.

- Risk Management: Futures provide a hedging mechanism for investors looking to protect their portfolios from adverse price movements.

Benefits of US Stock Futures

- Leverage: As mentioned earlier, leverage allows traders to control a larger position with a smaller investment. This can amplify potential profits, but it also increases risk.

- Accessibility: US stock futures are easily accessible to both institutional and retail investors, thanks to the standardization and liquidity of the contracts.

- Hedging: Investors can use stock futures to hedge their positions against adverse price movements, protecting their portfolios from potential losses.

Case Studies

Let's consider a hypothetical scenario. An investor owns 1,000 shares of Company X, currently trading at $100 per share. Concerned about a potential downturn in the market, the investor decides to hedge their position using US stock futures.

The investor enters into a futures contract to sell 100 shares of Company X at

Conclusion

US stock futures offer a unique way to speculate on the future price movements of stocks. Understanding their features, benefits, and risks is crucial for successful trading. By utilizing leverage and hedging strategies, investors can potentially maximize their returns while minimizing their risks. Whether you are a seasoned trader or a novice investor, US stock futures can be an invaluable tool in your investment arsenal.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....