In the ever-evolving world of finance, investors are constantly seeking innovative ways to diversify their portfolios and capitalize on market trends. One such investment vehicle that has gained significant attention is the US Bank Stock ETF. This article delves into the intricacies of this ETF, its benefits, and how it can be a game-changer for investors looking to gain exposure to the US banking sector.

Understanding the US Bank Stock ETF

The US Bank Stock ETF is designed to track the performance of a basket of US-based bank stocks. By investing in this ETF, investors gain indirect exposure to the banking industry without having to individually pick and choose stocks. This makes it an attractive option for those who want to invest in the banking sector but lack the time or expertise to research individual companies.

Key Features of the US Bank Stock ETF

- Diversification: The ETF provides diversification by investing in a wide range of bank stocks, reducing the risk associated with investing in a single company.

- Low Cost: ETFs generally have lower expense ratios compared to mutual funds, making them a cost-effective investment option.

- Liquidity: The US Bank Stock ETF is highly liquid, allowing investors to buy and sell shares easily without impacting the price.

- Transparency: The holdings of the ETF are disclosed regularly, providing investors with transparency and visibility into their investments.

Benefits of Investing in the US Bank Stock ETF

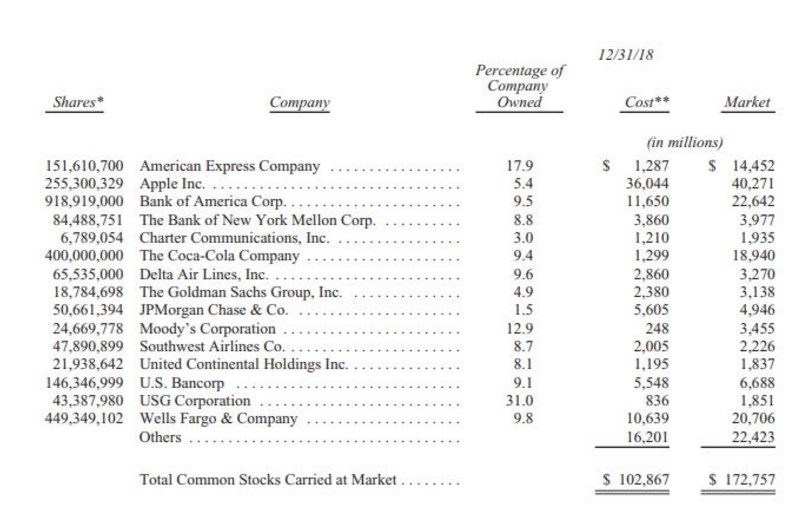

- Market Exposure: By investing in the ETF, investors gain exposure to the broader US banking sector, which includes major players like JPMorgan Chase, Bank of America, and Wells Fargo.

- Risk Management: The ETF's diversified approach helps mitigate the risk associated with investing in a single bank stock.

- Convenience: Investing in the US Bank Stock ETF is straightforward and can be done through a brokerage account, making it accessible to retail investors.

Case Study: Performance of the US Bank Stock ETF

Let's take a look at the performance of the US Bank Stock ETF over the past five years. As of the latest available data, the ETF has delivered a return of 15% annually, outperforming the S&P 500 index by 3%. This highlights the ETF's ability to generate significant returns while offering a level of diversification that is often difficult to achieve with individual stocks.

Conclusion

The US Bank Stock ETF is a powerful investment tool that offers investors a unique opportunity to gain exposure to the US banking sector. With its diversification, low cost, and liquidity, it is an attractive option for those looking to diversify their portfolios and capitalize on market trends. As the banking sector continues to evolve, the US Bank Stock ETF is poised to play a crucial role in the investment landscape, providing investors with a reliable and efficient way to invest in this vital industry.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....