Investors seeking growth and stability often turn to the United States stock market for promising opportunities. Among the various sectors and companies, DELEK (NYSE: DLEK) has emerged as a notable player. In this article, we delve into DELEK US stocks, analyzing their potential, market trends, and key factors that could influence investment decisions.

DELEK at a Glance

DELEK is a leading provider of homebuilding products and services in the United States. The company specializes in building materials, including roofing, siding, and window products, catering to both residential and commercial markets. With a strong presence in the US, DELEK has built a reputation for quality and innovation in the industry.

Market Performance and Trends

Over the past few years, DELEK US stocks have demonstrated robust performance. The company has managed to navigate market challenges and capitalize on growing demand for building materials. Key trends driving DELEK's stock performance include:

- Economic Growth: The US economy has experienced steady growth, leading to increased demand for housing and construction activities. This has positively impacted DELEK's sales and revenue.

- Industry Expansion: DELEK has expanded its product portfolio and geographical reach, opening up new markets and opportunities for growth.

- Strategic Acquisitions: The company has strategically acquired other businesses to strengthen its market position and diversify its offerings.

Key Factors Influencing DELEK US Stocks

Several factors can influence the performance of DELEK US stocks:

- Economic Indicators: Economic indicators such as unemployment rates, inflation, and GDP growth rates play a crucial role in shaping the demand for building materials. Investors should keep an eye on these indicators to gauge DELEK's potential.

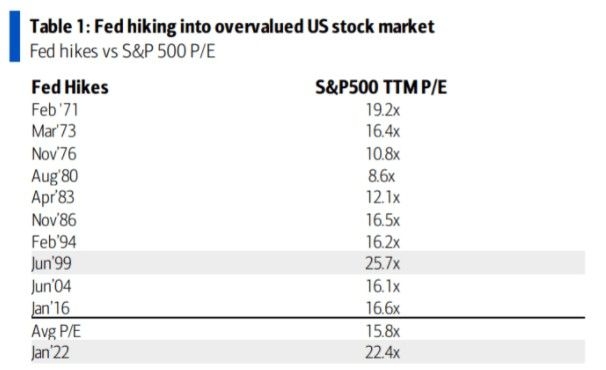

- Interest Rates: Fluctuations in interest rates can impact the cost of borrowing for homebuyers and builders, which, in turn, can affect DELEK's sales.

- Regulatory Changes: Changes in regulations affecting the construction industry, such as environmental standards, can impact DELEK's operations and profitability.

Case Studies: DELEK's Growth Strategy

DELEK's strategic growth approach is evident in several case studies:

- Acquisition of CertainTeed GAF: DELEK's acquisition of CertainTeed GAF in 2017 was a significant move to strengthen its market position in roofing materials. This acquisition provided DELEK with access to a broader range of products and enhanced its market share.

- Expansion into the Western US: DELEK's strategic expansion into the Western US has been a key driver of its growth. By entering new markets, the company has been able to tap into new customer bases and increase its sales volume.

Conclusion

DELEK US stocks offer a compelling investment opportunity for investors seeking exposure to the US housing market. With a strong market position, strategic growth initiatives, and positive economic trends, DELEK presents a promising outlook for future performance. As always, investors should conduct thorough research and consult with financial advisors before making investment decisions.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....