In the ever-evolving financial landscape, understanding the intricacies of financial exchanges is crucial for investors and traders alike. Financial exchanges serve as the heart of the global market, facilitating the buying and selling of assets such as stocks, bonds, commodities, and currencies. This article delves into the world of financial exchanges, exploring their significance, types, and the key factors that drive their operations.

The Significance of Financial Exchanges

Financial exchanges play a pivotal role in the global economy by providing a platform for investors to trade assets. They ensure liquidity, price discovery, and efficiency in the market. By bringing together buyers and sellers, financial exchanges enable participants to execute transactions swiftly and at competitive prices.

Types of Financial Exchanges

There are several types of financial exchanges, each catering to different asset classes and market segments. Here are some of the most prominent ones:

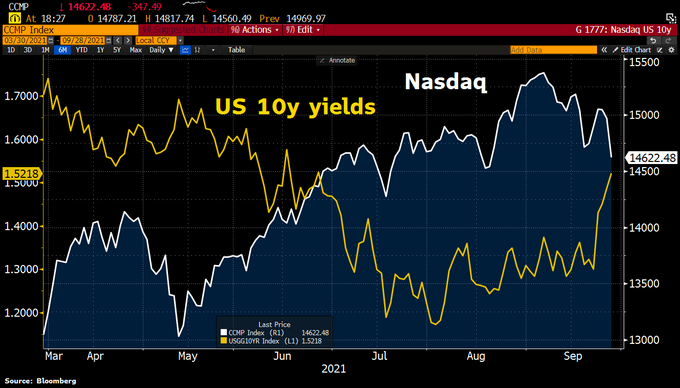

Stock Exchanges: These exchanges facilitate the trading of publicly listed companies' shares. The New York Stock Exchange (NYSE) and the NASDAQ are two of the most renowned stock exchanges in the world.

Bond Exchanges: Bond exchanges provide a marketplace for trading corporate and government bonds. The Chicago Board of Trade (CBOT) is a notable example of a bond exchange.

Commodity Exchanges: Commodity exchanges trade physical commodities such as oil, gold, and agricultural products. The Chicago Mercantile Exchange (CME) is one of the largest commodity exchanges globally.

Foreign Exchange (Forex) Markets: The foreign exchange market is the largest financial market in the world, where currencies are traded. The London Foreign Exchange Market is the most significant among them.

Key Factors Driving Financial Exchanges

Several factors drive the operations of financial exchanges:

Regulatory Framework: The regulatory environment plays a crucial role in ensuring the integrity and stability of financial exchanges. Regulatory bodies such as the Securities and Exchange Commission (SEC) in the United States and the Financial Conduct Authority (FCA) in the United Kingdom oversee the operations of financial exchanges.

Technology: The advent of technology has revolutionized the way financial exchanges operate. Advanced trading platforms, algorithmic trading, and blockchain technology have made trading more efficient and accessible.

Market Participants: Financial exchanges rely on a diverse range of participants, including institutional investors, retail traders, and market makers. The participation of these entities ensures liquidity and depth in the market.

Case Study: The Impact of Technology on Financial Exchanges

One of the most significant developments in the financial exchange industry is the integration of technology. A prime example is the rise of algorithmic trading, which has transformed the way trades are executed. Algorithmic trading allows for high-speed, automated trading decisions, leading to increased efficiency and lower transaction costs.

Conclusion

Understanding the world of financial exchanges is essential for anyone looking to participate in the global market. By providing a platform for buying and selling assets, financial exchanges play a crucial role in the global economy. As technology continues to evolve, financial exchanges will undoubtedly become more efficient and accessible, opening up new opportunities for investors and traders worldwide.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....