In today's volatile financial landscape, investors are constantly seeking opportunities to diversify their portfolios. One such avenue that has gained significant attention is the US Oil ETF stock. This article delves into the intricacies of these investment vehicles, providing you with a comprehensive guide to understand and capitalize on their potential.

Understanding US Oil ETF Stocks

An ETF, or Exchange-Traded Fund, is a type of investment fund that trades on a stock exchange, much like individual stocks. US Oil ETF stocks are specifically designed to track the price of oil or oil-related assets. These funds are a popular choice for investors looking to gain exposure to the oil market without having to directly invest in physical oil or oil-producing companies.

Benefits of Investing in US Oil ETF Stocks

Diversification: By investing in a US Oil ETF stock, you gain exposure to a wide range of oil-related assets, including crude oil, natural gas, and oil stocks. This diversification helps to mitigate the risk associated with investing in a single commodity or stock.

Liquidity: US Oil ETF stocks are highly liquid, allowing investors to buy and sell shares at any time during trading hours. This liquidity makes them an attractive option for short-term traders as well as long-term investors.

Cost-Effective: Compared to investing in individual oil stocks or physical commodities, US Oil ETF stocks offer a more cost-effective way to gain exposure to the oil market. They also eliminate the need for storage and insurance costs associated with physical commodities.

Ease of Access: Investing in US Oil ETF stocks is straightforward and can be done through a brokerage account. This ease of access makes them a convenient option for investors of all levels.

Key Factors to Consider When Investing in US Oil ETF Stocks

Fund Composition: It's crucial to understand the composition of the US Oil ETF stock you are considering. Look for funds that have a diverse portfolio of oil-related assets to ensure maximum diversification.

Expense Ratio: The expense ratio of a US Oil ETF stock represents the annual fees charged to investors. Lower expense ratios are generally preferable as they can help to minimize costs over time.

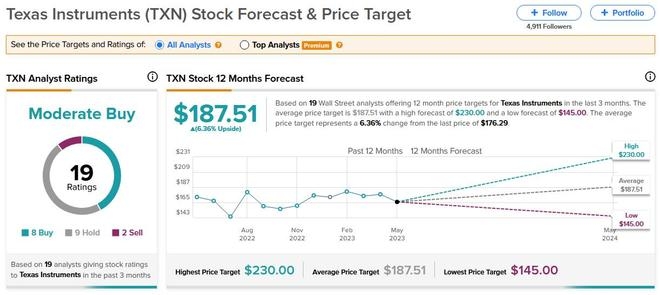

Performance History: Review the historical performance of the US Oil ETF stock to gauge its track record. However, keep in mind that past performance is not indicative of future results.

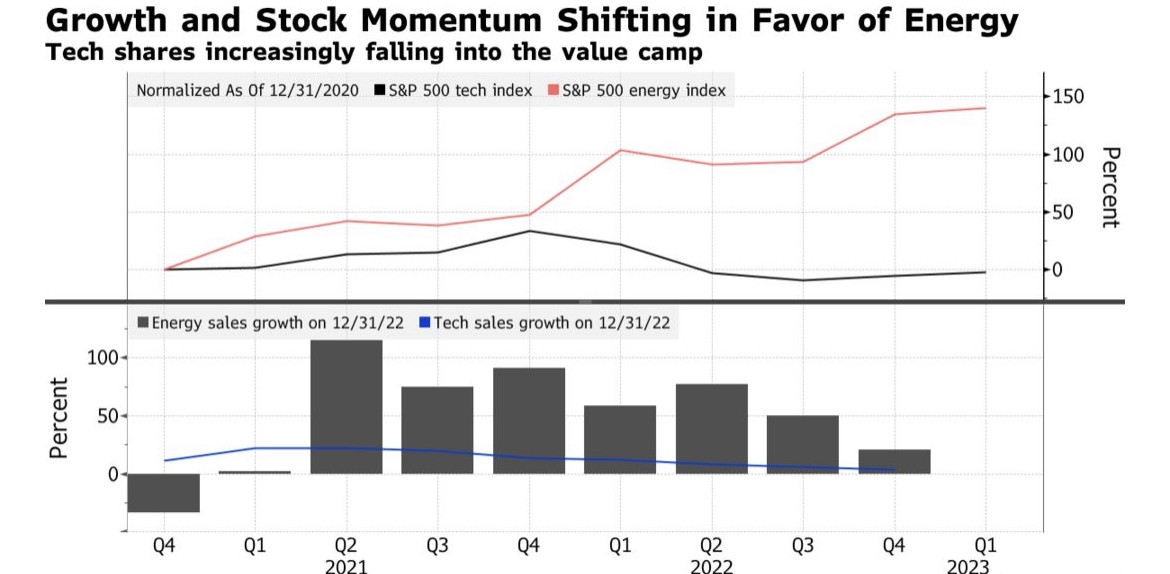

Market Trends: Stay informed about the latest market trends and economic indicators that can impact the oil market. This knowledge can help you make informed investment decisions.

Case Study: USO

One of the most popular US Oil ETF stocks is the United States Oil Fund (USO). Launched in 2006, USO tracks the price of West Texas Intermediate (WTI) crude oil. Over the years, USO has proven to be a reliable way for investors to gain exposure to the oil market.

Despite the volatility in the oil market, USO has consistently delivered strong returns. For example, during the oil price crash of 2014-2015, USO experienced significant losses. However, it quickly recovered and has since outperformed many other investment vehicles.

Conclusion

US Oil ETF stocks offer a unique opportunity for investors to gain exposure to the oil market without the complexities and risks associated with direct investments. By understanding the key factors to consider and staying informed about market trends, investors can make informed decisions and potentially capitalize on the potential of US Oil ETF stocks.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....