In the ever-evolving global financial landscape, the stock markets of China and the United States have emerged as two of the most influential and dynamic. This article delves into a comprehensive comparison of the Chinese and US stock markets, highlighting their unique characteristics, performance, and future prospects.

Market Size and Composition

The Chinese stock market is the second-largest in the world, with a market capitalization of over

Performance and Growth

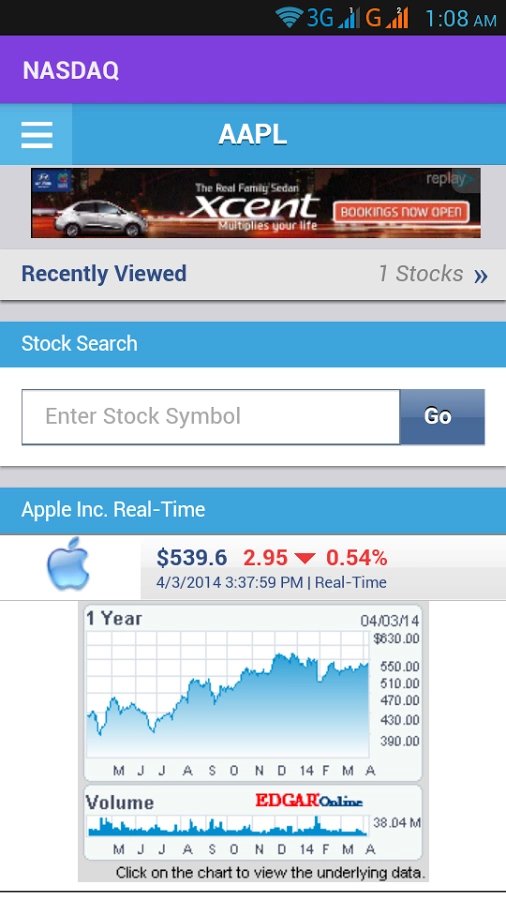

Over the past decade, the Chinese stock market has experienced significant growth, with the Shanghai Composite Index and the Shenzhen Component Index posting double-digit returns in many years. However, the market has also been subject to volatility and regulatory changes, which can impact investor sentiment. In contrast, the US stock market has been consistently strong, with the S&P 500 and the NASDAQ Composite Index posting robust returns, driven by strong economic growth and technological advancements.

Regulatory Environment

The regulatory environment in the Chinese stock market is characterized by a high level of government intervention. The China Securities Regulatory Commission (CSRC) plays a crucial role in regulating the market, and government policies can significantly impact market dynamics. In the US stock market, the Securities and Exchange Commission (SEC) is responsible for regulating the market, and the regulatory environment is generally considered to be more transparent and investor-friendly.

Investor Sentiment

Investor sentiment in the Chinese stock market is often influenced by macroeconomic factors, such as economic growth, trade policies, and political stability. In contrast, investor sentiment in the US stock market is influenced by a wide range of factors, including economic indicators, corporate earnings, and geopolitical events.

Case Studies

To illustrate the differences between the two markets, let's consider the performance of two major indices: the Shanghai Composite Index and the S&P 500.

- Shanghai Composite Index: In 2015, the index experienced a significant correction, driven by concerns about economic slowdown and regulatory changes. The market recovered in subsequent years, but it remains subject to volatility.

- S&P 500: The S&P 500 has consistently posted strong returns over the past decade, with the exception of the 2008 financial crisis. The index has been driven by strong corporate earnings and technological advancements.

Conclusion

In conclusion, the Chinese stock market and the US stock market offer unique opportunities and challenges for investors. While the Chinese market offers growth potential, it is subject to volatility and government intervention. The US market, on the other hand, offers stability and a diverse range of investment opportunities. Investors should carefully consider their risk tolerance and investment objectives when deciding where to invest.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....