The US Financial Stocks Index is a crucial tool for investors looking to gauge the health and performance of the financial sector. This article delves into what this index represents, how it's calculated, and why it's a vital component of any financial investment strategy.

Understanding the US Financial Stocks Index

The US Financial Stocks Index is a benchmark that tracks the performance of financial companies in the United States. It includes a diverse range of companies, such as banks, insurance companies, and investment firms. This index is designed to provide a snapshot of the financial sector's overall health and performance.

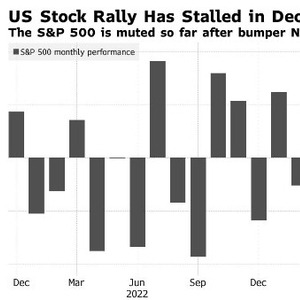

One of the most well-known financial stock indexes is the S&P 500 Financials Sector Index. This index includes the top 500 companies in the financial sector, weighted by market capitalization. It's a key indicator of the financial industry's performance and is often used by investors to make informed decisions.

How the Index is Calculated

The US Financial Stocks Index is calculated using a complex formula that takes into account the market capitalization of each company in the index. This means that the largest companies in the financial sector have a greater impact on the index's overall performance.

The calculation process involves several steps:

Selecting Companies: The index is made up of companies that are considered to be the most representative of the financial sector. These companies are selected based on their market capitalization, financial stability, and industry reputation.

Weighting: Each company in the index is given a weight based on its market capitalization. This means that larger companies have a greater impact on the index's performance.

Rebalancing: The index is periodically rebalanced to ensure that it continues to reflect the financial sector's composition. This rebalancing process involves adding or removing companies from the index based on changes in market capitalization and other factors.

Why the Index is Important

The US Financial Stocks Index is an essential tool for investors for several reasons:

Performance Tracking: The index provides a clear and concise way to track the performance of the financial sector. This makes it easier for investors to make informed decisions about their investments.

Market Trends: The index can help investors identify trends in the financial sector. For example, if the index is rising, it may indicate that the financial sector is performing well and that it's a good time to invest.

Risk Assessment: The index can also be used to assess the risk associated with investing in the financial sector. A falling index may indicate increased risk, while a rising index may indicate lower risk.

Case Studies

Let's look at a couple of case studies to illustrate the importance of the US Financial Stocks Index.

2008 Financial Crisis: During the 2008 financial crisis, the US Financial Stocks Index plummeted. This was a clear indication of the financial sector's turmoil at the time. Investors who paid close attention to the index were able to avoid investing in risky financial stocks.

2020 Pandemic: The US Financial Stocks Index also took a hit during the 2020 pandemic. However, it quickly recovered as the financial sector stabilized. Investors who tracked the index were able to capitalize on this recovery.

Conclusion

The US Financial Stocks Index is a vital tool for investors looking to understand and invest in the financial sector. By tracking the performance of financial companies, it provides valuable insights into market trends and risks. Whether you're a seasoned investor or just starting out, understanding the US Financial Stocks Index can help you make informed investment decisions.

railway stocks us

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....