In today's dynamic financial market, investors are always on the lookout for the best ways to grow their wealth. One of the most popular investment vehicles is the active US stock mutual fund. This article delves into the principal aspects of active US stock mutual funds, providing investors with valuable insights to make informed decisions.

Understanding Active US Stock Mutual Funds

Active US stock mutual funds are investment funds managed by professional fund managers. These managers actively select and buy stocks, aiming to outperform the market or a specific benchmark index. Unlike passive funds, which typically follow a buy-and-hold strategy, active managers continuously analyze and adjust their portfolios to capitalize on market trends and opportunities.

Key Components of Active US Stock Mutual Funds

Fund Managers: The principal of an active US stock mutual fund lies in the expertise of its fund managers. These professionals have extensive knowledge of the market, enabling them to identify undervalued stocks and capitalize on market trends.

Diversification: Active US stock mutual funds typically invest in a diverse range of stocks across various sectors and industries. This diversification helps reduce risk and enhance the fund's potential for returns.

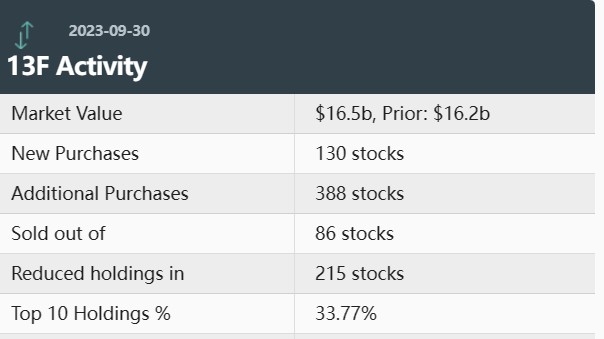

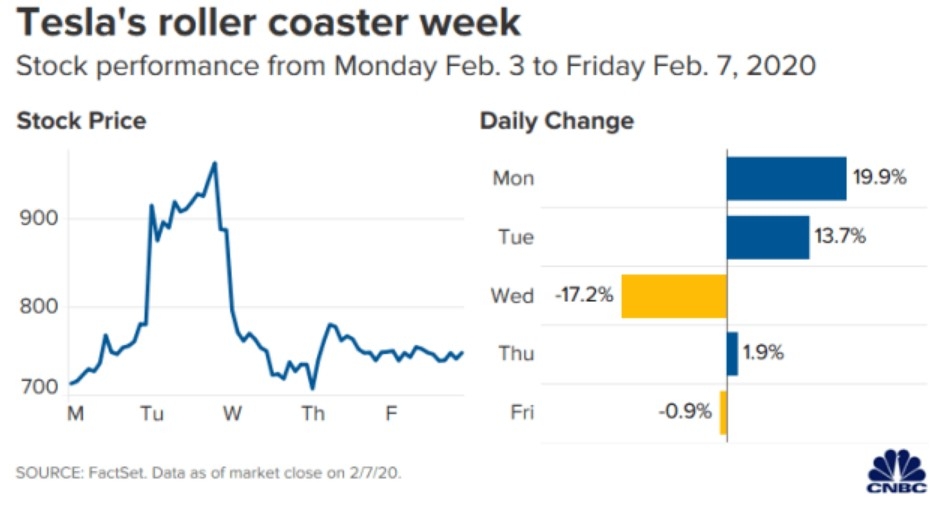

Performance Tracking: Active managers continuously monitor their portfolios and make adjustments to improve performance. They compare their fund's performance against benchmarks and market indices to evaluate their success.

Risk Tolerance: Investors should consider their risk tolerance when selecting an active US stock mutual fund. Some funds may be more aggressive, targeting higher returns with higher risk, while others may focus on conservative investments with lower risk.

Choosing the Right Active US Stock Mutual Fund

When choosing an active US stock mutual fund, consider the following factors:

Fund Manager: Research the fund manager's experience, track record, and investment philosophy. A successful manager can significantly impact the fund's performance.

Fund Performance: Look at the fund's historical performance, including its returns over different market cycles. However, remember that past performance is not always indicative of future results.

Expense Ratio: The expense ratio represents the annual fees charged by the fund manager. Lower expense ratios are generally preferable, as they can lead to higher returns for investors.

Fund Holdings: Review the fund's portfolio to ensure it aligns with your investment goals and risk tolerance.

Case Studies

Let's take a look at two active US stock mutual funds to illustrate their performance:

Fidelity Select Technology Portfolio (FSPTX): This fund focuses on technology stocks and has consistently outperformed the S&P 500 index over the past decade. However, it comes with higher risk and expense ratios.

Vanguard Growth Equity Fund (VGEQX): This fund targets high-growth companies across various sectors. It has a lower expense ratio and moderate risk, making it suitable for investors seeking long-term growth.

In conclusion, active US stock mutual funds can be an excellent investment vehicle for those looking to grow their wealth. By understanding the principal aspects of these funds and conducting thorough research, investors can make informed decisions and potentially achieve their financial goals.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....