In today's volatile financial market, investors are constantly seeking opportunities for growth. One of the most promising avenues for investment is in US stocks. With a robust economy and a diverse range of industries, the United States offers a plethora of growth opportunities for investors. This article delves into the world of growth US stocks, highlighting key sectors, strategies, and potential investments.

Understanding Growth Stocks

Growth stocks are shares of companies that are expected to grow at an above-average rate compared to their industry or the market as a whole. These companies often reinvest their earnings back into the business to fuel further expansion and increase profitability. Investors are willing to pay a premium for these stocks, as they anticipate significant future gains.

Key Sectors for Growth Stocks

Several sectors in the United States have shown remarkable growth potential in recent years. Here are some of the key sectors to consider:

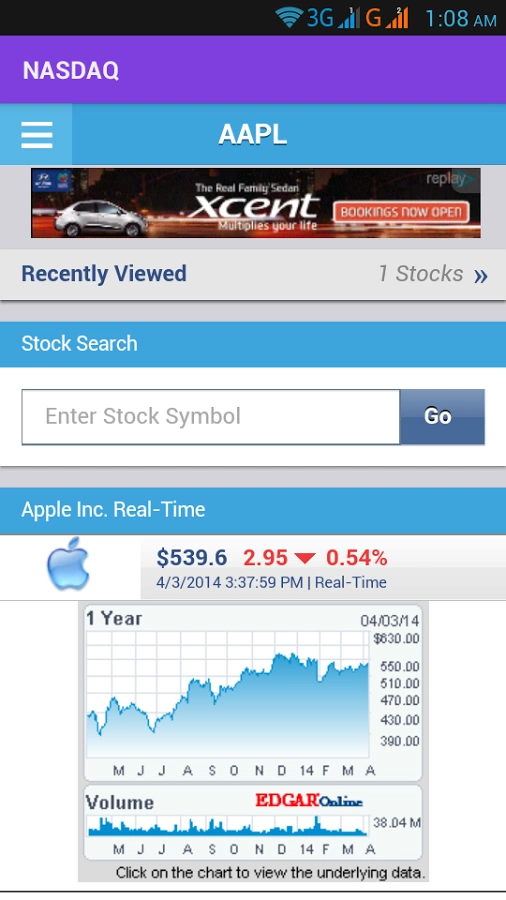

Technology: The technology sector has been a major driver of growth in the US stock market. Companies like Apple, Microsoft, and Amazon have seen substantial growth and continue to innovate, making them attractive investments for growth-oriented investors.

Healthcare: The healthcare sector is another area with significant growth potential. As the population ages and medical advancements continue, companies in this sector, such as Johnson & Johnson and Abbott Laboratories, are poised for continued expansion.

Energy: The energy sector, particularly renewable energy, has seen a surge in growth due to increasing environmental concerns and technological advancements. Companies like Tesla and NVIDIA are leading the charge in this sector.

Investment Strategies for Growth Stocks

Investing in growth stocks requires a well-thought-out strategy. Here are some key strategies to consider:

Research and Analysis: Conduct thorough research on potential investments. Look for companies with strong fundamentals, such as high revenue growth, strong profit margins, and a solid balance sheet.

Diversification: Diversify your portfolio to reduce risk. Investing in a variety of growth stocks across different sectors can help mitigate the impact of market volatility.

Long-term Perspective: Growth stocks often require a long-term perspective. Patience and discipline are crucial when investing in these stocks, as they may experience short-term fluctuations.

Case Studies

To illustrate the potential of growth stocks, let's consider a few case studies:

Tesla: Since its inception, Tesla has been a prime example of a growth stock. The company has revolutionized the electric vehicle (EV) market and continues to innovate. Its stock price has skyrocketed, making it one of the most valuable companies in the world.

Amazon: Amazon has been a dominant force in the e-commerce industry, with its stock price increasing exponentially over the years. The company has expanded into various sectors, including cloud computing and streaming services, further solidifying its growth potential.

In conclusion, growth US stocks offer a promising avenue for investors seeking above-average returns. By focusing on key sectors, employing effective investment strategies, and maintaining a long-term perspective, investors can capitalize on the growth potential of these stocks. As always, it is crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....