In recent years, Bitcoin has become one of the most talked-about digital assets in the world. Its meteoric rise in value has piqued the interest of investors and traders alike. As a result, many are looking to invest in Bitcoin stock in the US. But how do you go about doing this? In this article, we'll explore the steps to invest in Bitcoin stock in the US and provide some valuable insights along the way.

Understanding Bitcoin Stock

Before diving into the investment process, it's essential to understand what Bitcoin stock is. Bitcoin stock refers to shares of companies that are directly or indirectly involved in the Bitcoin ecosystem. This includes mining companies, exchanges, and even hardware manufacturers. Investing in Bitcoin stock means buying shares of these companies, allowing you to benefit from their success.

Steps to Invest in Bitcoin Stock in the US

1. Research and Choose a Brokerage Firm

The first step in investing in Bitcoin stock is to find a reputable brokerage firm. Many brokerage firms offer access to a wide range of investment opportunities, including Bitcoin stocks. Some popular brokerage firms in the US include TD Ameritrade, E*TRADE, and Robinhood.

2. Open a Brokerage Account

Once you've chosen a brokerage firm, you'll need to open a brokerage account. This process typically involves filling out an application, providing personal information, and verifying your identity. Be sure to read the brokerage firm's terms and conditions carefully before opening an account.

3. Fund Your Account

After your brokerage account is approved, you'll need to fund it. You can do this by transferring funds from your bank account, using a credit or debit card, or even wiring money. The amount of money you need to invest will depend on your budget and investment strategy.

4. Research and Analyze Bitcoin Stocks

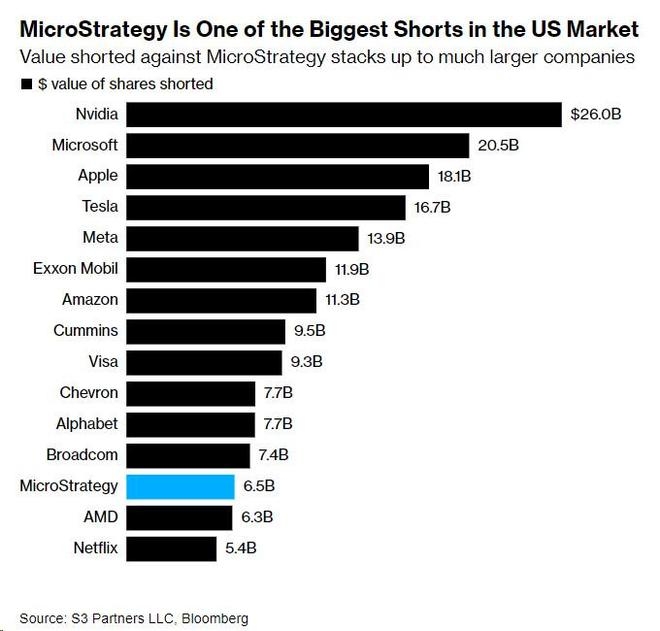

Now that your account is funded, it's time to research and analyze Bitcoin stocks. Look for companies with a strong track record in the industry, a solid business model, and a competitive advantage. Some popular Bitcoin stocks to consider include MicroStrategy (MSTR), Riot Blockchain (RIOT), and Canaan Inc. (CAN).

5. Place Your Order

Once you've chosen a Bitcoin stock to invest in, it's time to place your order. You can do this through your brokerage platform. Be sure to specify the type of order you want to place, such as a market order or a limit order. A market order will execute your order immediately at the current market price, while a limit order will only execute if the price reaches your specified limit.

6. Monitor Your Investment

After placing your order, it's crucial to monitor your investment. Keep an eye on the company's financial performance, industry news, and market trends. This will help you make informed decisions about when to buy or sell your Bitcoin stock.

Case Study: MicroStrategy

One notable example of a company that has successfully invested in Bitcoin is MicroStrategy. The business intelligence company has become a leading investor in Bitcoin, holding more than $4.2 billion worth of the digital asset as of the second quarter of 2021. MicroStrategy's CEO, Michael Saylor, has been a vocal advocate for Bitcoin, saying it is the "best way to preserve capital in a world where governments are printing money."

Conclusion

Investing in Bitcoin stock in the US can be a lucrative opportunity for investors looking to diversify their portfolios. By following these steps and conducting thorough research, you can make informed decisions about your Bitcoin stock investments. Remember to stay informed and keep an eye on the market to maximize your returns.

us stock market live

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....

railway stocks us-Backed by SEC-compliant security protocols and 24/7 market support, we don’t just let you trade U.S. stocks—we empower you to invest with confidence, clarity, and a competitive edge that sets you apart.....